David Larock in Mortgages and Finance, Home Buying

On Friday, the European Central Bank, the U.S. Federal Reserve, and the central banks of Britain, Switzerland and Japan all agreed to provide short-term loans, in U.S. dollars, to banks in the seventeen countries that use the euro as their currency (also called the euro zone). This coordinated action was designed to stave off a liquidity crisis when Greece finally defaults on its debt (which should be any day now). Based on lessons learned by central bankers during the Lehman-credit crisis, the move will help ensure that money will still circulate in the midst of the coming crunch; but it does nothing to address the fundamental, long-term problem in the euro zone - which is solvency, not liquidity.

On Friday, the European Central Bank, the U.S. Federal Reserve, and the central banks of Britain, Switzerland and Japan all agreed to provide short-term loans, in U.S. dollars, to banks in the seventeen countries that use the euro as their currency (also called the euro zone). This coordinated action was designed to stave off a liquidity crisis when Greece finally defaults on its debt (which should be any day now). Based on lessons learned by central bankers during the Lehman-credit crisis, the move will help ensure that money will still circulate in the midst of the coming crunch; but it does nothing to address the fundamental, long-term problem in the euro zone - which is solvency, not liquidity.

To help you better evaluate each successive development in the euro zone crisis as it unfolds, I’ll use this week’s update to explain why many experts predicted that two fatal flaws in the euro zone’s design ensured that what is happening now was inevitable from the outset.

Before the euro was invented, Germany’s economy had efficient markets, a strong currency and disciplined spending, while Greece’s economy was is in many ways the polar opposite. The international financial markets had an efficient way of dealing with these differences: if Greece was a mess (as it usually was) the markets would devalue the drachma until it reached a level where fair-value trade could again take place. Now that Germany and Greece share a common currency, this cannot happen, and as a consequence, there is enormous distortion and stagnation in inefficient countries (like Greece, Ireland and Portugal).

This is a crippling problem that can only ultimately be solved in one of two ways: by going back to separate currencies or by combining all of the countries into one unified state. In fact, the founders of the euro based many of their assumptions on the fundamental belief that the euro zone countries would move inexorably towards a one-state solution. It didn’t happen, of course, and isn’t likely to, because the idea is a political non-starter (and always was in the eyes of many).

The second fatal flaw in the euro zone’s basic design is that it requires individual countries to relinquish control over their interest-rate policy. When an economy is expanding too quickly, it needs higher interest rates to keep from overheating. Conversely, a stalled economy uses lower rates as a powerful stimulus to help restore growth. Without the ability to adjust interest rates, countries lose their most important monetary-policy tool for stabilizing their economy.

When you have seventeen member countries with different strengths and weaknesses, it’s not surprising that euro zone members like Ireland and Portugal need low rates at the same time that Germany wants higher rates. The euro zone’s structure practically guarantees that its centralized interest-rate policy will be perpetually wrong for many of its member countries – and this problem is further exacerbated at times of crisis.

So if all this was predicted, how did we get in this mess? The very short answer (which is all we have time for today) is that the creation of the euro zone was a decision driven by politics, not sound economics.

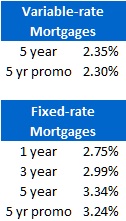

The five-year Government of Canada (GoC) bond yield closed at 1.55% on Friday, rising about 18 basis points (or .18%) for the week. In more normal times a move like this would be front page news, but lately it’s just par for the course. Five-year fixed-mortgage rates continue to inch downwards, with 3.39% now widely available. That rate gives lenders a gross spread (1.85%) which is still well above the long-term historical range (1.25% to 1.50%) for five-year fixed-rate mortgages.

Lenders moved in unison again last week to further reduce the discount offered on five-year variable-rate mortgages (VRMs), and market variable rates are now in the prime minus .45% range, which is 2.55% using today’s rates. (I still have a lender at prime minus .70%, but this offer is not widely available.)

Lenders fund VRMs by issuing 90-day Banker’s Acceptances, which closed at 1.17% on Friday. So after the latest rate increase, VRMs are now earning a gross spread of about 1.4% at the widely available market rate of 2.55%. Since fixed-rate mortgages are more expensive to administer (because they include hedging costs, for example) the relative profitability of fixed and variable-rate mortgages is more comparable than it has been in a very long time.

The bottom line: While the spread between market rates for a five-year fixed-rate mortgage (3.39%) and a five-year variable rate-mortgage (2.55%) is the narrowest it has been in quite a while, remember that this is because the skies over the global economic landscape are darkening. If we’re headed for an extended economic slump, paying any premium for fixed-rate certainty may look expensive in hindsight.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave