Last week continued a run of surprisingly strong economic data on both sides of the 49th parallel.

Statistics Canada estimated that our GDP increased by 0.2% in November (month-over-month) and pegged its initial estimate for December at 0.3%.

Both results came in higher than expected. Our GDP declined by 0.3% in Q3 (quarter-over-quarter), and the consensus had expected to see a continuation of that slowing trend.

Instead, our Q4 GDP is now tracking toward 1%, and that uptick is bolstering the narrative that our economy will avoid recession, as well as speculation that the Bank of Canada (BoC) will delay the timing of its first rate cut.

The US economy is showing even more resilience.

US GDP growth in Q3 was recently confirmed at 3.3%, well above the consensus forecast of 2%, and last week we learned that the US economy added 353,000 new jobs in January, blowing past the consensus estimate of 180,000. The previous estimate for US job growth in December was also revised up, from 216,000 to 333,000.

(As a reminder, anyone keeping an eye on our fixed mortgage rates should pay close attention to what is happening south of the border, because the Government of Canada (GoC) bond yields, which our fixed rates are priced on, move in near lockstep with their US Treasury equivalents.)

So what should mortgage-rate watchers make of this latest news?

If the US and Canadian economies achieve soft landings, that will be good news for our economies, but it also likely means that both our fixed and variable rates will stay higher for longer.

While I recognize that the soft-landing bandwagon is filling up, the contrarian in me is increasingly convinced that these upside surprises are just a distraction, and that they will ultimately prove to be the last gasps of an economic upswing that has nearly run its course.

Bluntly put, I believe that a sharper slowdown is still in store.

To explain, let’s pull back from the monthly data and look more broadly at the US and Canadian bond-yield curves, which are still steeply inverted.

A normal yield curve is upward sloping. It shows the lowest yields (and associated interest rates) for the shortest term. Other yields (and rates) steadily increase as the time period extends. (This makes sense because the longer you lend your money, the more you want to be compensated for things like future inflation and potential risks).

Occasionally however, as is the case now, the yield curve inverts and short-term money becomes more expensive than longer-term money. This typically happens when an economy is slowing and inflation is expected to fall.

While past is never guaranteed to be prologue, an inverted yield curve is one of the most reliable economic predictors we have. It has foreshadowed every US recession, ten in total, since 1955 (with one false signal in 1966, when the yield curve inverted and a recession did not ensue).

While an inverted yield curve tells us that a recession is almost certainly imminent, it doesn’t tell us when it will occur. The monetary-policy tightening (rate hikes) that causes a yield curve to invert hits the economy with a lag, which intensifies over time. The length of the lag will vary based on a variety of economic factors. Human nature being what it is, the longer the lag, the less likely a recession may seem.

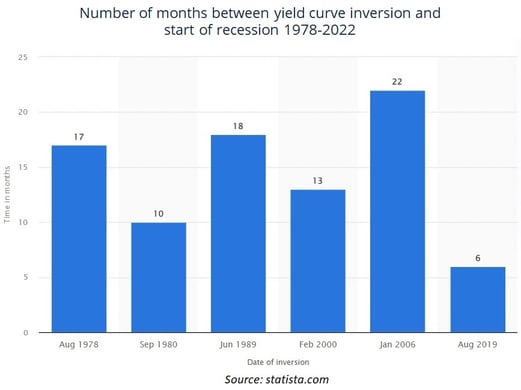

Here is a chart going back to 1978 that shows the gaps between when the US yield curve inverted and when the concomitant US recession ensued. (Note: I am using the US example because US data are easier to come by, but the Canadian data would tell a very similar story.)

The chart confirms that over the past five decades there has been an average gap of fourteen months between when the US yield curve inverts and when a US recession ensues. This time around, the US yield curve inverted in July 2022 (18 month ago) and the Canadian yield curve inverted in November 2022 (14 months ago).

We are still well within the normal lag period, and several extenuating factors increase the likelihood that it will be longer than normal this time.

For example, government transfer payments and higher saving rates during the pandemic created spending buffers that temporarily blunted the impact of higher rates. (US consumers have burned through more of their savings than Canadian consumers at this point.) The US Federal government also repeatedly paused student-loan repayment requirements, and the Canadian banking regulator allowed lenders to delay payment resets on variable-rate mortgages when they hit their trigger rates (which several did).

Our recent economic data have also been buoyed by unseasonally warm temperatures in November and December.

Statisticians make adjustments to smooth out the data when the weather gets cold because outdoor activities, like construction, typically slow during the winter months. But when the weather is warmer than normal, those seasonal adjustments, which artificially boost the results, aren’t as necessary but are still made.

Finally, while some of our recent economic data have come in stronger-than-expected, other indicators portend a sharper slowdown on the way.

In Canada, consumer spending has weakened, credit card utilization rates are spiking, business bankruptcies just hit a three-decade high, and consumer and business confidence levels are deteriorating.

While the mainstream narrative is doubling down on the soft-landing forecast, the bond market hasn’t paid much mind to the recent upside surprises.

The bets on when rate cuts will start were pushed out a little in both Canada and US last week, but bets on the total number of cuts expected this year didn’t change. Also, while US and Canadian bond yields spiked a little in response to the latest US employment data on Friday, they still finished the week lower than where they started it.

I am also focusing on the facts that our most recent rate-hike cycle brought the sharpest and most extensive tightening in modern history. The Canadian economy is still in the process of absorbing all the associated impacts at a time when our household and government debt levels are at record highs.

The soft-landing bandwagon is filling up now. If you’re on it, be sure to ask someone to leave the tailgate open (just in case).

The Bottom Line: GoC bond yields bounced around last week, but when the dust settled, they finished about where they started. Despite that, lenders sharpened their pencils a little. Several of them lowered their fixed mortgage rates.

Variable-rate mortgage discounts were unchanged last week.

The bond futures market is still betting that we’ll see the first BoC rate cut in June, and it continues to price in a total of four 0.25% cuts in 2023.

If my recession call is correct, we’ll likely see more cuts than that before the year is out.

Image credit: iStock/Getty Image

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

February 5, 2024

Mortgage |

.jpg?width=883&height=328&name=Rate%20Table%20(February%205%2c%202024).jpg)