David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Monthly employment reports should be closely monitored by anyone keeping an eye

on mortgage rates because they provide a wealth of specific information about an

economy’s momentum.

We learn whether average incomes are rising or falling (which ties into many

other parts of the economy such as the cost of labour and consumer spending

rates). We learn where jobs are being created and lost (this tells us which

sectors and industries are strengthening and which are weakening). We learn

whether people are working more or less (which helps us gauge whether our

economy is gaining or losing momentum – expressed as the change in our GDP

output). We also learn, on an overall basis, what percentage of our total

available labour force is currently employed (this tells us how much more room

our economy has to grow before it reaches full capacity - a key threshold in our

economic cycle beyond which adding incremental production becomes more expensive

and as such, can lead to significantly higher rates of inflation).

In today’s environment, both the U.S. and Canadian employment reports have

taken on even more significance. U.S. Fed Chairman Ben Bernanke has made it

clear that the Fed’s monetary policy will be geared toward promoting employment

growth, even at the expense of above-target inflation for an extended period.

Meanwhile, Bank of Canada (BoC) Governor Mark Carney has predicted that Canadian

interest rates will rise faster than most are expecting in large part because he

believes that the Canadian economy will return to full capacity more quickly

than the consensus is forecasting.

On Friday of last week we received the latest Canadian and U.S. employment

reports for September and given their elevated importance, today’s Update will

take a look at both in detail.

The U.S. Employment

Report

The latest U.S. employment data was weaker than expected, although some

optimists argue that the numbers show a positive trend when compared to

employment growth in the early summer. (In my view the optimists are reaching

for a pretty thin silver lining here because the data still barely clears

today’s ultra-low bar of expectations for U.S .employment.)

Here were the highlights from the report:

- Overall employment increased by 114,000 new jobs and the previous two job

reports were revised upwards by a total of 86,000. The upward revisions created

a mixed reaction because while they raised the most recent three-month average

for monthly new-job creation to 146,000, these revisions also mean that the

current month, at 114,000, now shows waning momentum. (To give 114,000 new jobs

some context, the U.S. economy needs to create about 150,000 new jobs each month

just to keep pace with its population growth and most experts agree that it

needs to average about 200,000 new jobs per month, for several years, to get

anywhere close to the U.S. Fed’s long-range target of 5.5%

unemployment.)

(Side note: David Rosenberg recently pointed out that only about half of

the eight million U.S. jobs that have been lost since the start of the Great

Recession have been recovered, despite rampant and unsustainable levels of

government stimulus. He also offered a surprising statistic: there are now more

Americans enrolling in the federal food stamp program each month than there are

new jobs being created).

- Average hours worked increased slightly from 34.4 in August to 34.5 in

September, which is a trend in the right direction but also the first uptick

since the June report. - Average incomes rose an impressive 0.6% for the month but the experts I read

expect the September consumer price index (CPI) to increase by almost the same

amount as a result of higher food and energy prices. As such, this increase in

earnings is not expected to expand the purchasing power of the average American

over the short term. - Most of the new jobs were created in the service sector and these are often

of a lower-paying variety. - Factory payrolls fell by 16,000 for the month after a 22,000 slide in

August. This may be a signal that a significant slowdown in U.S. export demand

is now taking root. - Two-thirds of the new jobs created in September were in part-time work and

most of these were taken for what are deemed to be “economic reasons”. In other

words, people took part-time work because they could not find full-time work

(this group is often referred to as “the under-employed”). The 582,000 new jobs

created in this category marked its largest single monthly gain ever. - On an overall basis the U.S. unemployment rate fell to 7.8%, which is a

happy political coincidence for President Obama because it is now back to the

same level it was at when he first took office in January of 2009. In reality

though, the sub-8% unemployment rate was really just the bi-product of a lower

participation rate (which measures only those people who are either working or

actively looking for work). One U.S. analyst reported that if the participation

rate was the same as it was 19 months ago, the U.S. unemployment rate would

actually be 8.6%. - Meanwhile the U6 unemployment rate, which many experts feel is a more

accurate and meaningful measure of the U.S. employment picture (because it

counts people who have not actively looked for work in the past month as well as

those who are under-employed), held steady at 14.7%, or about double the

“official” unemployment rate.

The Canadian Employment

Report

The latest Canadian employment report came in much higher than expected. But

while the overall Canadian employment picture is far rosier than the one south

of the 49th parallel, the details in our September employment data

still showed some areas of concern.

First, the positives:

- Overall employment increased by a whopping 52,000 new jobs in September,

which was more than five times what the market was expecting. Better still,

Canadian employment levels are now at an all-time high. - Full-time jobs accounted for 85% of the total gain and the private sector

expanded by 30,000 new jobs. - While the unemployment rate increased slightly from 7.3% to 7.4%, that was

only because 73,000 more Canadians began actively looking for work. Without this

change in our participation rate, unemployment would have actually fallen to

7.1%.

(Side note: By comparison, if we use the same methodology that the U.S.

uses to calculate its unemployment rate of 7.8%, ours would be 5.8%.)

- Average hours worked jumped by 0.4% and average earnings increased by 1.5%

on a month-over-month basis, and by 3.5% on a year-over-year basis. This means

that, unlike our southern neighbours, the average Canadian’s earnings are rising

more quickly than our rate of inflation (as measured by our CPI).

Now you’re probably wondering: If we have record employment levels, if most

of our new jobs are full-time and in the private sector, and if our incomes are

outpacing our rate of inflation, what’s not to like?

Consider the following:

- Of the 52,000 new jobs created last month, 33,800 of them were for newly

self-employed workers. This is considered a ‘soft’ employment category because

people who are actually in a job transition or who are unable to find more

traditional employment will often categorize themselves as self-employed. As

such, a spike in newly self-employed workers is treated with a dose of

scepticism and is not normally considered a strong employment indicator. - The September report showed 34,000 new retail positions, which can tend to

be lower-paying jobs, and 29,000 new jobs in construction, which many experts

consider to be tenuous given the consensus outlook for most of our regional

housing markets. - Youth unemployment rose to 15% and that sub-group holds 70,000 fewer jobs

than it did only a year ago.

- Of greatest concern was the loss of another 6,200 manufacturing jobs,

marking the fourth month in a row that jobs in this sector have contracted. The

strong Loonie combined with slowing economic growth in most of the world’s

largest economies continues to hurt demand for Canadian exports. While a strong

surge in service-related jobs is a welcome short-term development, manufacturing

jobs still form the bedrock of our economy, particularly in Ontario and Quebec,

and this sector continues to shrink.

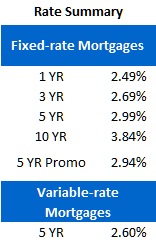

Five-year Government of Canada (GoC) bond yields drifted lower through most

of last week before surging higher after our latest employment report was

released. When the dust settled the GoC five-year yield finished the week 3

basis points higher, closing at 1.33 % on Friday. That momentum carried through

% on Friday. That momentum carried through

to yesterday with the five-year yield rising another 4 basis points to close at

1.37%. But despite this continued volatility, the GoC five-year continues to

fluctuate in a fairly tight range between 1.25% to 1.50%. Five-year

fixed-mortgage rates can still be found in the 3.00% range and a few lenders

dropped their shorter-term fixed rates last week, bringing them more in line

with the market.

Variable rate discounts can be found in the prime minus 0.40% range (which

translates to 2.60% using today’s prime rate) and that is tweaking the curiosity

of borrowers who are looking to take advantage of the savings offered at the

short-end of the yield curve. To that group of borrowers I still suggest that a

one-year fixed rate may prove a better bet. Consider that my best one-year fixed

rate (2.49%) is currently lower than my best five-year variable rate (2.60%) and

that BoC Governor Mark Carney has made it very clear that he has no intention of

lowering the BoC’s overnight rate (on which variable mortgage rates are based)

any time soon.

The bottom line: The latest U.S. jobs report basically confirmed

that U.S. employment remains “stuck in the mud” (to use U.S. Fed Chairman Ben

Bernanke’s words). While the Canadian employment picture is more encouraging by

comparison, there is still plenty of slack in our economy and we’re a long way

from reaching full capacity. On balance then, these reports did not alter my

long-standing view that GoC bond yields (and our fixed-mortgage rates by

association), should remain at ultra-low levels for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave