John and Urmi in Urban Issues, Toronto Real Estate News, Home Buying

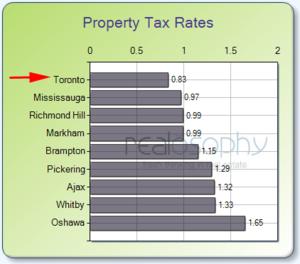

With a major tax vote just around the corner, Mayor David Miller hasn’t exactly convinced Toronto that his “fair tax plan” is actually fair. Miller seemed to ask - not insist - that the province help support one of its greatest assets – Toronto – during the recent provincial elections. And instead of proposing to raise the city’s property taxes, which are the lowest in the Greater Toronto Area (see chart below), the Mayor proposes that select residents do the heavy lifting in the form of an up to 2% land transfer tax and a $60 vehicle registration fee. While any tax plan necessarily involves targeting, this one is proving to be way off the mark.

With a major tax vote just around the corner, Mayor David Miller hasn’t exactly convinced Toronto that his “fair tax plan” is actually fair. Miller seemed to ask - not insist - that the province help support one of its greatest assets – Toronto – during the recent provincial elections. And instead of proposing to raise the city’s property taxes, which are the lowest in the Greater Toronto Area (see chart below), the Mayor proposes that select residents do the heavy lifting in the form of an up to 2% land transfer tax and a $60 vehicle registration fee. While any tax plan necessarily involves targeting, this one is proving to be way off the mark.

Given that the City of Toronto and the province aims to encourage high density living by enabling families, immigrants and young professionals to live, work and play in the urban core, we doubt whether the land transfer tax would be effective, much less fair. But it seems that Miller’s tax plan was never intended to be fair to all Torontonians – since distributing the burden of paying for city services more evenly amongst the greatest number of residents possible would necessarily target seniors along with everyone else. The key argument voiced by Miller and his supporters against raising property taxes is the need to protect seniors:

"My ward and the rest of the City are full of neighbourhoods made very valuable through the wonderful care of long time homeowners. Residents who invested as much as they could afford for homes years ago, due to the boom in property values, are now paying property tax on assessed values they never expected to see in their lifetimes. By diversifying our streams of revenue, Council would not have to tax these people, who have made our city great, right out of their homes."

Councillor Shelley Carroll

There is no doubt that seniors have had a difficult time paying higher taxes since the introduction of the City's revamped property tax assessment scheme - based on the current estimate of a home's market value – in 1998. There is room for improvement when it comes to these assessments. But however unpleasant their situation, it is important to note that much of the trouble stems from what Councillor Carroll herself describes as “a boom in property values.” The principle beneficiaries of this boom are these same seniors whose ever-appreciating assets have not only increased their tax burden, but have dramatically increased their personal wealth. To paraphrase the Councillor, seniors have more wealth tied up in their real estate than they ever expected to see in their lifetime.

There is no doubt that seniors have had a difficult time paying higher taxes since the introduction of the City's revamped property tax assessment scheme - based on the current estimate of a home's market value – in 1998. There is room for improvement when it comes to these assessments. But however unpleasant their situation, it is important to note that much of the trouble stems from what Councillor Carroll herself describes as “a boom in property values.” The principle beneficiaries of this boom are these same seniors whose ever-appreciating assets have not only increased their tax burden, but have dramatically increased their personal wealth. To paraphrase the Councillor, seniors have more wealth tied up in their real estate than they ever expected to see in their lifetime.

It is also true that seniors “have made the city great” through diligent home ownership, but it is equally true that spending on public transit, culture and social programming has gone a long way to boost their home values by ensuring that the urban core remains an attractive and safe place to live. The City now needs money to do more of the same – so why is asking seniors to contribute so unfair?

The traditional argument in support of protecting seniors is that they are on a fixed income, so while their home may be appreciating in value, no extra cash is at hand to pay for the increase in home costs such as property tax. It is a classic ‘house-rich, cash-poor’ situation. For these seniors, downsizing may be a forced option, not a freely chosen desire to get away from the demands of living in larger or more expensive properties.

It is an unfortunate situation, one that we would be unhappy to see our own parents face, but it is not entirely unfamiliar to us either. What happens when newer HomeBuyers try to buy in the neighbourhoods they have grown up in, only to be forced – due to the same rapid appreciation – to live a little further out or a little more cramped? What about the countless numbers of students, immigrant families, artists and young professionals who have made neighbourhoods like the Annex remarkably vibrant, only to see ownership in the area drift hopelessly out of reach? (See Realosophy's Annex Neigbourhood Profile for local school and housing stats.) There is plenty of unfair to go around.

What makes the position on senior HomeOwners even more puzzling is that unlike most, they are actually able to fight back - to stay in their home. Asset-rich seniors have the option of leveraging the value of their home by taking out a reverse mortgage to pay for current expenses such as increased property taxes. P.J. Wade, Canadian financial planner and author of Have Your Home and Money Too explains:

"It's a way to tap into the equity you've accumulated in your home and have cash, a lump sum, a stream of income and still be the owner of your home -- to live where you want to live without the worry of repayment until sometime in the future."

This type of loan doesn’t have to be paid back until the house is sold or an estate is transferred to inheritors. There is no denying that a reverse mortgage will reduce the housing wealth of an individual, but in the case of housing-wealthy seniors (and eventually, their beneficiaries), this is not likely to be an untenable reduction.

Younger HomeBuyers struggling to afford a home to raise their families in are having a tough time connecting with Miller’s campaign. The disconnect was also present in a recent Toronto Star story which detailed how provincial political parties might help a struggling senior with close to $1 million invested in a north Toronto home and Georgian Bay cottage. Even seniors are divided on Miller’s proposed taxes; some feel it’s only fair that they pay their share of Toronto’s tax increase. Across the pond, a look at the “residential gap” growing among British generations revealed that some British seniors are more dismayed by the fact that their children and grandchildren haven’t been able to get onto the property ladder at all.

As it now stands, Miller’s plan rings untrue. What would get us closer to fair is a plan that would ensure that we all contribute towards realizing our vision of Toronto – high density, greener and inclusive. This plan should feature a clear strategy to secure a better deal with Queen’s Park, economical spending and a better mix of property tax increases, targeted taxes and user fees. If partially off-set by a moderated property tax increase, a land transfer tax need not come off of the table, provided that it is lower and fully exempts all first-time HomeBuyers. Even better, a vehicle registration tax and user fees on garbage disposal, for example, would not only raise revenues - they would help re-shape how we live in the city.

Council votes on Miller's tax plan this Monday, October 22. If we can’t pull off a plan that's actually worthy of our city, let’s not add insult to injury by using the word ‘fair’ to describe what it is that Toronto is settling for.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

Urmi Desai is an economic analyst and a freelance writer specializing in urban issues. She is editor of the Move Smartly blog. Email Urmi

Subscribe to Move Smartly by Email

Related Posts: