John Pasalis in Toronto Real Estate News, Condo Buying

Given all the press about Toronto’s booming condo market, it’s no surprise that one of the most common questions I get from condo buyers is how should they decide which neighbourhood to buy in. More specifically, which neighbourhood is a safe bet and has strong potential for future price appreciation.

While it’s impossible to predict future appreciation in prices, there are a number of things you can do to help ensure you’re buying in a neighbourhood that has a higher likelihood of appreciating when compared to other neighbourhoods in the same city.

Since 2008, Realosophy has been analyzing real estate sales by neighbourhood for our clients and for the Globe and Mail and one thing we’ve learned in that time is that house and condo prices within the same city can appreciate at very different rates across neighbourhoods - the same way markets within Canada like Toronto, Ottawa and Calgary can behave and appreciate at very different rates.

There are two main things we look for when advising our clients who are concerned about future price appreciation. The first is the balance between the supply of condos in the resale market today and the demand for those condos in that neighbourhood. For example, imagine you’re considering buying a condo in two different neighbourhoods and in both neighbourhoods roughly ten condos per month are available for sale. Now suppose in neighbourhood A only one condo actually sells each month and in neighbourhood B five condos sell each month. Clearly the market for condos in neighbourhood B is far more competitive than in neighbourhood A.

One way we like to measure this balance between supply and demand is by looking at the sales-to-inventory ratio (SI ratio). The SI ratio is calculated by taking the number of sales in a given month divided by the number of properties available for sale at the end of the month. In our example above, neighbourhood A would have a SI ratio of 10% (1 sale/ 10 condos available for sale) compared to 50% for neighbourhood B (5 sales/10 condos available for sale).

It makes sense then that condo prices over time will appreciate at a faster rate in neighbourhood B where 50% of available condos are selling every month compared to just 10% in neighbourhood A. This means that neighbourhoods with a high SI ratio are more likely to appreciate at a faster rate when compared to neighbourhoods with a low SI ratio.

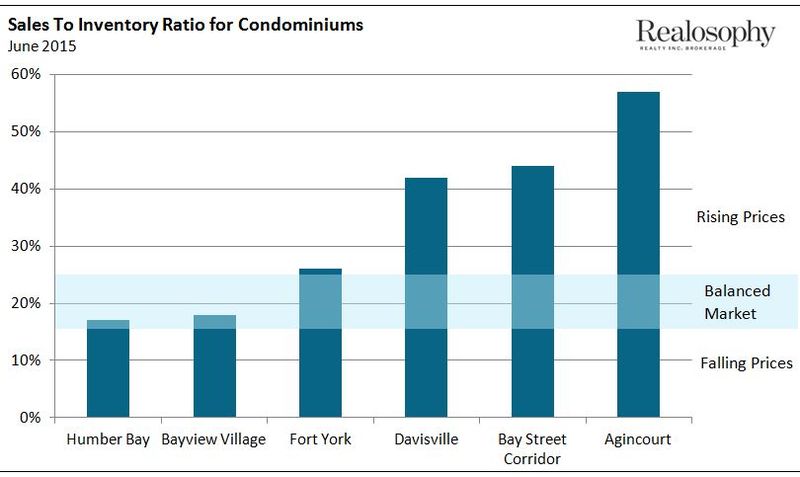

To get a better idea of what this looks like in real life, the chart below shows the SI ratio for condos (condo apartments and condo townhouses) in June 2015 for six different neighbourhoods in Toronto. You can see that the SI ratio ranges from a low of 17% in Humber Bay to a high of 57 % in Agincourt. This means that just 17% of the available condos in Humber Bay sold in June compared to 57% in Agincourt.

This chart tells us that the demand for condos in Davisville, Bay Street Corridor and Agincourt is very high relative to the number of condos available for sale in those neighbourhoods. In contrast, the demand for condos in Humber Bay and Bayview Village is relatively balanced for June.

When the SI ratio is in the range of 15% to 25% the market is generally considered to be balanced resulting in little to no change in average prices. When the SI ratio is below 15% there’s a higher likelihood that prices will fall over time and when the ratio is above 25% we tend to see higher rates of appreciation.

Because we are looking at just a one month snapshot of the SI ratio in these markets, we cannot draw any big conclusions about the condo market in these neighbourhoods and in particular on potential price appreciation in the future because we don’t know if these numbers are anomalies or if they are consistent with the neighbourhood’s longer term trend. That being said, I decided to also look at the appreciation rates for condos in these neighbourhoods over the previous two full years to see how prices have changed over time.

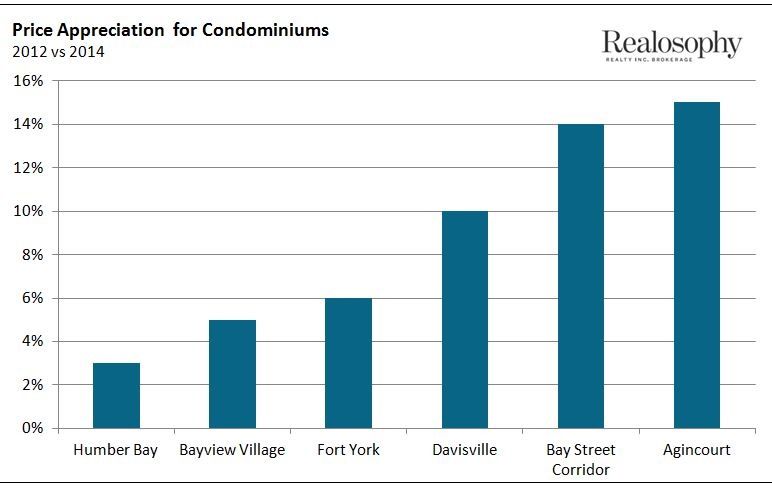

The following chart shows the two year appreciation in condo prices from 2012 to 2014.

From the chart above we can see that the average price for a condo over the two year period has appreciated from a low of 3% in Humber Bay to a high of 15% in Agincourt suggesting that the SI ratios we are seeing for June are probably not one month anomalies, but likely consistent with the neighbourhood’s longer term SI ratio trend.

Looking at the ongoing SI trend for a particular neighbourhood gives us a good sense for how balanced the resale market is today.

The other factor buyers need to consider when deciding which neighbourhood to buy in is the new condo construction market in each neighbourhood. You want to look at how many units are currently under construction in each neighbourhood and you’ll need to consider how this might impact the balance between supply and demand in the future.

In Toronto, we've started to assume that if too many cranes are up in a neighbourhood, that neighbourhood is going to take a dive soon.

It's important to remember that just because a neighbourhood has new condos under construction, it does not necessarily mean that this new supply will cause the SI ratio and prices to fall over time. In a neighbourhood where the SI ratio has been rising over time – meaning the demand over time has exceed the supply of units available for sale – new condos are needed to keep up with the rising demand. On the other hand, in a neighbourhood that has seen the SI ratio fall over time – meaning that demand has not been keeping up with the supply of units available for sale – any new construction will likely drive the SI ratio further down until prices eventually begin to fall.

If you’re in the market for a condo remember to look at the balance between the supply and demand for condos in the resale market in the neighbourhoods you’re considering, along with the new condos planned for that neighbourhood. It could make the difference between your condo being a money making vs money losing investment.

John Pasalis is the President and Broker of Realosophy Realty Inc. Brokerage in Toronto. A leader in real estate analytics and pro-consumer advice, Realosophy helps clients buy or sell a home the right way. Email John