Dave Larock in Interest Rate Update, Mortgages and Finances

The Bank of Canada (BoC) left its policy rate unchanged last week, as expected.

In its accompanying statement the Bank explained how developments both at home and abroad have influenced its overall economic view and today’s post will unpack this brief but detailed assessment by highlighting five key observations for anyone keeping an eye on Canadian mortgage rates:

- The BoC noted “stronger than forecast” third-quarter growth in the U.S. but predicted that it will “moderate in the months ahead”. The Bank also explained that while “growth has firmed in other advanced economies … the global outlook remains subject to considerable uncertainty, notably about geopolitical developments and trade policies”. Central bankers don’t typically tighten monetary policy for as a long as “considerable uncertainty” is one of their central themes.

- The BoC assessed that the recent moderation in Canadian economic growth after our red hot second-quarter has been “in line” with its expectations. “Employment growth has been very strong and wages have shown some improvement, supporting robust consumer spending in the third quarter”. If wage growth continues to accelerate, the BoC may feel that it has to raise its policy rate to stave off rising inflationary pressures. That said, while year-over-year wage growth has been impressive of late, rising from 0.5% in April to 2.7% in November, that is still considerably less wage growth than we have seen historically when our unemployment rate is 5.9% or lower. To that end, the Bank acknowledged “ongoing – albeit diminishing – slack in the labour market”.

- The BoC noted that “business investment continued to contribute to growth after a strong first half”. While that is an encouraging sign that businesses are becoming more confident, given that “exports declined by more than was expected in the third quarter”, it is not clear whether that will continue. The most recent trade data support the Bank’s view that “export growth will resume as foreign demand strengthens” but that is far from guaranteed. If the U.S. Federal Reserve raises its policy rate this week, as is widely expected, that should weaken the Loonie against the Greenback and give a boost to our exporters – but only for as long as the BoC preserves the gap in rates by holding its policy rate steady.

- The BoC observed “slightly higher than expected” overall inflation but attributed this to “temporary factors, particularly gasoline prices”. Given that wording, we should expect the Bank to look through any short-term spikes in our key inflation gauges. Also, while the BoC noted that core inflation has “edged up in recent months”, it doesn’t sound too concerned because it estimates that our higher levels of GDP growth have corresponded with “a higher level of potential output” for our economy, creating what BoC Governor Poloz recently dubbed our “inflationary sweet spot”.

- The BoC closed its statement by noting that “while higher interest rates will likely be required over time … [the Bank] will continue to be cautious, guided by incoming data in assessing the economy’s sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation”. While the BoC looks at many factors when determining the correct monetary-policy path going forward, today it is primarily focused on the interplay of these three key elements:

- “Our economy’s sensitivity to interest rates” – The BoC has repeatedly predicted that our elevated household debt levels will make our economy more sensitive than usual to policy-rate increases. Given that, the Bank is likely to allow extra time for our economy to absorb the impact of the two policy-rate increases it made this past summer, and is likely to spread any additional rate increases over a longer time period.

- “The evolution of economic capacity” – The Bank has observed that while our economic output is expanding, our economy’s maximum potential is expanding as well. This is extending our runway for non-inflationary growth and reducing the urgency for additional policy-rate increases.

- “The dynamics of both wage growth and inflation” – Our current lengthy period of below-target inflation has given the BoC the luxury of time. That said, if wage growth continues to accelerate, inflationary pressures could increase to a point where the BoC will have no choice but to raise its policy rate. For that reason, our monthly employment data will have outsized importance in the months ahead.

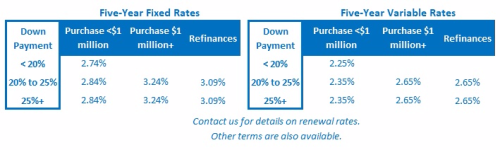

The Bottom Line: Last week the BoC confirmed that there is still “considerable uncertainty” clouding its current economic forecast. Fortunately, below-target inflation has given the Bank time to wait for some of that uncertainty to dissipate. But if our average wage growth continues to accelerate, that window could close quickly. At this point, although a continuing run of robust employment reports would change my view, I continue to believe that both our fixed and variable mortgage rates will remain at or near their current levels over the near term.

The Bottom Line: Last week the BoC confirmed that there is still “considerable uncertainty” clouding its current economic forecast. Fortunately, below-target inflation has given the Bank time to wait for some of that uncertainty to dissipate. But if our average wage growth continues to accelerate, that window could close quickly. At this point, although a continuing run of robust employment reports would change my view, I continue to believe that both our fixed and variable mortgage rates will remain at or near their current levels over the near term.

David Larock is an independent mortgage broker and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear on Mondays on this blog, Move Smartly, and on his own blog, Integrated Mortgage Planners Email Dave

December 11, 2017

Mortgage |