Dave Larock in Interest Rate Update, Mortgages and Finances

Editor's Note: The Interest Rate Update appears weekly on this blog - check back every Monday morning for analysis that is always ahead of the pack.

We received the September Canadian employment report last Friday and while it showed that our rate of job creation slowed, it also confirmed that average wages increased by 2.2% on a year-over-year basis. The average wage has been slow to rise over the past several years, even as our economy has created jobs at a robust rate. That hasn’t come as a total surprise because wage growth typically lags job growth, but the lag in our current cycle has persisted for longer than expected. This has led to speculation that other factors such as globalization, automation, and the increased prevalence of just-in-time manufacturing are conspiring to keep wages down.

With year-over-year average wage growth peeking its head over the 2% threshold for the first time since last June, investors are increasing their bets that the Bank of Canada (BoC) will raise its policy rate again before the end of this year.

The Bank has recently emphasized that it will be very data dependent when determining future monetary policy and accelerating wage growth raises the odds that it might raise rates pre-emptively to stave off a sharp acceleration in overall inflation (because labour costs have a big impact on the prices of most of what we buy).

Before I offer my take on what this latest development means for our near-term mortgage rates, let’s look at the other highlights from the September employment report:

- Our economy added an estimated 10,000 new jobs last month, less than the average of about 25,000 new jobs per month over the past year.

- Our unemployment rate held steady at 6.2% for the second straight month, marking its lowest level since October, 2008.

- Our average wage growth accelerated to 2.2% last month but that rise followed an extended period when wage growth hovered at a little more than 1% and barely kept pace with inflation.

- Our economy has traded lots of higher-paying full-time jobs for lower-paying part-time jobs since the start of the Great Recession but that trend reversed last month. In September, we added 112,000 new full-time positions and shed 102,000 part-time positions.

- Our participation rate, which measures the percentage of working-age citizens who are either employed or actively looking for work, fell from 65.7% in August to 65.6% in September, marking its lowest level in more than a year. Those market watchers who are less worried about rising inflation risks point to our below-average participation rate and argue that disenfranchised workers will come off the sidelines as the demand for labour rises, thereby helping to keep labour costs down for longer than our unemployment rate would otherwise indicate.

- Also of note: all of last month’s newly created jobs were in the public sector (which added 29,000 new positions); the biggest employment gains were for people aged 55 and older; and men aged 25 to 54 lost 29,000 jobs in September.

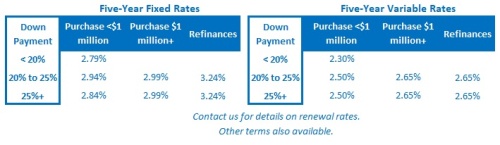

The chart below shows the five-year fixed and variable rates that are currently available for different down payment amounts and transaction types. (This chart replaces my usual two paragraphs outlining current rate conditions.) It should also be noted that lender terms and conditions vary, and can significantly impact the total cost of a mortgage over time.

The Bottom Line: The accelerating wage growth we saw in September increases the odds that the BoC will raise its policy rate again in 2017. But one month does not a trend make and other recent data show that our overall economic momentum has already started to slow.

Bluntly put, while the BoC will be encouraged that average wage growth picked up last month, I expect that it will want to see this nascent trend confirmed in October and November before deciding whether to raise rates again in December. Until then, talk about wage-growth-fueled rises in our mortgage rates seems premature.

David Larock is an independent mortgage broker and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog, Move Smartly, and on his own blog: integratedmortgageplanners.com/blog Email Dave

October 10, 2017

Mortgage |