David Larock in Mortgages and Finance, Home Buying

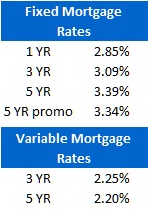

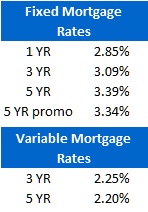

Canadian lenders lowered their variable-rate mortgage discounts last week and for the time being, prime minus .90% is a thing of the past. (The prime rate is currently at 3%, so prime minus .90% works out to a five-year variable-mortgage rate of 2.1%). Most lenders lowered their discounts by 20 basis points (or 0.2%), which now leaves standard variable rates in a range between prime minus .50% (2.5% today) and prime minus .65% (2.35% today). Of course, if you know where to look, there are still better rates to be had.

Canadian lenders lowered their variable-rate mortgage discounts last week and for the time being, prime minus .90% is a thing of the past. (The prime rate is currently at 3%, so prime minus .90% works out to a five-year variable-mortgage rate of 2.1%). Most lenders lowered their discounts by 20 basis points (or 0.2%), which now leaves standard variable rates in a range between prime minus .50% (2.5% today) and prime minus .65% (2.35% today). Of course, if you know where to look, there are still better rates to be had.

From a borrower’s perspective, if you need a $250,000 mortgage that is amortized over twenty-five years, every 10 basis-point increase in variable rates (when they are in the 2 to 3% range) will cost about $12 more each month. While these higher rates won’t be taken as good news by borrowers, this is a small increase.

From a lender’s perspective, this pricing change narrows the still wide gap between the profitability of fixed versus variable-rate mortgages. Lenders were earning a gross spread of about 90 basis points on a five-year variable-rate mortgage at 2.1%, compared to a gross spread of about 190 basis points on a five-year fixed-rate mortgage at 3.49%. When you net out all of a lender’s costs, at those comparable rates, the profits earned on variable-rate mortgages were a mere fraction of those being earned on fixed-rate mortgages.

The profit gap between fixed and variable-rate mortgages has been even more of a problem for lenders in recent months because the majority of borrowers have been choosing variable rates. Instead of bringing fixed rates down to better compete with variable rates, lenders decided to raise their variable rates. This change still decreases the difference in rate between the two options, but it does so by raising profit margins rather than by lowering rates. Not what borrowers would have preferred, but lest we have forgotten, those with the gold make the rules (for as long as the big banks all agree at least).

Lenders may also choose to justify this as a defensive move. They recognize that the Bank of Canada isn’t planning to raise short-term rates anytime soon and that Finance Minister Flaherty is concerned about keeping consumer borrowing under control in an extended low-rate environment. If raising variable rates helps achieve this, the move may pre-empt the need for a fourth round of mortgage rule changes, which would be more permanent in nature.

Five-year Government of Canada (GOC) bond yields were up last week, finishing 13 basis points higher overall. If lenders eventually revert to their traditional gross spread levels of around 150 basis points, the current GOC bond yield implies a five-year fixed-mortgage rate of about 3.1% versus the 3.4% to 3.5% range currently on offer. For now, lenders are still banking that extra spread, so it is small wonder that they have also decreased variable-rate mortgage discounts to try to push more borrowers into fixed rate products. At times like this, when the market is changing rapidly and variable rates are rising, talking to a good independent mortgage broker who has access to multiple lenders is the best way to ensure that you are getting the best discount possible when the dust settles.

The bottom line: Now that variable rates have edged up, pundits will revisit the age-old question of whether fixed or variable-rate mortgages will prove cheaper over the next five years. While my answer to that question will take a full post, not a paragraph, I am still leaning towards variable. I’ll explain exactly why in my upcoming posts, so stay tuned.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave