Dave Larock in Interest Rate Update, Mortgages and Finances

Editor's Note: The Interest Rate Update appears weekly on this blog - check back every Monday morning for analysis that is always ahead of the pack.

Did you know that home buyers who make down payments of less than 20% of their purchase price have access to lower mortgage rates than buyers who put down more than that?

This comes as a surprise to many borrowers. After all, doesn’t loan risk decrease as the down payment increases? Why should borrowers who have less skin in the game enjoy lower rates?

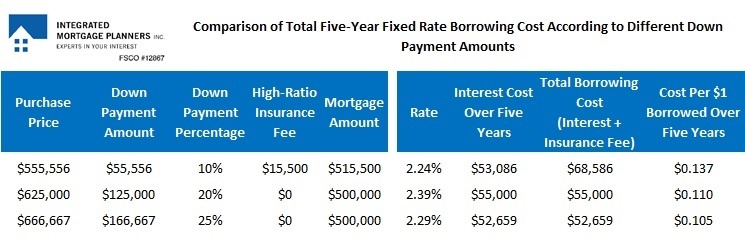

To explain, let’s start with a comparison of my lowest rates available today depending on the size of your down payment. The chart below assumes that you have a purchase that is closing in the next 60 days and you want to borrow $500,000 at a five-year fixed rate on a mortgage that is amortized over twenty-five years:

As you can see, borrowers who put down less than 20% of the purchase price of a property (called “high-ratio borrowers”) pay less interest than borrowers who put down 20% or more (called “conventional” borrowers). But this chart does not capture everybody’s total borrowing cost because high-ratio borrowers must also pay for default insurance.

Default insurance makes the lender effectively bullet proof against loss. If a borrower stops making payments and the lender has to seize and sell their property for less than what they owed on their mortgage, the insurer reimburses the lender for any loss (as long as there wasn’t gross incompetence or fraud during the underwriting stage).

This insurance is offered by three different providers (CMHC, Genworth and Canada Guaranty) and all of their policies are backed in whole or in part by the full faith and credit of our federal government.

Once a mortgage is insured, lenders can fund it more cheaply, and they pass some of that saving back to borrowers in the form of lower rates. But default-insurance is a significant additional cost and the difference in rates only offsets a fraction of it.

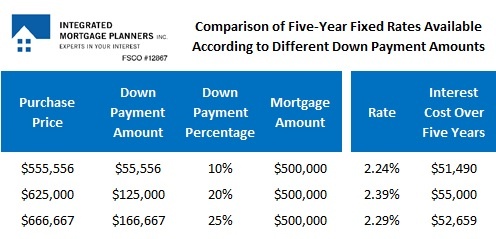

Here is the same chart with the cost of high-ratio mortgage insurance included:

While it’s true that the high-ratio borrower’s lower five-year fixed rate produces a saving of a couple of thousand dollars when compared to the five-year fixed rates offered to conventional borrowers, the added cost of default-insurance dwarfs that saving by a considerable margin. As a result, conventional borrowers still enjoy lower all-in borrowing costs. (The last column in the chart compares the all-in cost of each dollar borrowed over the full five-year term.)

Does that make today’s mortgage rate-pricing seem more reasonable?

You may also have noticed that borrowers putting down exactly 20% of the purchase price of a property pay the highest interest rate. These are the riskiest loans in a lender’s portfolio because they have just enough equity to avoid the default-insurance requirement, but also the least amount of equity to serve as a buffer against loss. On conventional loans, lenders typically offer their best five-year fixed rates on mortgages with down payments of anywhere from 25% to 35%, believing that these buffers are large enough to absorb even a significant drop in property values.

Five-year Government of Canada bond yields fell five basis points this week, closing at 0.95% on Friday. Five-year fixed-rate mortgages are available at rates as low as 2.24% for high-ratio buyers, and at rates as low as 2.29% for low-ratio buyers, depending on the size of their down payment and the purchase price of the property. Meanwhile, borrowers who are looking to refinance should be able to find five-year fixed rates in the 2.59% to 2.69% range.

Five-year variable-rate mortgages are available at rates as low as prime minus 0.80% (1.90% today) for high-ratio buyers, and at rates as low as prime minus 0.70% (2.00% today) for low-ratio buyers, again, depending on the size of their down payment and the purchase price of the property. Borrowers who are looking to refinance should be able to find five-year variable rates around the prime minus 0.40% to 0.45% range, which works out to 2.20% to 2.25% using today’s prime rate of 2.70%.

The Bottom Line: High-ratio borrowers have access to the best mortgage rates available but only because their loans are insured against default. Once the cost of default insurance is added to their interest cost, high-ratio borrowers pay substantially more overall than conventional borrowers. So high-ratio mortgages come with a lower rate but a higher overall cost - and today’s world of Canadian mortgage-rate pricing isn’t as crazy as it might have seemed at first glance.

David Larock is an independent mortgage broker and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog, Move Smartly, and on his own blog: integratedmortgageplanners.com/blog Email Dave

May 23, 2017

Mortgage |