The Bank of Canada (BoC) hiked its policy rate by another 0.25% last Wednesday, as widely expected. That means our variable mortgage rates will increase by the same amount in short order.

The Bank was non-committal on the need for further increases, but its accompanying communications hinted that additional hikes may be required, as did the updated forecasts in its most recent Monetary Policy Report (MPR).

Here are my responses to the five key questions that Canadian mortgage borrowers are asking in the wake of the BoC’s latest move.

- Are we done yet?

The Bank continues to insist that it will rely on the continuously incoming data and that its next move is not pre-determined. That said, its latest communications provided many reasons why more hikes may be required and no hint that this most recent hike will be its last.

For starters, the BoC sees much stronger demand in the economy than it had expected. It now forecasts that it will take three quarters longer for that excess demand to sufficiently dissipate.

It also observed that inflation has been more “persistent” than expected and noted that three-month measures of inflation, which provide a better indication of inflation pressures in the here and now, “have been stuck in the range of 3½% to 4% since September 2022”. At the same time “wages have been growing at around 4% to 5% for about a year, despite the weakness in productivity growth”.

BoC Governor Macklem expressed concern that there has been “little downward momentum in inflation” and noted that “over half of the components in the CPI (Consumer Price Index) basket are rising by more than 5%”. Macklem also warned that “if we don’t do enough now, we’ll likely have to do even more later”. He emphasized the Bank’s concern that “progress toward price stability could stall and that inflation could rise again if there are positive surprises.”

Simply put, the BoC’s latest communications made it clear that it sees more risk in raising too little than by raising too much. I believe that revealed bias increases the odds that more rate hikes are in store.

- When will the BoC start cutting rates?

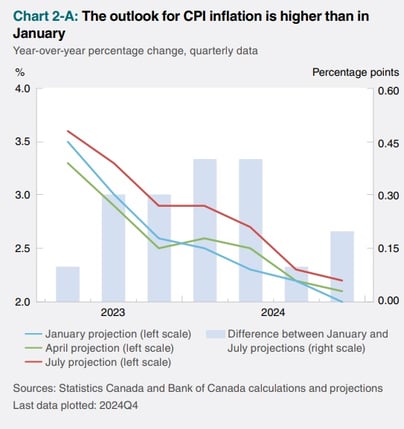

In its latest Monetary Policy Report (MPR), the BoC forecasts that inflation won’t return to its 2% target until Q4 2025 (see chart on right), two quarters later than it had previously anticipated.

In its latest Monetary Policy Report (MPR), the BoC forecasts that inflation won’t return to its 2% target until Q4 2025 (see chart on right), two quarters later than it had previously anticipated.

Governor Macklem has repeatedly insisted that the Bank won’t consider rate cuts until that occurs.

Last week, he warned that “the downward momentum of inflation is waning”, and he expressed concern that “the progress toward price stability could stall”.

That risk seems increasingly likely now that the tailwinds from the normalization of supply chains and lower energy prices are abating.

The consensus forecast from economists now projects that the BoC will start cutting in Q3, 2024. That’s a long way off from today and a far cry from this fall, which is what the bond futures market was pricing in until recently.

If inflation swings higher, as I expect, the timing on rate cut bets will continue to be pushed further out.

- Why isn’t inflation falling more quickly?

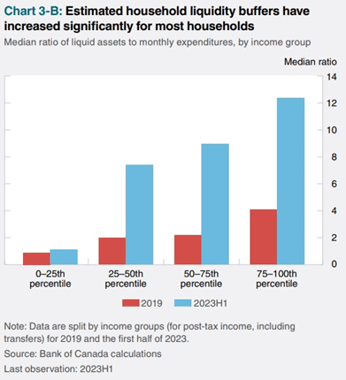

The BoC assessed that “underlying inflationary pressures are proving more persistent than we expected” and that two factors were largely responsible: 1) elevated pandemic savings, 2) robust wage growth.

The BoC assessed that “underlying inflationary pressures are proving more persistent than we expected” and that two factors were largely responsible: 1) elevated pandemic savings, 2) robust wage growth.

The Bank also offered a chart (see right) to summarize the size of the “liquidity buffer” each income quartile has remaining.

As I have been writing for several months, it is unlikely that demand will slow, or that prices will cool, as long as most Canadians can still rely on their savings to absorb higher costs.

Once those savings run out, companies won’t be able to pass on higher prices to consumers so easily, and falling demand will reduce their appetites for hiring additional workers.

Savings levels and spending will be the first shoes to drop, with wage growth following thereafter.

- Where are fixed mortgage rates headed?

Although most of the media’s attention has focused on variable mortgage rates this year, our fixed mortgage rates have risen by more.

As the higher-for-longer view has become more widely accepted, the gap between the BoC and bond-market expectations has narrowed (although the two are still not fully aligned).

For example, the shapes of the bond-yield curves in both Canada and the US are signaling the very high probability of a recession in the near future. It’s important to note that rates have fallen in every recession in the last fifty years. Conversely, the BoC’s most recent forecast indicates that growth will slow in 2024, but that it will not stop altogether.

Relatedly, the bond market still expects inflation to cool and rates to drop about a year before the BoC sees that happening. The next big move in bond yields (and our fixed mortgage rates) will depend on which outlook is validated as evolving economic data are released.

- Why aren’t higher rates having more impact on house prices?

Mortgage rates have undergone their sharpest spike ever and have now reached their highest levels in twenty-five years. But house prices have “picked up earlier than anticipated” and the BoC projects that “previously unforeseen strength in house prices is likely to persist and boost inflation by as much as 0.3 percentage points by the end of 2023, compared with the January outlook”.

Housing momentum is being bolstered by myriad factors:

- Record levels of immigration are stoking demand across the housing spectrum.

- Federal and provincial governments have made minimal progress on improving the supply of housing.

- Overall inflation is combining with acute labour shortages in construction to drive up construction costs.

- Canadian mortgage borrowers were stress-tested at rates that were much higher than what they originally secured. Requiring borrowers to clear those hurdles helped to ensure that they could afford significantly higher rates. (To wit, the BoC noted that Canadian mortgage default rates are well below their pre-pandemic levels, as are the default and utilization rates on home-equity lines of credit and the credit cards used by mortgage holders.)

- Our banking regulator is allowing wide discretion to lenders who offer variable-rate mortgages with fixed payments when they adjust minimum required payments after rate increases. (That, in turn, also helps the lenders’ loan performance data.)

Predicting the path forward for our mortgage rates is unusually difficult today. Our economy is still dealing with the aftereffects of the pandemic. We have record high levels of debt and unprecedented levels of immigration. Deglobalization is adding to inflation at the same time that technological advances are counteracting it.

For its part, the BoC conceded that “a considerable amount of uncertainty surrounds the forecast”. I readily share the humility implied by that statement.

I still believe that the higher the BoC’s policy rate goes, the more it will hasten the arrival of rate cuts following their peak. But it is also important to note that just about everyone, policy makers and bond-market investors alike, has consistently underestimated the amount of time it will take for inflation to return to its pre-pandemic range.

The Bottom Line: GoC bond yields dropped somewhat surprisingly last week despite the BoC’s hawkish raise. They followed their US treasury equivalents lower after the release of the latest US inflation data (which showed the US CPI came in at 3% in June).

If GoC bond yields remain at their current levels, there will be room for lenders to drop their fixed rates a little. But now is probably a good time to remind readers that rates take the elevator on the way up and the stairs on the way down, especially during volatile periods.

Variable-rate borrowers will see their rates rise by another 0.25% over the near term. Based on the BoC’s latest communications, it doesn’t seem as though we’ve seen the peak just yet.

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

July 17, 2023

Mortgage |