John Pasalis in Toronto Real Estate News

Every time we see a slight slowdown in the real estate market I find our agents get many of the same questions from our clients:

Why didn’t this house get multiple offers? What’s wrong with it?

Why are some houses still for sale 2 weeks after they went on the market?

Is the real estate market going to crash?

Toronto’s market has been so competitive this year that many buyers assume that it’s normal to see virtually every home get multiple offers and some with even 10 or more offers on their offer night. The reality is that the intense competition we saw earlier this year and the slow down we are seeing today are just part of the mini cycles we regularly see in the real estate market.

When most people hear the words real estate cycle they typically think of the big overarching trends in the market, mainly booms and slumps. We think of Toronto as being in a boom phase while the US market is currently in a slump.

The fact is that during both boom and slump periods in the real estate cycle it’s common to see mini cycles (mini booms and mini slumps) when we see short term shifts in the balance between supply and demand.

As I’ve discussed in previous blog posts, one of the best ways to measure the balance between supply and demand in the market is by looking at the sales-to-inventory ratio. This is a ratio of the number of homes sold in a given month divided by the number of homes available for sale at the end of the month. If five houses sold out of ten available for sale we have a sales-to-inventory ratio of 50%. Similarly if 1 house sold out of ten available for sale we have a sales-to-inventory ratio of 10%. From a home buyers perspective a market where 5 out of ten homes are selling would be a far more competitive environment than one where 1 out of ten homes are selling. You can read more about the sales-to-inventory ratio here.

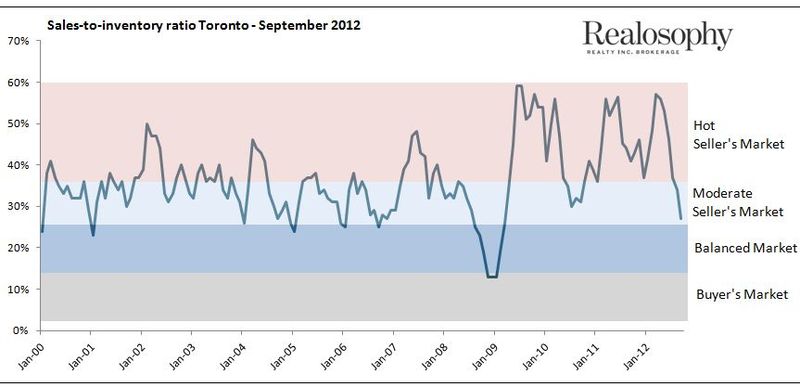

The following chart shows the sales-to-inventory ratio for the Greater Toronto Area over the past twelve years.

The first thing you’ll notice is that during the past 12 year boom period we have seen a number of short term peaks and valleys in the cycle. These peaks and valleys are the mini booms and slumps we regularly see in the market when the balance between supply and demand changes.

When the chart shoots up from the blue zone to the red zone it means demand is significantly outpacing supply which is resulting in a very heated and competitive market. When the chart drops from the red zone to the blue zoon it means we are seeing demand slow down relative to supply.

I layered four bands on this chart to better illustrate how the overall mood of the market can shift from one month to the next when the balance between supply and demand changes.

During a Hot Seller’s Market it’s common to see virtually all homes (in good downtown neighbourhoods) set an offer date roughly a week after a home is listed for sale in order to create a bidding war. Virtually all homes receive multiple offers with the most desirable homes receiving as many as 10-15 offers on their offer night.

Toronto’s market shifted from a Hot Seller’s Market in the spring to a Moderate Seller’s Market in the late summer and fall. During a Moderate Seller’s Market we see some houses setting offer dates to create a bidding war while other sellers avoid the bidding war strategy all together by allowing buyers to make an offer at any time on their house. The most desirable houses are still getting multiple offers while the average homes are taking 2-4 weeks to sell.

Now that we we have a better understanding of these mini cycles you might be wondering why they happen.

Changes to our mortgage rules can be a key driver behind a mini boom and slow down. When Canada went from 25 year mortgages to 40 year mortgages late in 2006 we saw a strong boom in demand in early 2007 as a result. Similarly we’ve seen the federal government tighten mortgage rules significantly over the past three years which may have cooled the market slightly when new rules where introduced. Changes in interest rates can impact demand in the short term as can the introduction of new taxes like the City of Toronto’s land transfer tax.

The time of year can also have a big impact on the balance between supply and demand. Spring is normally the most competitive season in the real estate market and historically the sales-to-inventory ratio virtually always declines as we move from the spring to the fall market, as it did this year.

I’ll wrap up today’s post with the question most buyers are probably asking themselves right now; is the slow down we are seeing this fall a mini slump or is it the start of a longer term slump in the real estate market?

Toronto’s real estate market has shifted into two sub-markets, the condo market and the freehold market. While the condo market requires a bit more discussion and analysis I can say that I don’t see freehold house values dropping any time soon. The market will continue to be a moderate seller’s market through the winter but I expect demand to increase again in the spring. That being said, I do not expect the spring market in 2013 to be nearly as competitive as 2012.

The freehold market is more likely to moderate and reach a phase were prices are increasing by 3-5% per year vs the 8-10% we have been seeing over the past couple of years.

John Pasalis is the President and Broker-Owner of Realosophy

Realty Inc. Brokerage in Toronto. A leader in real estate analytics and

pro-consumer advice, Realosophy helps clients buy or sell a home the

right way. Email John

Want to Know Realosophy's Top Picks for Best Value Schools? Sign up for our popular monthly Schools for Home Buyers Workshop!

October 12, 2012

Market |