Dave Larock in Monday Interest Rate Update, Mortgages and Finance, Home Buying, Toronto Real Estate News

Editor's Note: Dave's Monday Morning Interest Rate Update appears on Move Smartly weekly. Check back weekly for analysis that is always ahead of the pack.

The Bank of Canada (BoC) met last week and decided to keep

its overnight rate unchanged, as expected.

The BoC also issued its latest

Monetary Policy Report (MPR) which I read with great interest because it

gives us the Bank’s views on the state of the world’s economies and includes

projections on where the BoC sees both foreign and domestic economies headed

over the next several years.

In the latest MPR, the BoC forecasted that the Canadian

economy would return to full capacity sometime in mid-2015. Not surprisingly,

this mirrors the consensus forecast of when the U.S. economy is expected to

reach full capacity - although both estimates are dependent on rather optimistic

assumptions.

When an economy reaches full capacity, inflationary

pressures increase and that’s why expectations of when the BoC will next increase

its overnight rate converge around the mid-2015 time frame. (As a reminder, Canadian

variable-rate mortgages are priced using the BoC’s overnight rate.)

That got me thinking.

Since there is now a fairly widespread view that the BoC and the U.S. Federal

Reserve won’t start increasing short-term rates until mid-2015 at the earliest,

how high would variable rates have to rise after mid-2015 before borrowers who

took a variable-rate mortgage today would end up with about the same overall borrowing

cost as those who opted for a five-year fixed-rate mortg age instead?

age instead?

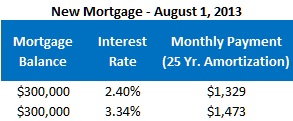

To answer this question, let’s start by assuming that you take

out a mortgage of

$300,000 on August 1, 2013 and that you are currently

choosing between a five-year variable rate at 2.40% (prime minus 0.60%) and a

five-year fixed rate at 3.34%.

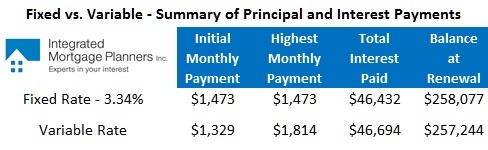

For the reasons outlined above, we’ll assume that the first

variable-rate increase of 0.25% will occur on August 1, 2015. From that point

on, we assume that the BoC increases its overnight rate by 0.25% every three

months over the remaining three years, which means that your variable rate

would rise to 5.40% by the end of your five-year term.

This scenario translates into twelve 0.25% rate increases

over thirty-six months. To put that in perspective, this aggressive tightening of

monetary policy would greatly exceed the magnitude of the last five tightening

cycles that have been implemented by the BoC over the past fifteen years (and

that’s as far back as I checked).

Here is a comparison of

how five-year fixed- and variable-rate borrowers would fare under this

scenario:

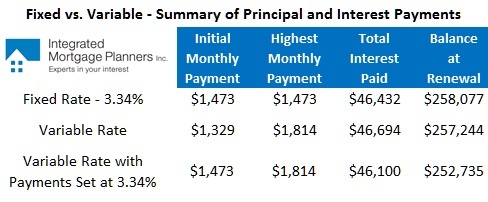

Let’s add one more wrinkle to this comparison.

I regularly advise my variable-rate mortgage borrowers to

bank the savings inherent in today’s variable-rate mortgage by setting their monthly

payment as if they had actually taken a five-year fixed rate of 3.34% instead. In

this case, that would mean increasing the monthly payment from $1,329 to $1,473,

which we would do by calling the lender and asking them to take an ongoing additional,

discretionary payment of $143 every time the regular monthly payment of $1,329

is taken. (The lender can put a note on file so that this extra amount is taken

automatically for as long as you leave the instruction in place, meaning that you

don’t have to call every month to keep this arrangement going).

I love this strategy because it gets you used to paying a

higher rate (3.34% instead of 2.40%) and as such, if your variable rate rises,

you simply adjust the $143 discretionary payment down so that your total

monthly payment remains at $1,473 until your variable rate rises above 3.34%.

In the meantime, you pay off your mortgage more quickly and increase the odds

that you will have a lower mortgage balance at renewal, even if your rate rises

precipitously in the latter part of your term.

Here is the comparison chart again with the results from

this make-hay-while-the-sun-shines approach for variable-rate borrowers

included:

Surprised? The key to this scenario is the assumption that

the variable rate doesn’t begin to move until mid-2015. If the BoC doesn’t move

its overnight rate until then, as you can see in the example above, even frequent

and consistent rate increases over the remaining three years of the term are

manageable.

Five-year Government of Canada bond yields dropped another

nine basis points last week, closing at 1.66% on Friday. Despite a twenty-one

basis-point drop in yields over the past two weeks, lenders have not yet

lowered their five-year fixed rates in response. Some have speculated that this

is because lenders used the previous round of fixed-mortgage rate increases to

pass on higher back-end funding costs to consumers. While this explanation may

be accurate, I expect natural market forces to rekindle more aggressive rate

competition soon enough.

Five-year variable-rate mortgages can still be found with discounts

of as much as prime

minus 0.60% (which works out to 2.40% using today’s prime rate). If you’re

considering a variable rate, check out my post on how

different lenders apply interest-rate compounding to their variable-rate

mortgages. This is a fine-print detail that is overlooked by most

borrowers.

The Bottom Line:

Recent comments by the BoC and the U.S. Fed suggest that neither Canadian nor

U.S. short-term policy rates are expected to go anywhere until at least

mid-2015. If that’s true, as the calculations in today’s post show, the odds

that a variable-rate mortgage will save you money over the next five years are stacked

in your favour.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

July 22, 2013

Mortgage |