Last Friday we learned that overall Canadian inflation, as measured by our Consumer Price Index (CPI), came in at 2.5% in June, and that result was higher than the consensus forecast of 2.4% for the month.

The reaction was predictable. Most mainstream economists speculated that the Bank of Canada (BoC) would raise its policy rate again in either September or October to rein in rising inflationary pressures.

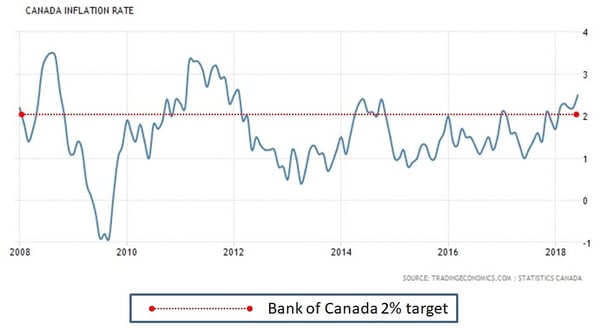

Our inflation rate has certainly increased of late.

In January, our CPI rose by just 1.7%. But then rising inflationary pressures pushed it over the BoC’s target rate of 2% for each of the next five months. This extended period of above-target inflation is unfamiliar territory for our economy of late. It has spent most the past ten years looking up at that target (see chart).

While rising inflation is certainly a normal justification for higher rates, I’m not yet convinced that more BoC hikes are imminent.

Here are my five reasons:

- Last month’s inflation rise was essentially caused by a 24% spike in average gas prices and by labour cost increases that were triggered by the higher minimum wages introduced in British Columbia, Alberta and Ontario. Energy prices are notoriously volatile and the bulk of the labour cost increases were caused by legislative changes, not by tighter labour-market conditions that could stoke inflationary pressures over the longer term.

- Core inflation, which strips out the more volatile price inputs, like energy, from our overall CPI measure, came in at only 1.3% for the month, which was below the consensus forecast of 1.4%. Meanwhile, the other three sub-measures that the BoC uses to gauge inflation remain at or just below 2%.

- In its latest Monetary Policy Report (MPR), the BoC predicted that inflation would peak at 2.5% - and for exactly the reasons listed above. The Bank also said that it expected these impacts to be temporary and predicted that they would dissipate by the end of the year. Against that backdrop, why should we assume that additional policy-rate increases are in the offing?

- While the BoC uses a 2% target for inflation, it also operates with a broader “inflation range” of 1% to 3% to allow for short-term fluctuations that are caused by temporary factors, exactly like the ones we saw in the latest inflation data. In other words, 2.5% isn’t going to send our central bankers into a panic.

- The BoC has repeatedly emphasized that it will use a gradual approach when moving its policy rate higher. It wants to allow time to assess the impact of the four rate increases that it has already made over the past twelve months (which the Bank has estimated can take up to one to two years to run their full course), and probably prefers to err on the side of caution for as long as there is so much trade-policy uncertainty.

In summary, the BoC must carefully balance its need to stay out in front of whatever sustainable inflationary pressure it sees against our economy’s vulnerability to higher rates, particularly when consumer debt levels are so high. In my estimation, last month’s inflation data don’t meet the definition of sustainable pressure - and at a time of elevated economic uncertainty (the BoC uses the term uncertainty twenty-three times in its latest MPR), keeping a little stimulus around doesn’t seem like a bad idea.

The Bottom Line: Our rate of inflation is now the highest it has been in more than six years and that is fuelling speculation that the BoC will raise its policy rate again this fall. While our latest headline CPI result supports that view, for the reasons outlined above I think a fall raise is far from a foregone conclusion, and I expect that the Bank will prove more cautious than the consensus now believes.

Top Image Credit: Aeya, Getty Images

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

July 23, 2018

Mortgage |

.jpg?width=600&name=Rate%20Table%20(July%2023,%202018).jpg)