All eyes will be on the Bank of Canada (BoC) when it meets this Wednesday.

I hope that you enjoyed the break. I took the long weekend off, so there won’t be a new post this week.

On that note, and for context, here are three recent posts that I have written in the lead up to this meeting:

1. This post summarized the Canadian and US economic news that continued to surprise to the upside before the collapse of Silicon Valley Bank caused bond yields to plunge.

2. This post explains how the US and European banking scare has impacted the Canadian economy and our mortgage rates. (It also offers my take on an underappreciated factor that is underpinning our economic momentum.)

3. This post explains why good news for our economy is bad news for our mortgage rates. It also offers my recommendation on the mortgage option that stands above the rest as the safe middle-of-the-road pick in these turbulent times.

I’ll be back next week with highlights from the BoC’s latest Monetary Policy Report, and to offer my take on what it said. (Spoiler alert: I’m betting that the Bank will hold its rate steady and maintain a hawkish overall tone.)

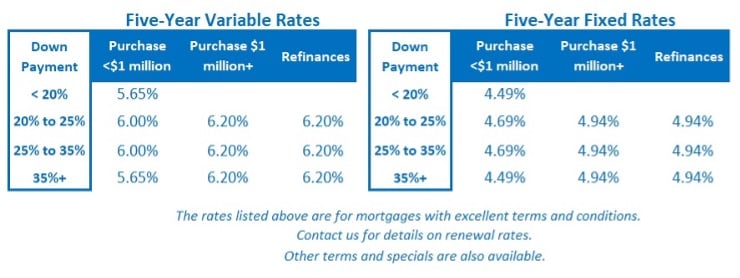

The Bottom Line: Government of Canada bond yields dipped again last week. That is keeping downward pressure on our fixed mortgage rates for the time being.

With variable-rate discounts holding steady last week, I think variable-rate borrowers shouldn’t be too worried about a BoC rate hike this Wednesday.

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

April 11, 2023

Mortgage |