The Bank of Canada (BoC) meets this Wednesday, and bond-market investors now put the odds of a 0.25% rate cut at about 70%.

If the Bank cuts, the rates on variable mortgages and home-equity lines-of-credit (HELOC) will decrease by the same amount.

In last week’s post, I explained why I think the BoC will cut.

In this week’s post, I will revisit the age-old fixed vs variable debate by using three different rate simulations. They will include a scenario where the variable rate proves cheaper, one where the fixed rate wins, and one where the two rates essentially break even.

Readers can then decide for themselves which one seems most likely.

Let’s start with some basic assumptions:

- I’m going to assume that the borrower is buying a home with a down payment of 20% of the purchase price, and they are applying for a $500,000 mortgage amortized over twenty-five years.

- In each simulation, I am going to compare the cost of a five-year variable rate at prime minus 1.00% (which works out to 6.20% today) to the cost of a three-year fixed rate at 5.29%.

I have chosen these two options because they are today’s most popular fixed and variable-rate options. The rates I am using are competitive and should be widely available to most borrowers (as opposed to today’s best promotional rates, which may not last as long).

Simulation #1 – Variable Wins

This simulation assumes that the BoC cuts this week and enacts a steady series of cuts thereafter.

Inflation has cooled steadily thus far in 2024 and our economy is slowing more rapidly than expected. The BoC forecast Q1 GDP growth of 2.8% (quarter-over-quarter) in its most recent Monetary Policy Report. Last week Statistics Canada confirmed that actual Q1 GDP growth was only 1.7%.

There are other signs that the BoC’s first cut is overdue.

Mortgage default rates have risen steadily of late; credit card and line-of-credit utilization rates have surged; and business bankruptcies are also spiking.

Furthermore, only about half of Canadian mortgage borrowers have renewed into higher rates thus far. While these emerging credit strains are already concerning, the Bank also knows that the borrowers who have yet to renew will be facing even larger payment shocks at renewal. (Most of them will be renewing ultra-low rates, which were secured during the pandemic.)

That means even if rates just stay where they are, the BoC’s monetary-policy tourniquet will continue to tighten.

Against this backdrop, in Simulation #1, the BoC concludes it has held its policy rate at 5.00% long enough and starts cutting this week. Here is the forecasted path for variable rates in that scenario:

- The BoC cuts by 0.25% at its meeting this week.

- It cuts again in July before pausing, perhaps to allow time for the US Federal Reserve to enact its own cuts.

- The Bank then cuts again in December as our economy cools alongside the weather.

- The BoC cuts four more times in 2025, and twice more in early 2026.

- By the time the dust settles, the BoC has slashed its policy rate from 5.00% all the way down to 2.75%.

Here is a summary of how fixed and variable mortgage costs would compare:

The borrower with the three-year fixed-rate term will then likely be renewing into a new, lower fixed rate at the end of their term.

Meanwhile, the variable-rate borrower has two years left on their term, but at an already lower rate. That comes with the option to convert to a fixed-rate term equal to or greater than the time remaining on their existing variable mortgage at no cost. (Fair warning: the competitiveness of the conversion rates offered can vary significantly.)

Simulation #2 – Fixed Wins

The market has expected rate cuts for some time now.

At the start of 2024 the bond market was giving odds that the first 0.25% cut would arrive by March, and it was pricing in as many as six cuts by the end of this year. Things didn’t work out that way. Inflation proved more stubborn than expected, and the Bank remained unconvinced that the genie had been put back in the bottle.

In a recent speech BoC Governor Macklem offered this word of caution to anyone hoping for a rapid series of rate hikes: “When you look at our forecast right now, inflation is coming down pretty gradually. So even when we start reducing interest rates, it's likely to be a pretty gradual path.”

It is also possible that inflation will see a resurgence. There are many forces that could drive it higher. From abroad, strong export demand, rising energy prices, and higher import prices tied to a weaker Loonie are all in play. Here at home, wage growth remains high while productivity gains continue to lag. The BoC has repeatedly warned that those trends are “inconsistent with achieving two per cent inflation”.

Here is the path for variable rates that I have charted in Simulation #2:

- The BoC’s first 0.25% arrives in December, later than expected.

- The Bank cuts twice more in early 2025 but then pauses (perhaps to ensure that those cuts don’t release a wave of pent-up real-estate demand).

- Inflation also levels off at above-target levels, and the Bank loses confidence that it has done enough to return it to target. This also allows time for US Fed cuts to materialize, which, in turn, helps stabilize the Loonie.

- The Bank doesn’t resume rate cuts until the middle of 2026. It then enacts four 0.25% cuts between July of 2026 and June 2027. By that point its policy rate has fallen to 3.95%, but it ends up taking much longer than expected to reach that level.

Here is a summary of how fixed and variable mortgage costs would compare:

Readers will note that the saving for the fixed-rate borrower in Simulation #2 is smaller than the saving for the variable-rate borrower in Simulation #1. That is consistent with my assessment that we are still near the peak of this interest-rate cycle. If you agree with that view, variable rates should have the potential for more saving.

Simulation #3 – Breakeven

In this scenario, forces competing to push inflation up or down cancel each other out.

For example, reduced spending by consumers can be offset by increased government spending. Rate cuts that reduce mortgage costs can fuel a resurgence in housing demand. Labour market conditions can loosen overall while skilled labour in key sectors is still in short supply.

The BoC’s current policy rate level is highly restrictive, so it does cut. But more cautiously than expected.

Here is an illustration of the path that variable rates follow in Simulation #3:

- The BoC waits until September to make its first 0.25% cut.

- Thereafter, it cuts at every second meeting until it has cut a total of five times.

- By the time we reach September 2025, the Bank’s policy rate has been lowered to 3.75%.

- Inflation has stabilized at around 2%, and the economy is muddling along with GDP growth rates in the 1% to 2% range. The Bank begins a long pause that holds through the end of our three-year simulation period.

Here is a summary of how fixed and variable mortgage costs would compare:

In this scenario the cost of the two options is essentially the same.

If you knew that would be the case going in, you’d probably choose a variable rate because it comes with more flexibility.

In addition to being convertible to fixed rates, variable mortgages typically come with payout penalties that are capped at three months’ interest (whereas fixed-rate mortgage contracts include interest-rate differential penalties that can be much more expensive).

Some variable-rate mortgages also come with fixed payments, which give borrowers the option of holding their payment steady if their rate rises (up to the point where the minimum payment is no longer covering the cost of interest). Instead of increasing their payment when rates rise, these borrowers extend their amortizations instead.

Mortgage Selection Advice for Now

If you’re willing to start your term with a higher rate and to assume the inherent risk that the BoC’s policy rate may not fall as quickly, or by as much as expected, I think five-year variable rates are now most likely to generate the lowest borrowing cost over the entire term of the mortgage.

There is no way to know for sure where rates are headed, but if we are, in fact, near the peak of the current interest-rate cycle, the odds should favour variable-rate mortgages.

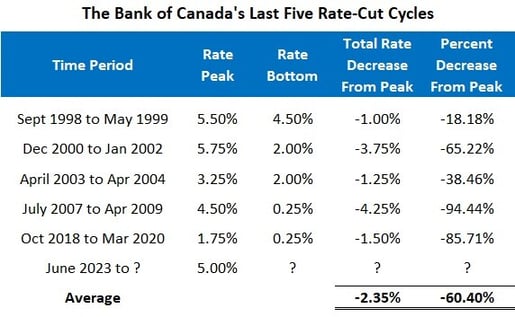

The BoC’s first rate cut is very likely not far off, regardless of whether it materializes this week. The consensus expects the BoC to cut with a range between 1.50% to 2.00% over the next year and a half. If variable rates drop by that amount by the end of 2025, they should easily outperform all of today’s fixed-rate options.

If you’re a more conservative and risk-adverse borrower, I think three-year terms are still the best choice among today’s fixed-rate options. The premiums required for one- and two-year fixed rates remain substantial. And while five-year fixed-rate terms come with today’s lowest rates, I still worry that five years is too long to be locking in when rates are near their highest levels in more than three decades.

The Bottom Line: Government of Canada (GoC) bond yields remained range bound last week, and so did our fixed mortgage rates.

All eyes will be on the BoC when it meets this Wednesday.

I expect the Bank to cut. If it does, variable-rate borrowers will finally experience some long-awaited relief.

The first policy-rate cut should also put downward pressure on GoC bond yields, and possibly lead to lower fixed mortgage rates, but that is far from assured.

The direction of our bond yields will also depend significantly on what happens south of the 49th parallel.

On that note, there are several secondary US economic data releases due this week and then the US payrolls report will be released on Friday. GoC bond yields will likely be pulled in the same direction as their US Treasury equivalents.

Image credit: iStock/Getty Image

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

June 3, 2024

Mortgage |

.jpg?width=771&height=286&name=Rate%20Table%20(June%203%2c%202024).jpg)