Dave Larock in Interest Rate Update, Mortgages and Finances

In Part One, we focused on the mortgage-rule change that will take effect on October 17, 2016. Today, in Part Two, we’ll focus on the additional rule changes that will take place on November 30, 2016.

(I will also provide my usual weekly interest-rate update at the bottom of this post.)

The first change our regulators announced was that, as of October 17, all default-insured borrowers would have to be qualified using the Mortgage Qualifying Rate (MQR), which stands at 4.64% currently, or slightly more than double today’s typical five-year fixed-rate. That change was made to enhance the safety of insured-mortgages portfolios by ensuring that, in future, only those who can afford significant mortgage-rate increases will be eligible for the ultra-low rates that insured mortgages provide.

If the first rule change raised the qualifying bar for mortgage insurance, the second wave of rule changes completely eliminates mortgage insurance for certain categories of borrowers. To be clear, these changes don’t mean that affected borrowers won’t still have access to mortgages, but they do mean that these borrowers will have fewer options than before and should expect to pay rates that are higher than the lowest available.

First, a quick refresher. An “insured mortgage” is backed against default by the full faith and credit of the federal government (otherwise known as the Canadian taxpayers). Once an insurance policy is in place, a properly underwritten mortgage is basically bullet proof. If an insured borrower stops paying their mortgage and the lender has to seize and sell their property, and if the sale proceeds are less than the outstanding balance of the mortgage, the insurer reimburses the lender for any shortfall.

With this default protection in place, insured mortgages can be sold to investors who will accept interest rates that are only slightly higher than those paid by our federal government when it borrows money. That insurance protection also reduces the amount of capital that lenders must set aside for each loan they make, which further reduces the lenders’ cost of the funds.

Our policy makers are now worried that the substantial benefits provided by readily available mortgage insurance may have become too much of a good thing for our housing markets, and that the current $450 billion in insured mortgage-backed debt outstanding represents too much risk for Canadian taxpayers.

When most people think of mortgage insurance, they think of a buyer who is putting down less than 20% of the purchase price of a property. This type of buyer is referred to as a “high-ratio” borrower, and they are required to pay a one-time fee that covers the cost of insuring their mortgage against default. Conversely, buyers who are putting down more than 20% of the purchase price of a property, or existing home owners who have more than 20% equity built up in their property, referred to as “low-ratio” borrowers, are not typically required to pay for mortgage default insurance, but it is still used widely on these types of mortgages today.

“Portfolio insurance” for low-ratio mortgages has become increasingly popular with lenders. They pay for the default coverage themselves because the benefits of reduced securitization costs and lower capital requirements that come with this protection are worth more to them than the cost of the coverage. Today, low-ratio portfolio-insured loans account for 35% of our total residential insured mortgages outstanding, and the vast majority of the borrowers whose mortgages are portfolio insured don’t even know it.

Nonetheless, it is this group of low-ratio borrowers who will impacted by the changes that will take effect on November 30, 2016.

Until now, the rules for insuring low-ratio mortgages have been more lenient than those used for high-ratio mortgages, in recognition of the fact that low-ratio loans have more paid-in equity, which makes them inherently less risky. But after November 30, the qualifying rules used to underwrite portfolio-insured low-ratio loans will be the same as those that are used to underwrite insured high-ratio loans.

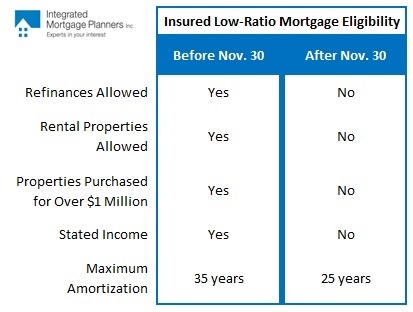

Here is a summary of the types of mortgages and features that will no longer be eligible for low-ratio mortgage insurance after November 30, 2016:

Bluntly put, when these types of mortgages and features are no longer eligible for low-ratio mortgage insurance, lenders’ costs to fund these types of loans will rise, and the lenders will, of course, recover these increased costs by charging higher interest rates to their borrowers.

In fact, lenders have already begun announcing surcharges on new mortgage applications for refinances and for rental-property loans that will close after November 30. Several have suspended lending on rental properties altogether, and these announcements are expected to continue over the coming weeks.

Now that I have explained both the October 17 and November 30 changes in detail, in Part Three of my posts covering the latest mortgage-rule changes, I’ll offer my take on the longer-term impacts that they will have on our borrowers, on our lenders, and on our housing markets across Canada.

Meanwhile, here is this week’s interest-rate summary:

Five-year Government of Canada bond yields rose by eleven basis points last week, closing at 0.73% on Friday. Five-year fixed-rate mortgages are available in the 2.29% to 2.39% range (for now), and five-year fixed-rate pre-approvals are offered at about 2.59%.

Five-year variable-rate mortgages are available in the prime minus 0.40% to prime minus 0.50% range, which translates into rates of 2.20% to 2.30% using today’s prime rate of 2.70%.

The Bottom Line: The mortgage-rule changes that will take effect on November 30 make it less likely that the Bank of Canada (BoC) will raise its policy rate any time soon. They were intended to push our overall mortgage rates higher, as a way to reduce insured-mortgage originations and to help slow the pace of our household debt accumulation. If these changes work as planned, they will give the BoC the flexibility to leave the borrowing rates for our broader economy unchanged, preserving the hope that rock-bottom rates will eventually stimulate a rise in business spending and investment.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog, Move Smartly, and on his own blog: integratedmortgageplanners.com/blog Email Dave

October 11, 2016

Mortgage |