David Larock in Mortgages and Finance, Home Buying

The U.S. federal government now spends about $120 billion more than it takes in each month and it covers the shortfall by issuing U.S. treasury bonds which have historically been viewed as the safest in the world. But like any other borrower, the U.S. fed has to pay its bills on time to keep the party going, and experts estimate that on or around August 2, it will run out of money thanks to the Second Liberty Bond Act of 1917.

The U.S. federal government now spends about $120 billion more than it takes in each month and it covers the shortfall by issuing U.S. treasury bonds which have historically been viewed as the safest in the world. But like any other borrower, the U.S. fed has to pay its bills on time to keep the party going, and experts estimate that on or around August 2, it will run out of money thanks to the Second Liberty Bond Act of 1917.

Article 1, Section 8 of this act requires that the U.S. congress vote to increase the total number of treasury bonds that can be issued, in other words, to raise the debt ceiling. (Interestingly, the debt ceiling was originally intended to make it easier, not harder, for the federal government to borrow money. It was more efficient for the U.S. congress to set a cap than to vote on individual expenses, as they had previously done.) While most of the seventy-four debt ceiling increases over the last fifty years have happened quietly, this particular deadline has turned into a political football.

In theory, if the U.S. federal government runs out of money, all hell will break loose. Programs like Medicare and social security will stop sending out cheques, the military will no longer be able to pay its troops, and all non-essential employees of the federal government will be sent home to wait out the shutdown. Overnight, the U.S.’s credit rating would plummet from AAA to D (the lowest possible rating) and since all U.S. state and municipal government debt is tied to the fed’s rating, no level of government would be able to borrow without paying much, much higher interest rates. Any real loss of confidence in the U.S.’s ability to meet its debt obligations would probably also cause the U.S. dollar to collapse and trigger crashes in the U.S. equity markets. You can use your imagination about how the rest of the world’s economies would fare as the inevitable economic shockwaves made their way around the globe.

Of course, this is not likely to happen but the prospect of the debt ceiling triggering a U.S. default is no longer a distant threat, and with only two weeks left until the money runs out, the markets are starting to get nervous; of all the times to test the world’s confidence in the U.S., there could hardly be a worse moment. The debt ceiling is going to be front page news until it is raised and bond markets everywhere will be jittery for as long as uncertainty reigns. Former U.S. Treasury Secretary Robert Rubin recently put it best when he said, “We don’t know exactly what will happen, but why would we want to find out?”

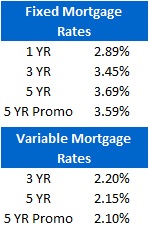

The Big Five banks lowered their fixed-mortgage rates last week, continuing their well-established pattern of raising with a bang and lowering with a whimper (five-year fixed-rate mortgages are back below 3.7%). The five-year Government of Canada bond yield bounced around, finishing the week down 11 basis points.

While the Bank of Canada is not expected to raise the overnight rate when its directors meet this week, variable-rate mortgage holders will be interested to hear how they and Governor Carney are reading the tea leaves in such an uncertain time (more on this next week).

The Bottom Line: Binyamin Appelbaum of the New York Times recently said that using the debt ceiling as a way to control the deficit was like “chopping off someone’s arms and legs because they don’t fit in a bed”. Let’s hope the ceiling is raised soon so we can get back to worrying about all of the many other threats to the global recovery, but if it isn’t, anyone who locks in a mortgage rate in the next two weeks will look like a genius.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

July 18, 2011

Mortgage |