While good job numbers normally mean rising mortgage rates, our economy is still far from normal.

Last week was a quiet one in the lead-up to the Bank of Canada’s (BoC) meeting this Wednesday.

On Friday we learned that our economy recovered another 246,000 jobs in August, most of them full-time positions. A gain like that would normally push up our bond yields and, by association, our fixed mortgage rates, but at this point nobody needs to be reminded that these are not normal times.

Here are five quick thoughts on our current employment situation:

- Our official unemployment rate now stands at 10.2%. That’s down from 10.9% in July, and from a peak of 13.7% in May, but still almost double February’s 5.6% pre-pandemic rate.

- Statistics Canada also publishes an “underutilization rate”, which includes all unemployed working-age Canadians (both those looking for work and those not looking for work) plus anyone who worked less than half of their normal hours in the prior month. Our underutilization rate came in at 20.3% in August, roughly double the 11.2% where it had been in February, pre-pandemic. Our economy still has a lot of labour slack left to absorb.

- We have recovered approximately 65% of the jobs lost since the start of the pandemic. We’re off to a good start, but employment gains will be much harder to come by going forward. Bluntly put, if they haven’t come back yet, they are increasingly likely to be lost for good.

- The positive economic multipliers that typically accompany job creation, such as increased incomes and spending, are less likely to materialize this time around. Our government’s emergency income-replacement program was so generous that many of the Canadians who are returning to work will see their incomes actually fall relative to where they were during their time off.

-

The working-from-home trend may not be as entrenched as was first believed. Last month 300,000 fewer Canadians worked from home. Maybe the office coffee isn’t so bad after all.

The Bottom Line: Five-year fixed and variable mortgage rates dropped a little again last week, as the COVID-related risk premiums that had pushed gross lending spreads above their long-term historical averages continued to dissipate.

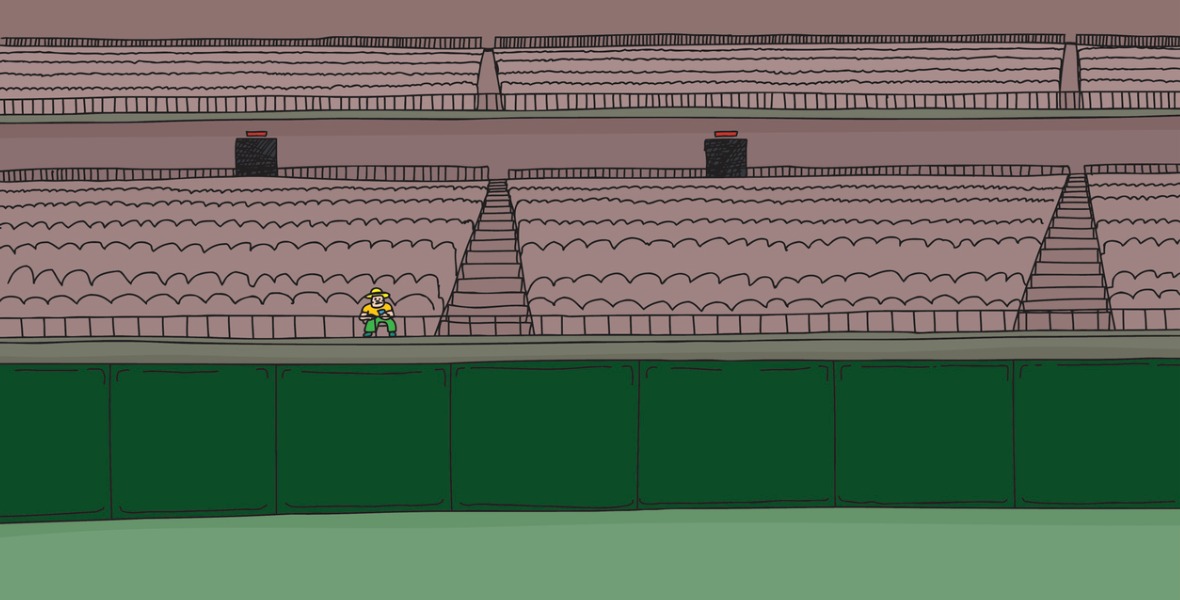

Last week’s robust employment headline was an encouraging sign for our economy, but for the reasons outlined above, it doesn’t change the fact that we are probably only in the early innings of a nine-inning recovery. That belief lends support to the view that our mortgage rates are likely to remain at or below their current levels for the foreseeable future.

Image credit: iStock/Getty Images

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

September 10, 2020

Mortgage |