Labour represents the largest single cost for most businesses, and there are a lot of unfilled job openings in both countries right now. The mainstream media have relayed anecdotal feedback about employers who have had to increase pay and/or add incentives to lure back sidelined workers.

If labour shortages continue and employers are forced to continue increasing their pay offerings, inflationary pressures (and mortgage rates) are likely to sustainably rise. But that outcome is far from guaranteed, and both the Bank of Canada (BoC) and the US Federal Reserve have committed to maintaining their ultra-accommodative monetary policies until their respective labour markets have fully recovered to pre-pandemic levels.

Before we get to the latest reports, here are a few observations about the current employment backdrop, which is still being heavily impacted by COVID-related factors.

The strangest anomaly today is that US economy is purported to have 8.7 million Americans looking for jobs at the same time as there are an estimated 10 million positions available, which begs the question – why?

For starters, generous emergency unemployment benefits have so far helped workers in low-paying, high-contact industries to weather long lay-offs, but that will soon change. (US benefits are set to expire on September 4 while Canadian benefits were recently extended to October 23.)

At the same time, some part of the working-age population has been forced to stay home to care for dependents, and that impact should also be reduced in the fall if and as US schools resume in-class learning.

But not everything is expected to go back to pre-COVID normal.

An increased number of older workers are opting for retirement, and COVID has pushed others to pursue new, less risky employment in new fields.

Employers are increasing their focus on technological advances that will reduce their need for labour, and some are still reluctant to fully re-staff while they remain uncertain about the prospect of more lockdowns and/or the permanent changes in consumer behaviour.

Each new employment report provides an update on how COVID-related factors are impacting our recoveries today, and, more gradually as those impacts fade, how they are altering what our new employment landscape will look like.

To that end, here are the highlights from the latest jobs data on both sides of the 49th parallel.

Canadian Employment Data Highlights

- Our economy added an estimated 94,000 new jobs last month, but that impressive headline still fell well short of the consensus forecast of 165,000. (That gap can be explained, in part, by the fact that Stats Can’s latest employment-data sample included only the very beginning of Ontario’s reopening phase.)

- We have now recovered all the jobs that were lost during the third-wave shutdown, but we are still about 275,000 jobs short of our pre-pandemic total and about 650,000 jobs short of the level we need to match our pre-pandemic employment rate (which includes the natural growth of our labour force over the past seventeen months).

- Last month’s gains were all in the private sector (+123,00) and were primarily in full-time positions (+83,000). The number of employed Canadians who worked less than half of their normal hours (referred to as “underemployed” workers) fell by another 116,000, after decreasing by 276,000 in June. That trend is an encouraging sign that more businesses are resuming normal operations.

- Average hourly earnings for permanent workers rose by 0.6% on a year-over-year basis last month, so anecdotal reports about employers having to raise wages still aren’t translating into a material rise in broader labour costs (at least for now). Total hours worked were up 1.3% in July on a month-over-month basis, but that number is still 2.7% below its pre-pandemic level.

- The biggest concern in the latest report remains goods-producing employment, which was flat in July after decreasing by 108,000 in the second quarter. Goods-producing employment tends to be higher paying and helps to create derivative jobs across the broader economy. Instead, most of last month’s new jobs came, not surprisingly, from high-contact, low-paying service-sector positions.

US Employment Data Highlights

- The US economy added an estimated 943,000 new jobs last month, which was above the consensus forecast of 870,000 (and the original estimates for May and June were also revised upwards by another 119,000).

- The official US unemployment rate fell from 5.9% to 5.4%, and the broader measure of US unemployment that includes workers who are only marginally attached to the work force (called the U-6 rate) also fell from 9.8% to 9.2%. The US employment rate, which measures the percentage of working-age Americans who are employed, and which the Fed watches more closely, is now 58.4%. That leaves it about 6 to 7 million jobs shy of its pre-pandemic level (depending on estimates of US population growth since then).

- The US participation rate, which measures the total percentage of working-age Americans who are either working or actively looking for work, edged up to 61.7%, but remains well below its pre-pandemic level of 63.4%.

- Average hourly earnings were up 0.4% last month and are now up 4% on a year-over-year basis. The impact of that increase on broader labour costs is somewhat muted, however, by the fact that hourly wage jobs tend to be lower paying.

- Most of the gains were centred in the areas of the US economy most directly tied to reopening. The leisure and hospitality sector added 380,000 new positions, and the education sector also showed big gains, adding 261,000 new jobs.

While last month’s Canadian and US employment reports were both solid on an overall basis, I think there is a significant chance that our recovery trajectories will diverge in the months ahead.

Canada’s initial vaccination efforts were hampered by a lack of supply, but we now lead the world (61.69% fully vaccinated, 72.01% at least partially vaccinated). That high take-up rate reduces the likelihood that COVID’s surging Delta variant will force us back into lockdown or otherwise destabilize our recovery.

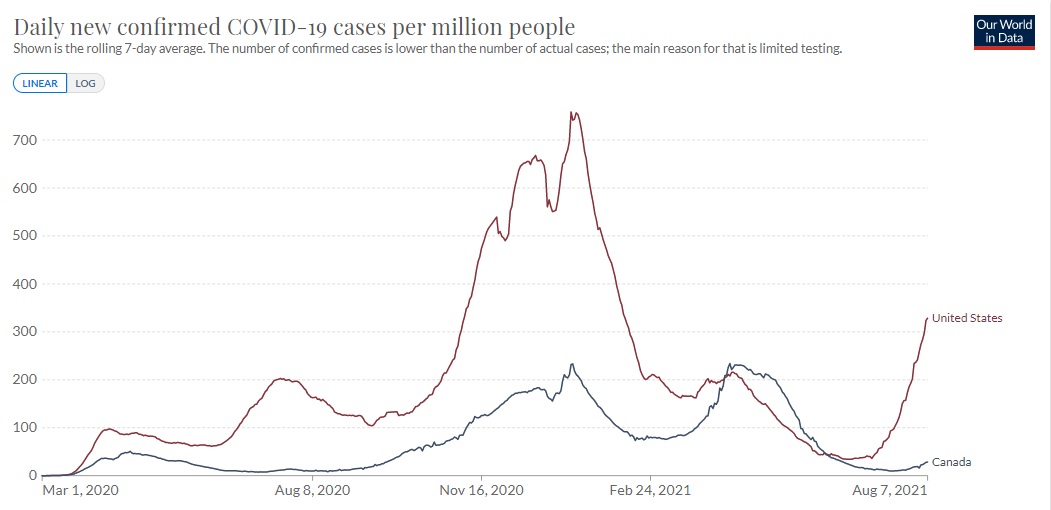

Conversely, US vaccination rates appear to be stalling out (49.7% fully vaccinated, 58.2% at least partially vaccinated), and US infection rates have just soared above 100,000 new cases per day (and that’s during summer months when infection rates are typically lower).

The combination of surging US infection rates (see chart) and increased US vaccine hesitancy raises the odds that more US lockdowns could be on the horizon.

We may now be heading toward a situation where Canadian employment recovers well ahead of US employment.

In such a scenario, the Government of Canada (GoC) bond yields that our fixed mortgage rates are priced on are likely to remain lower than they otherwise would because they will continue to mirror their US equivalents - and US yields will be suppressed by a delayed US recovery.

Meanwhile, if the US recovery is faltering and the Fed is maintaining its low-rates-for-longer stance at the point when the BoC might otherwise be ready to raise its policy rate, doing so would cause the Loonie to rise further against the Greenback and threaten our own recovery as a result.

(The last time the BoC raised ahead of the Fed was in 2010. The Loonie soared against the Greenback, even moving above par for a period, and our export sector took another five years to recover to its pre-2008 level.)

With that relationship in mind, over the near term, Canadian and US COVID vaccination and infection rates will likely provide the most reliable single indicators of what’s ahead for job-market recoveries in both countries – even more so than the details in the employment reports to come.

The Bottom Line: Last week’s employment data pushed US bond yields higher, and GoC bond yields rose in near lockstep with their US counterparts. That said, the GoC five-year bond yield closed last week at 0.88% and is still well below the 1.00% level it was at when mortgage lenders last moved their rates.

Five-year fixed and variable rates held steady last week, and while I don’t expect any near-term changes to either rate, surging US COVID infection rates are raising downside risks to the US recovery, and by association, to the US and Canadian mortgage rates that are tied to it.

August 9, 2021

Mortgage |

%20(1).jpg?width=687&name=Rate%20Table%20(August%202%2c%202021)%20(1).jpg)