We received the latest GDP data for both Canada and the US last week, and today’s post will start with my take on how it will likely impact our mortgage rates over the near term.

I will then offer my thoughts on whether our mortgage stress test has become too onerous for today’s conditions. Then I’ll bang my drum about another mortgage qualification rule that is unfairly penalizing an increasing number of Canadian mortgage borrowers.

Canadian GDP Hits Stall Speed

Last week, Statistics Canada confirmed that our GDP flatlined in July, after declining by 0.2% in June, and it estimated that our economy grew by only 0.1% in August. The bond futures market responded to this news by paring back the odds of another BoC rate hike this year (continuing its recent strong see-saw reactions to each new data point).

Our stalling GDP momentum confirms that the Bank of Canada’s (BoC) rate hikes are biting harder and that the pandemic saving buffers, which enabled consumers to absorb higher prices while maintaining their spending, are being diminished.

That said, slow economic growth is a necessary but not sufficient condition for returning inflation to the BoC’s 2% target. The dominant theme is that we are still a long way from that point.

US GDP Keeps Right on Rolling

Last week we learned that US GDP increased by 2.1% in Q2 on a year-over-year basis.

The US economy is humming along at a much stronger pace than ours, and here are two of the main reasons for that:

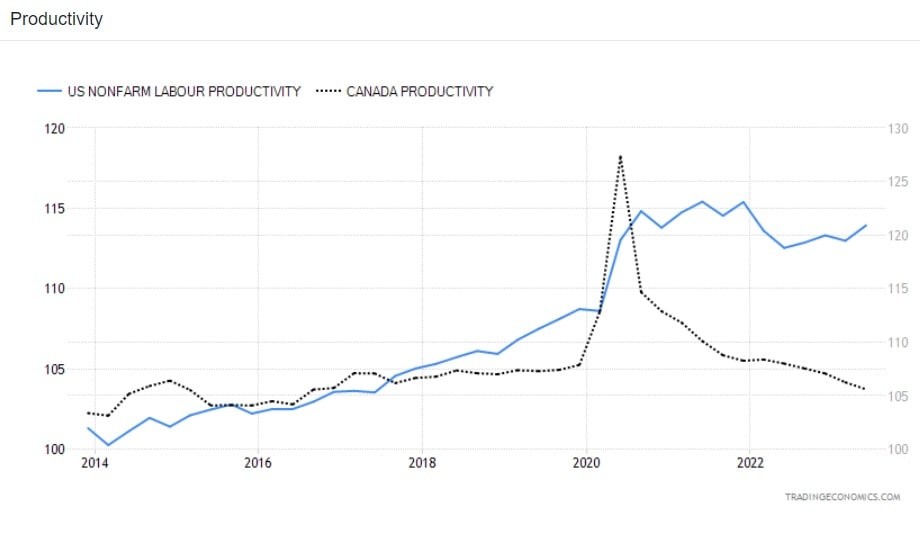

1. US productivity has risen impressively since the pandemic, and Canadian productivity has steadily declined over that same period (see chart). The importance of this measure, especially over time, cannot be overstated.

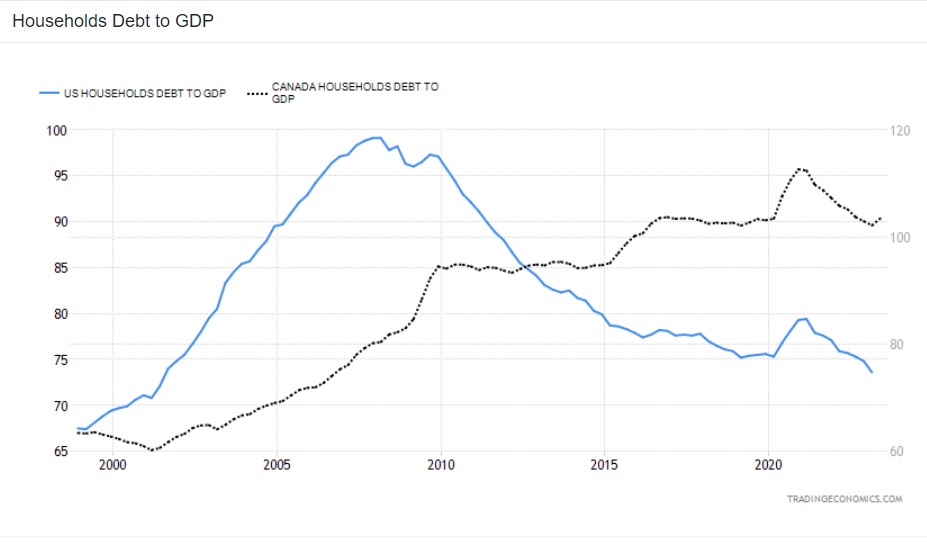

2. US households deleveraged considerably during the Great Recession in 2008 while Canadian households kept borrowing(see chart).

Lower household debt-to-GDP levels will make the US consumer less sensitive to rate hikes and

will likely compel the US Federal Reserve to keep its policy rate higher for longer than the BoC.

If that comes to pass, there will be spillover impacts for Canadian fixed-mortgage rates.

Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, tend

to follow their US equivalents in lock step. That dynamic could keep them at higher levels than

our weakening domestic economy would otherwise require.

On the other hand, our variable mortgage rates won’t be similarly constrained. They move up

and down in tandem with the BoC’s policy rate, and as such, will more closely mirror our

domestic conditions.

If elevated fixed mortgage rates start to unduly restrict housing activity, there is another lever

our policy makers could pull to offset much of that impact … but will they?

A Growing Case for Testing Less Stress

As our economy slows and our housing markets weaken, some of our sacred cows are fair

game.

For example, a growing chorus of market watchers now question the validity of a 2% inflation

target, arguing that it is an arbitrary construct and that perhaps a somewhat higher target, of

say 3%, would be more appropriate going forward.

Increasing the inflation target seems unlikely, but that argument probably haunts the BoC’s

nightmares about inflation expectations becoming unanchored.

The stress test is another policy tool that should re-examined under today’s changed

conditions.

To borrow from a poem about woodchucks: How much more stress should the stress-test test,

when our mortgage rates are already stressed?

When our mortgage rates dropped to rock-bottom levels, it made sense to qualify borrowers at

higher rates that were closer to their long-term averages (which is why I fully supported its

introduction).

Without that stress test, we would be in the middle of a full-blown housing crash today after

homeowners loaded up on cheap debt and rates then tripled from their lows.

But mortgage rates have now spiked above their long-term averages and are still climbing, and

the BoC’s policy rate is firmly in the restrictive range. Should we still be qualifying borrowers

using rates that are another 2% above their already high current levels?

To be clear, I’m not calling for the stress-test rate to be changed overnight. Our policy makers

need slower housing-market momentum to help cool inflation, and there is still some excess

leverage to be wrung out of some regional markets that over-heated during the pandemic.

But at some point, and maybe sooner than we expect, debate about the reduction or

reconfiguration of the stress test is going to intensify – and justifiably so.

An Indefensible Policy

There is a glaring flaw in our banking regulator’s mortgage rules, which some of us have been

pointing out since the day it was first announced.

Our regulator mandates that renewing borrowers who want to switch to a different lender at

renewal must be requalified at today’s stress-tested rates. (Conversely, borrowers do not have

to requalify if they renew with their existing lender.)

When this rule was introduced, it was to designed to ensure that lenders wouldn’t compete

aggressively for the most leveraged borrowers, even though those very borrowers would

benefit most by accessing the lowest rates available.

In reality, this anti-consumer policy traps marginal borrowers at their existing lenders, and, to

no one’s surprise outside of the regulator’s office, often forces them to renew at inflated rates.

Until now, our banking regulator has chosen to demur when questioned about this anti-

competitive policy and to ignore the higher borrowing costs that flow from it.

Today’s 8%+ stress-test rates are increasing the swath of borrowers who can’t access the most

competitive rates available. That fact should put more pressure on our regulator to right this

wrong.

The Bottom Line:The five-year GoC bond yield finished last week right about where it started but not before its mid-week surge triggered another round of increases to our fixed mortgage rates.

At some point, fixed rates will stop rising, but bond yields have so much upward momentum that I can’t be confident about when that will be. Anyone in the market for a mortgage today should be locking in whatever rate they can get their hands on–because even a poor pre-approval rate today could be below market by this time next week.

Variable-rate discounts were unchanged

The consensus still believes that the BoC has made its last rate hike for 2023. But not with a high degree of conviction. The bond futures market continues to swing wildly, and this Friday’s US and Canadian employment reports may set off an other round of volatility.

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

October 3, 2023

Mortgage |

.jpg?width=883&height=328&name=Rate%20Table%20(October%202%2c%202023).jpg)