The Bank of Canada (BoC) held its policy rate steady last week, and that was welcome news for variable-rate borrowers who have watched their rates increase by 4.25% over the past thirteen months.

It was also clear from the Bank’s accompanying policy statement, press conference and latest Monetary Policy Report (MPR) that it remains far more concerned about whether it has done enough to cool inflation than whether it has done too much.

In a rare move, BoC Governor Macklem pushed back directly against bond-market futures pricing when he said,“the implied expectation in the market that we are going to be cutting our policy rate later in the year … that doesn’t look today like the most likely scenario to us”.

The bond market did scale back its bets on BoC rate cuts in 2023 from 0.50% to 0.25% following the policy meeting last Wednesday, but it is still on a different page.

Before offering my take on which view will win out, I should start by pointing out that the bond market has a much better track record of predicting where rates are headed than the BoC (or any other central bank).

Bond-market investors currently believe that inflation will cool enough later this year to give the BoC room to loosen its tourniquet. But the Bank continues to caution against that view.

Governor Macklem reminded the assembled press last Wednesday that while he expects inflation to fall to “around 3%” this summer, “the destination is not 3, the destination is 2”. In other words, inflation at 3% might seem close enough for the bond market, but the person with his hand on the rate lever continues to insist that it’s 2% or bust.

On that note, the April MPR showed that the BoC is not forecasting 2% until the end of 2024, and that provides an indication of when the Bank thinks it will begin cutting its policy rate.

Here are the key factors that it will be watching in the quarters to come:

- Inflation expectations – The BoC’s latest consumer and business surveys confirmed both segments still believe “that CPI inflation will be higher than the Bank’s inflation forecast over the next two years”. The Bank needs to remain hawkish for as long as that is the case because expectations of higher inflation can engender more actual inflation.

- Service Price Inflation and Wage Growth – The Bank assessed that “service price inflation remains high and is expected to decline only gradually”. Wages, the largest and stickiest component of most service costs, have been increasing at a rate of between 4% and 5% over the past year, and are “still elevated relative to productivity growth”. Inflation won’t be returning to 2% until our wages cool considerably.

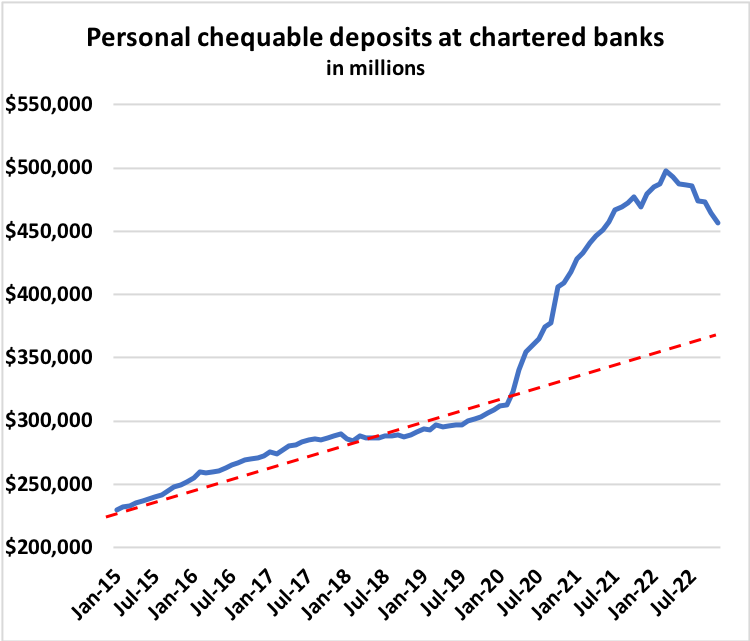

- Corporate pricing behaviour – Businesses have been able to increase prices substantially and, as per my recent post, that will likely persist until Canadians have burned through most of the surplus cash they saved during the pandemic. That process will take time to play out (see chart, courtesy of Ben Rabidoux).

The disconnect between the BoC and the bond market is exacerbated further by our recent economic data.

The bond market knows the Bank’s rapid series of rate hikes will impact our economy with a lag. It sees weakness ahead, and its pricing is always forward looking. But the BoC can’t ignore that our economy is still showing more momentum than expected in the here and now.

Our employment reports have blown past the market consensus. Our GDP growth has been stronger than expected. Our consumer spending has also proven more robust than the consensus predicted.

In fact, the only part of our economy that was responding as expected to sharply higher rates was our real-estate sector, which had cooled considerably. But then the US banking crisis caused Government of Canada (GoC) bond yields to plunge, because they piggyback on their US Treasury equivalents.

That drove our fixed mortgage rates lower and created a new tailwind for our regional real-estate markets that is stimulating demand, and the effects are readily apparent to anyone who works in the industry.

The BoC assessed that our “housing activity remains subdued” in its latest MPR. But readers of this blog should expect to see “Real-estate Rebound” headlines in the mainstream media two months from now when today’s purchase offers close and are officially counted in the data.

I am instinctively reluctant to bet against the bond market. But when inflation, and inflation expectations, have stayed persistently above target for an extended period, the BoC’s willingness to cause economic pain increases considerably. There is also no way to ignore that since the pandemic ended two things have stayed consistently true: 1) inflation has been sticker than expected, and 2) our economic momentum has been stronger than expected.

With those points in mind, I continue to believe that BoC rate cuts won’t materialize until the second half of 2024, notwithstanding the bond market’s expectation that they begin towards the end of this year.

For that reason, if you are in the market for a mortgage today, I think that variable rates are an aggressive bet. While they could certainly prove cheaper than their fixed-rate equivalents over their full term, they require you to pay an initial premium on the belief that you will save that extra cost (and more) farther down the road.

Those seem like long odds when our economy is still rife with upside surprises and when our central bank remains determined that if it is going to err, it will do so on the side of overtightening.

Short-term fixed-rate mortgages of one or two years come with big premiums today, along with the risk that you could be renewing before inflation cools sufficiently. Five-year fixed rates increase the risk that you will be locked in past the point when rates begin to fall.

For now, I continue to believe that the three-year fixed rate looks like the safe middle-of-the-road pick. In today’s risk/reward environment, I’d be prioritizing a limit on my potential risk over maximizing my potential reward.

The Bottom Line: GoC bond yields moved higher last week as financial markets continued to normalize after the US banking scare. (The five-year GoC yield opened the week at 2.92% and closed at 3.28% on Friday.)

Fixed rates will likely move higher if yields rise much farther from this point.

Variable mortgage rate discounts were unchanged last week, and existing variable-rate borrowers breathed easier when the BoC held its policy rate steady last Wednesday. That said, and for the reasons outlined above, I continue to believe that the rate relief, which variable rate borrowers are ardently hoping for, won’t materialize until the second half of next year.

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

April 17, 2023

Mortgage |

.jpg?width=883&height=328&name=Rate%20Table%20(April%2017%2c%202023).jpg)