Why the celebration is likely premature - and what Canadian mortgage borrowers should do now.

Last week we learned that US inflation slowed by more than expected in October.

The headline US Consumer Price Index (CPI) increased by 7.7% on a year-over-year basis last month. That result was down from 8.2% in September and lower than the consensus forecast of 8%.

US core CPI, which strips out the most volatile inputs to overall CPI, such as food and energy prices, fell from 6.6% in September to 6.3% last month and came in lower than the consensus forecast of 6.5%.

The market reaction was euphoric. Stock markets surged higher and bond yields plunged in response. It was as if the inflation dragon lay slain on the steps of the New York stock exchange.

I think that will prove to be an over-reaction when we get a little farther down the road.

For starters, inflation is still too high, and an increasing proportion of today’s inflation pressure is coming from service prices which tend to be stickier than goods prices (which are now declining on average). That is in large part because service prices are highly correlated with wage costs, which are now rising at an average of around 5% year-over-year on both sides of the 49th parallel. While declining inflation is certainly welcome news, it would be an over-reaction to assume that it will fall much below our average wage growth on a sustainable basis (as I wrote in last week’s post).

Bond-market investors were quick to price in a lower peak for the US Federal Reserve’s policy rate, but Fed officials themselves did everything they could to push back against that assumption. Here are some of the comments they made late last week after the CPI data were released and financial markets reacted:

Lorie K. Logan, the president of the Federal Reserve Bank of Dallas: “This morning’s CPI data were welcome relief, but there is still a long way to go.”

Mary C. Daly, the president of the Federal Reserve Bank of San Francisco: “This is just one piece of information. It’s far from a victory, 7.7% is very limited relief. We can’t be complacent.”

Loretta Mester, president of the Federal Reserve Bank of Cleveland: “Inflation continues to be broad based … we need to do more, and we will.” (For reference, 70% of the price inputs to US core CPI are still increasing by 4% or more on a year-over-year basis.)

It is one thing to price in the fact that US (and Canadian) inflation measures appear to have finally peaked, but quite another to infer that a 7.7% headline US CPI result gives our central bankers a green light to take their feet off their monetary-policy brakes any time soon. They left their policy rates too low for too long when economies re-opened after the pandemic, and they are keenly aware of the hit their credibility took as a result.

The historical record also warns them not to ease up too soon.

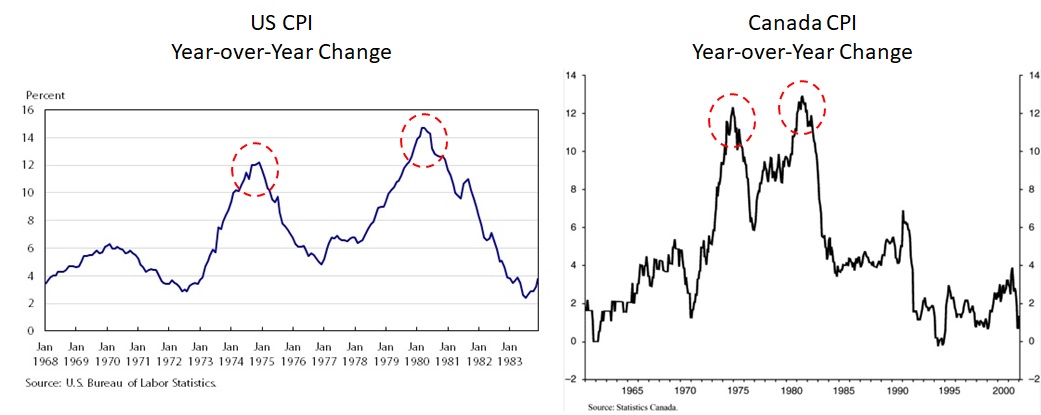

Their predecessors made that mistake during the last big inflation spike in the mid 1970s and 1980s, and that misjudgement caused inflation to re-accelerate to even higher peaks thereafter (see charts below).

Simply put, the Fed and the BoC aren’t going to flinch from their hawkish stances just because the inflation data confirm that they have finally put a lid on surging inflation. Instead, I continue to believe that the most likely outcome is that the Fed and the BoC will both err on the side of caution and end up overtightening.

If that happens, we won’t see a second inflation surge like the ones illustrated in the charts above, but we will see a sharp slowdown in both the US and Canadian economies that will almost certainly push them into recession. (For reference, 11 of the Fed’s last 14 tightening cycles since World War II have been followed by recessions within two years, and this current tightening cycle is already their sharpest and steepest on record.)

Those factors lead me to believe that interest rates will remain elevated for longer than the market is currently expecting. But then, if past is prologue, they will decline (because interest rates have fallen in every past recession) by a significant amount (because erring on the side of overtightening will trigger a sharper-than-expected slowdown).

If you’re in the market for a mortgage today, variable mortgage rates will test your courage over the near term, but they will also offer the most immediate benefit if/when mortgage rates start to drop.

As an alternative, shorter-term fixed-rate mortgages of two to three years provide more security than a variable rate, and they offer the opportunity to reset your rate sooner than would be the case with longer-term fixed rate options. This option is well worth considering if you are willing to accept the risk that your renewal date arrives before lower rates materialize.

Five-year fixed rates are now among the cheapest of the options available, and for some, locking in a small amount of definite saving today will be worth forgoing the opportunity for more potential saving down the road. There should be no shame in playing it safe. Extra insurance usually costs more, but that doesn’t mean it isn’t worth it (and that is true regardless of whether you end up needing it or not). Just make sure your mortgage contract doesn’t come with a huge prepayment penalty that effectively blocks you from refinancing if rates drop significantly (as this post explains).

The Bottom Line: US Treasuries plunged in response to the latest US inflation data, and GoC bond yields fell in near lockstep with their US equivalents.

If the current bond-market rally lasts much longer, we should see fixed mortgage rates move lower. However, I expect them to resume their steady upward climb in relatively short order, so if you’re a variable-rate borrower who has been chomping at the bit to lock in, you should take advantage of any rate-drop window that opens while you can. (That said, if I were in the early stages of a five-year variable-rate term today, I would stay the course and bet that I’ll be saving money by the time my term reaches its later stage.)

Five-year variable rates held steady last week. The futures market is now pricing in a 0.25% hike by the BoC at its next meeting on December 7 (reduced from 0.50% after last Thursday) but that could change when we receive the latest Canadian CPI data this Wednesday.

Stay tuned.

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

November 14, 2022

Mortgage |

.jpg?width=883&height=328&name=Rate%20Table%20(November%2014%2c%202022).jpg)