Last week we touched on how to assess the impact of investors when evaluating a condo building – this week we’re going to take it one step further by delving into three other measures that can be used to determine the viability of a particular condo unit or building for end users and investment purposes.

Builder and Management Company

Taking a look at the builder and management company of a certain condo corporation can shed light into how that property might perform in the future based on the history of other similar developments. This can help us get an idea of whether a condo building will be successful in terms of maintaining a low maintenance fee, annual unit price appreciation and high resident satisfaction.

Typically, we would look at how the building has performed over time (much the same way you would analyze a business) by reading over a legally required document referred to as the condo corporation’s status certificate. If you were purchasing a business you would want to know how much money the business brings in, how much money it spends, and if it’s being sued – the status certificate tells you this and more: it is a snapshot in time of the condo corporation’s financials and gives data pertaining to any expected maintenance fee increases and past special assessments (if there were any).

If the condo building is a new property, it won’t have years of history to draw on for the status certificate, which makes purchasing in a building like this akin to buying blind – but there are ways to get around this. By looking at the builder, we are able to look at other properties the builder has completed to get a sense of how they generally perform – do they have a history of construction related issues, how have the maintenance fees in these other buildings performed over time, what kind of reputation does the builder have, how many projects have they completed in the past, etc. We’ve all heard horror stories about people purchasing in a condo that went awry (e.g., skyrocketing maintenance fees, difficulty reselling, special assessments), but what’s important to know is that this can sometimes be avoided by looking at who the developer is.

Think of the management company as the Chief Operating Officer (COO) of the condo building – the management company is there to carry out day-to-day duties and to provide advice to the condo board (who operates more like the CEO). That said, the COO is still an integral part to the overall viability of a business, similar to the way the management company plays a large role in the price appreciation and sustainability of a condominium and its units. Having a management company who handles building repairs in a timely matter and obtains the best service contracts ensures that resident issues are addressed aids the condo board in setting the condo up for success.

Historical Maintenance Fees

One of the most important details I look at when evaluating a condo building are how the maintenance fees have performed over time. Maintenance fees are paid by the residents of a condo building to the condo corporation to use as funds to maintain the building. They are charged to the unit owners on a cost per square foot basis, meaning you pay a certain amount for every square foot you own within the condo – including parking spaces and lockers. A good range to look for would be between $0.50 and $0.65 per square foot, but this can change based on the amenities that are included in the fee. Maintenance fees pay for things like water, heat, pools, security, snow removal and lawn maintenance, etc. Typically, the more amenities a condo has, the higher the maintenance fees are – as the money to keep the condo operational has to come from somewhere.

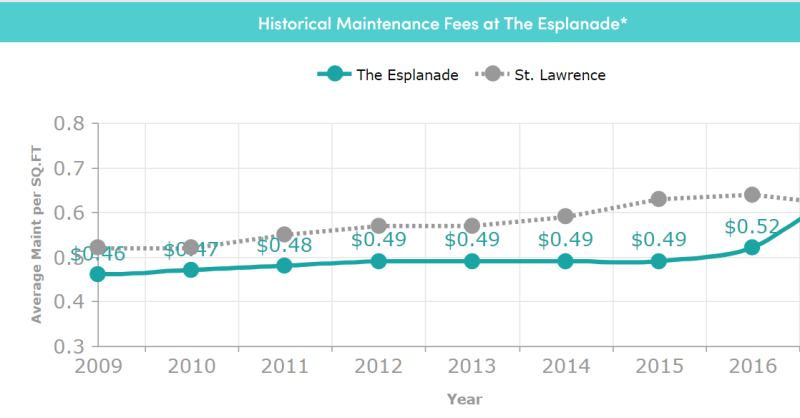

What I like to see is maintenance fees that have been generally steady over time. Although they have recently gone through a fee increase, 25 The Esplanade is still one of my favourite condo buildings in the downtown core due to the consistency of their maintenance fees over time. As we can see from this snapshot, fees have been generally steady since 2009 staying within an excellent range on a price per square foot basis (much lower than many Toronto condos):

Credit: Condos.ca

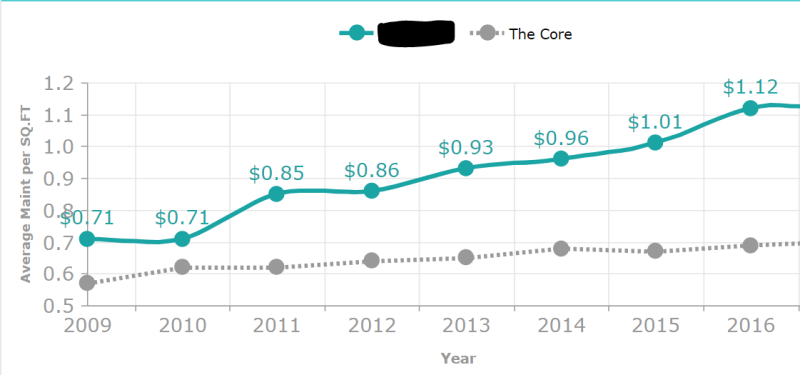

In contrast, we can see the fees at this unnamed downtown condo (in green) in the Core tell a much different story:

Credit: Condos.ca

Both buildings have similar amenities and were built in a similar year, yet the maintenance fees for the second property have been steadily increasing since 2009 and are now double on a price per square foot basis.

It’s important to look at the historical maintenance fees as they help paint a picture as to whether or not the condo corporation is managing the condo effectively and provide insight as to the possibility for future fee increases.

What else do you look for when you evaluate a condo building in terms of financial sustainability? Do details like number of rental units and historical maintenance fees matter to you or are items like amenities and location more important?

Nicole Harrington is a Sales Representative with Realosophy in Toronto. She specializes in using data and analytics to help her clients make smarter real estate decisions, concentrating on Toronto and the GTA, and hosts her own website: SheSellsToronto.com.