John in HomeBuying, Toronto Real Estate News

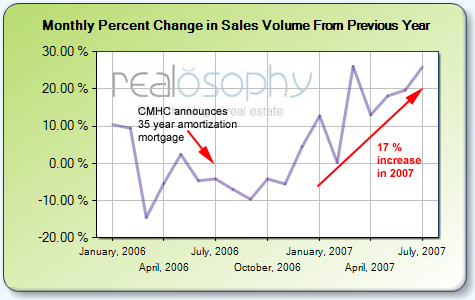

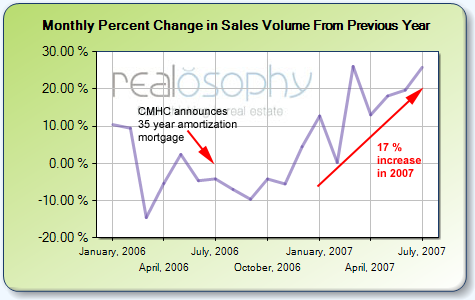

Talk about real estate in Toronto usually centers on the city’s booming housing market. For the past seven years, we’ve been hearing what seems to be the same media report about record real estate sales. But the numbers are not necessarily the same old: the last seven months have seen a dramatic increase in sales volumes (17% compared to the same period last year). So what is driving the significant increase in demand for homes in 2007?

The number of homes sold each year in Toronto has remained relatively constant since 2004 (figures released by the Toronto Real Estate Board do not include those for new construction). Roughly 83,500 homes have been sold in the Greater Toronto Area in each of the past three years. But 2007 has seen a sudden surge in the number of home sales. In the first seven months (January – July) of 2007,we’ve seen 60,424 homes change hands compared to 51,706 during the same period in 2006. That represents a 17% increase from the previous year. If sales continue at this pace we can expect to see a record 97,000 homes change hands this year.

* Note that the volume increase of approximately 25% in March 2007 in the above chart is not correct. Sales actually declined by 2% that month.

Changes in demand of this magnitude are usually triggered by significant changes in our market. Interest rates are usually a good first place to look, but since rates have been on the rise for most of this year, we can’t attribute this increase in demand to favourable changes in rate conditions.

The one shock to our market that does stand out is Canada Mortgage and Housing Corporation (CMHC)’s decision to extend mortgage default insurance (required by lenders for those buying a home with less than a 20% down payment) to cover mortgages with 35- and 40-year amortization limits. Prior to 2006, CMHC would only insure mortgages with up to a 25-year amortization. Early in 2006, CMHC began insuring mortgages with a 30-year amortization. This was later extended to those with 35- and 40-year amortizations. This is one in a series of policy changes that the CMHC has recently introduced to enable more HomeBuyers to enter the market, and in light of growing product competition from its main competitor, Genworth Financial.

Increasing the amortization limit on a mortgage allows HomeBuyers to borrow more money to put towards the purchase of their home. What appears to have happened in Toronto is that many HomeBuyers were not jumping into the market because they couldn’t afford the type of home they wanted. An increase in the length of the amortization period on offer suddenly made HomeBuying a possibility for these purchasers because it allowed them to spend more money on a home.

The chart above shows the percentage change in the number of homes sold per month as compared to the same month in the previous year. For example, a 10% value for January 2006 means that sales in that month were 10% higher than in January 2005. Because demand for real estate is seasonal, we usually compare one month’s sales to the same month in the previous year in order to examine emerging trends.

Although the increase in the amortization limit was a significant change in our market, we wouldn’t expect such changes to have an immediate market effect. There is some lag time before consumers become aware of these changes, get pre-approved for a mortgage, start shopping for a home and, finally, purchase a home. If we look at the chart above, we notice that sales volumes have either increased or remained constant every month since December 2006, five months after CMHC announced that they would be insuring 35-year amortization mortgages.

A recent RBC Economics report confirms that HomeBuyers are taking advantage of these longer amortizations:

Our forecast performance for Canadian household debt markets is partly right in that we argued that financial innovation could lift mortgage growth, but partly wrong because it is happening somewhat faster than we had thought likely.

There is enough evidence to convince us that a very material amount of mortgage originations are going for much longer amortization periods.

The RBC report also suggests that a rise in interest rates may not have the traditional effect of slowing down the real estate market:

First, a rising rate environment may not crimp home affordability as hard as in the past, as typically measured by housing-related payments over income. To offset the impact on payments of our forecast for a one percentage-point hit to rates, a borrower would need to go from a 25-year mortgage to a 33 year amortization period, assuming the same house price, while still having the flexibility to pay off the mortgage faster later on. In the absence of higher rates, longer amortizations are contributing to upward price pressures in some markets, but also insulate against higher rates.

Economists traditionally try to moderate shocks to the economy by introducing significant policy changes over time rather than overnight. For that reason, we (and perhaps Bank of Canada governor David Dodge) might have expected CMHC to phase in their extended amortization programs over several years instead of increasing the insurable amortization limit by 15 years in under a single year.

Demand for homes in Toronto is increasing at an incredible pace, no doubt due, in part, to the increased availability of extended amortization products. Economics 101 tells us that when more HomeBuyers are willing and able to buy, prices will soon rise. This has been a reality in the Toronto market. As demand levels off in response to rising prices, will Toronto’s real estate market actually achieve the “soft landing” we’ve been hearing about for years, or does a rough landing await? Only time will tell.

John is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John