From John's Desk

Bank of Canada and CMHC at Odds

Deferral Cliff

Urban Exodus and Cottages

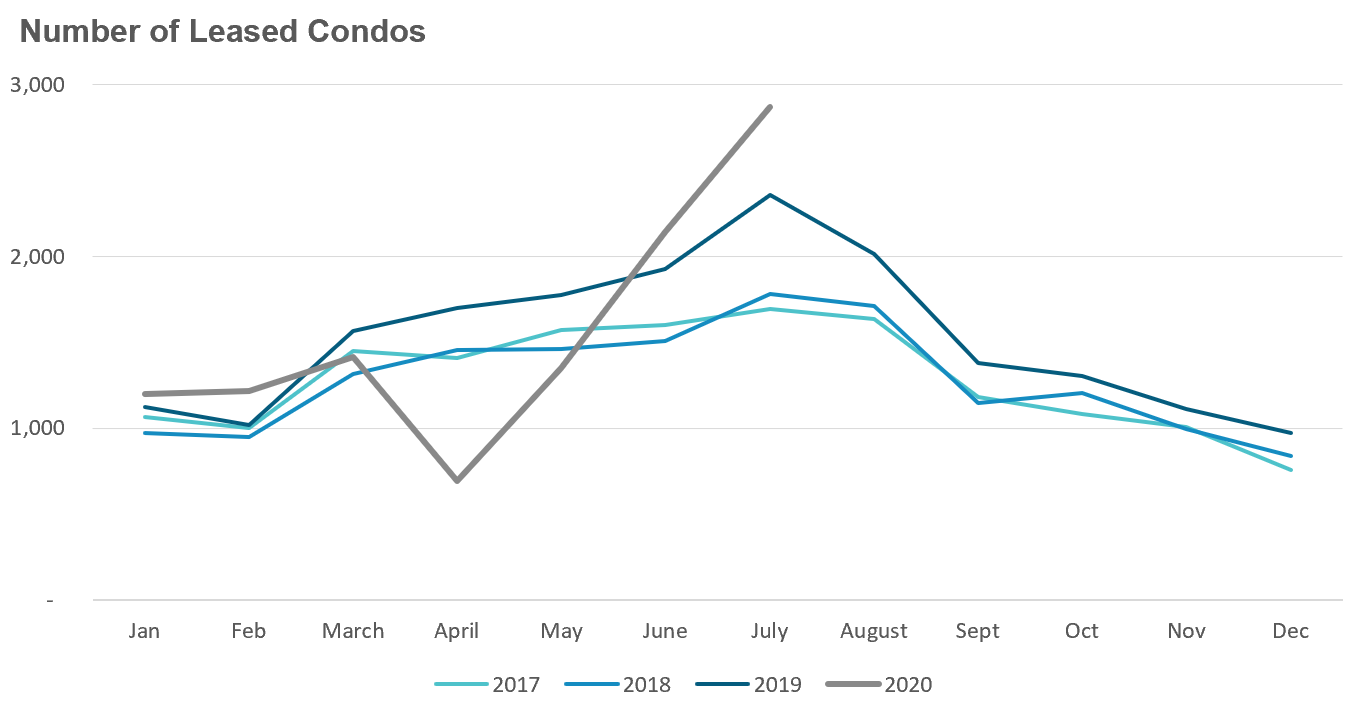

One of the most Important segments of the market to keep an eye on right now Is the condominium rental market, primarily In downtown Toronto.

In July 2020 there were 6,697 condominiums available for lease compared to just 1,492 last year, a 350% Increase.

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area saw sales in July surge 39% above last year's volume

From John's Desk

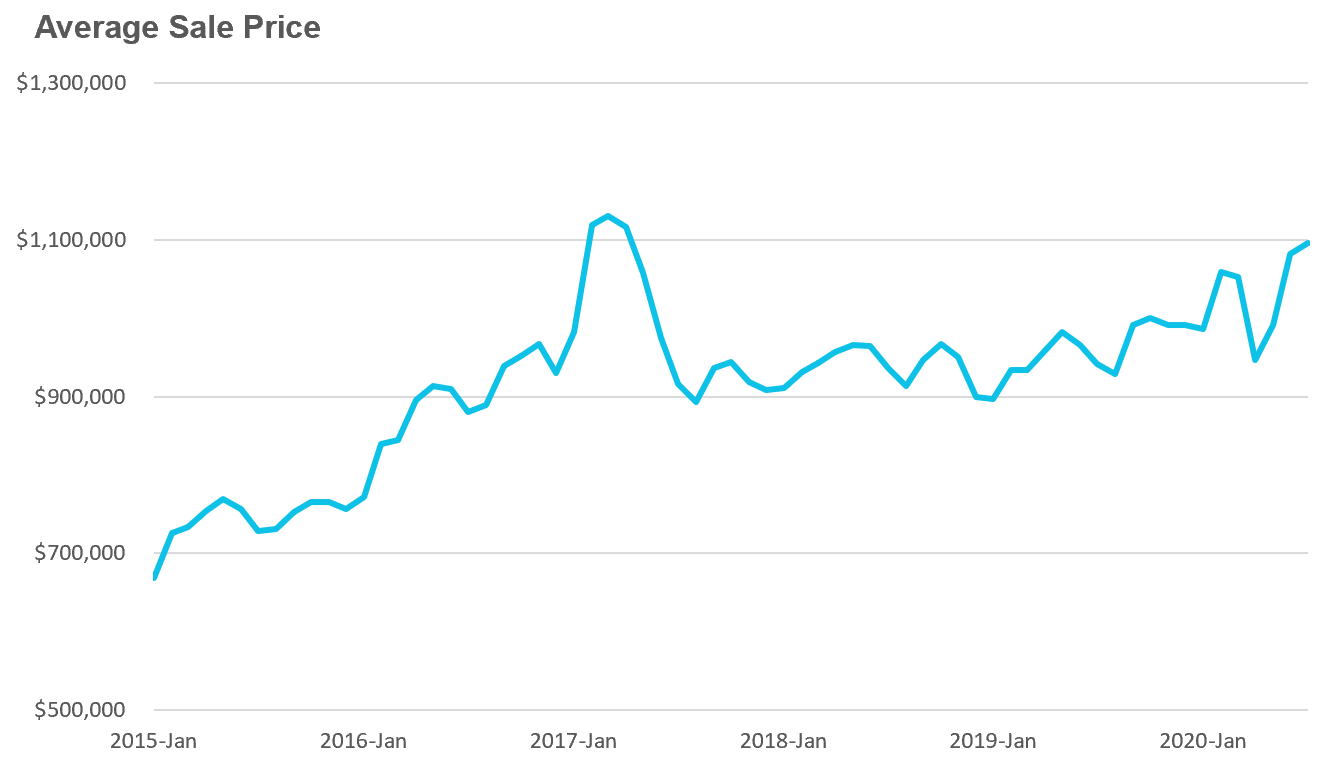

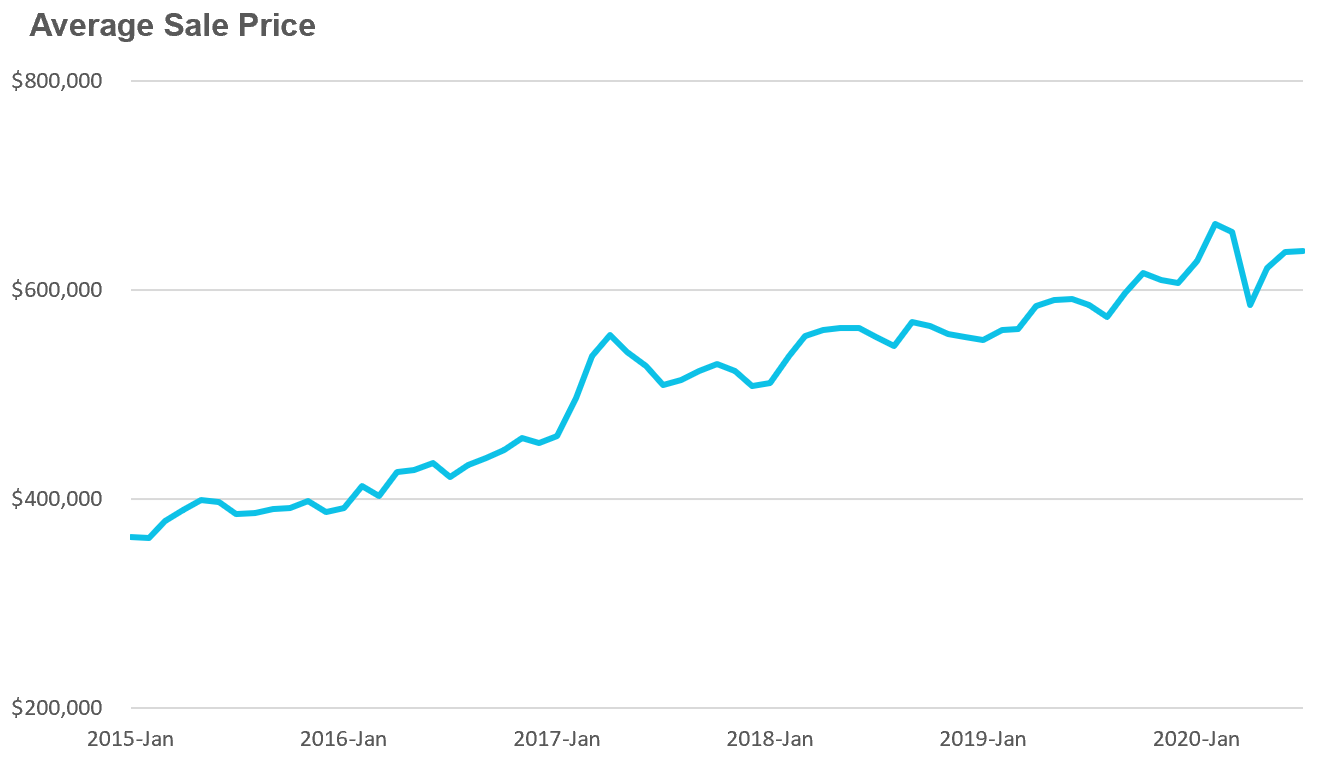

The Toronto area real estate market continued to show signs of strength with sales in July up 28% over the same month last year and prices up 17% over the same period.

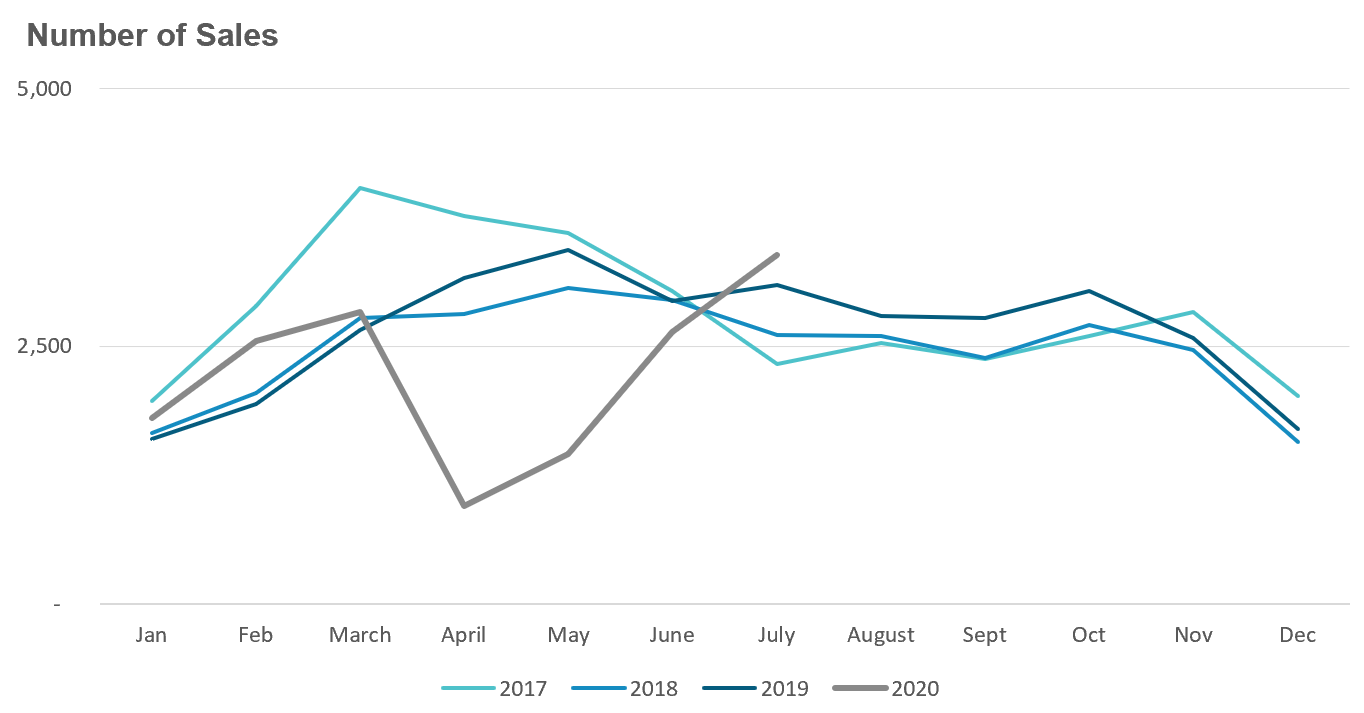

With the COVID pandemic effectively shutting down the housing market during April and May, the busy spring market got pushed out two months as many of the buyers who hit pause on their home search several months ago jumped back Into the market.

We are also seeing a wave of new buyers enter the market, people who currently live In the downtown core who are trading urban living for a more suburban and even rural lifestyle. More on that below.

Here are the key themes Impacting the Toronto area housing market this month:

In their 2019 Financial System Review the Bank of Canada highlighted high levels of household debt as a key vulnerability for Canada's economy. Just over a year later, not only is high household debt not a primary concern for the Bank, but they are encouraging households to take on even more debt.

"Our message to Canadians is that Interest rates are very low and they are going to be there for a long time. We recognize that Canadians, Canadian businesses are facing an unusual amount of uncertainty. So we have been unusually clear about the future path for Interest rates. If you've got a mortgage or if you're considering to make a major purchase or you're a business and you're considering making an investment you can be confident that interest rates will be low for a long time"

Bank of Canada Governor, Tiff Macklem

This shift In thinking comes down to what Joe Rennison of the Financial Times calls a Catch-22 of post-pandemic policy making.

"To stave off a debt crisis, monetary policymakers create conditions that allow companies to borrow even more, increasing the potential severity of the next crisis. No central banker wants to encourage excessive borrowing but, equally, no central banker wants to stand by while companies default, increasing unemployment and throttling economic growth."

The Bank of Canada achieves this goal by lowering their policy rate to the effective lower bound of 1/4 percent and by established a number of large-scale asset purchase programs - often referred to as quantitative easing. You can hear Manulife's Frances Donald and the Bank of Canada's Mikael Khan explain how quantitative easing works.

In short, the Bank of Canada's decision to buy billions of dollars In bonds has lowered the Interest rate on long term bonds which In turn has pushed five year mortgage rates below 2% which is helping fuel demand for housing by end users and Investors.

But while there is no debate that lower rates are the right policy response during a recession, there Is some debate that these aggressive monetary policy measures are doing more to boost asset prices versus our real economy, a tension discussed in a recent column by the Globe and Mail's Konrad Yakabuski.

The Canada Mortgage & Housing Corporation (CMHC) on the other hand has a very different outlook and proposed solutions for our recovery which CEO Evan Siddall discusses in a letter to mortgage lenders on August 10th, 2020.

In it Siddall makes his case for why he believes high household debt and CMHC's conclusion that house prices will fall by between 9-18% are their top concerns.

But CMHC's approach to addressing these concerns has been a bit unorthodox to date.

On July 1st CMHC tightened underwriting guidelines for the mortgages that they Insure in order to "protect future home buyers" but their competitors Genworth and Canada Guaranty were not required to make any changes to their underwriting guidelines.

Within a month CMHC's market share was significantly eroded which prompted Siddall to send the above letter which had two requests. First, a request for more business by arguing that CMHC's "ability to respond effectively in a crisis will be weakened if our market share deteriorates significantly further".

But more Importantly, a request for bankers to do what CMHC believes Is the right thing.

"we would hope you would reconsider highly leveraged household lending. Please put our country’s long-term outlook ahead of short-term profitability"

There are two significant problems with CMHC's approach to date.

Firstly, while household debt Is certainly a problem in Canada, the absolute worst time to be tightening credit to reduce debt Is during a recession. If CMHC Is In fact worried about home prices falling, then policies that make It harder for home buyers to obtain a mortgage only amplify these downside risks. The right time for tighter underwriting that protects home buyers was when times were good. While CMHC has tightened credit under Siddall's tenure it's clear that they believe they didn't do enough.

More Importantly, CMHC's approach to changing mortgage underwriting is very problematic. CMHC has shared their thesis with bank executives and are now asking them to change their business practices by appealing to their morals to "put our country’s long-term outlook ahead of short-term profitability".

The first problem with this approach is that it is not the job of bank executives to speculate what is and what is not in the country's long-term Interests, especially when there appears to be no consensus between CMHC and the Bank of Canada on the role that credit growth should play in our economic recovery.

Secondly, even if every single bank executive agrees with Siddall and believes that tightening credit during a recession is in the best Interest of the country and their business over the long term, we are still unlikely to see bank executives go along with Siddall's request. Doing so would expose them to the risk of losing significant market share should even one bank refuse to tighten credit. In essence, banks may find themselves in the exact same position that CMHC finds themselves in today. A dilemma familiar to any first-year economics student.

This is why mortgage underwriting In Canada is changed through policy changes not through appeals to bank executives to "do the right thing". Policy changes provide banks with the confidence that all of their competitors are playing by the exact same rules, something that Siddall's letter cannot.

Finally, more can be done federally to ensure a unified vision outlining what needs to be done to pull Canada out of this recession. Currently, the Bank of Canada's encouragement to take on more debt is at odds with CMHC's policies that are trying to tighten lending. Moreover, what can we make of the fact that the Department of Finance did not require CMHC's competitors to also tighten their underwriting guidelines? Are they not convinced by CMHC's outlook or have the Liberals decided to insure what CMHC calls riskier mortgages offered by competitors to reap the economic lift demand in housing provides?

“If CMHC Is In fact worried about home prices falling, then policies that make It harder for home buyers to obtain a mortgage only amplify these downside risks”

-

With 16% of households currently deferring their mortgages (according to the Canadian Bankers Association) one of the big concerns among industry watchers is what happens when the deferrals come to an end after their six month limit, commonly referred to as the "deferral cliff". This deferral cliff begins as early as September for some households.

Some analysts are concerned that when deferrals come to an end, we will see a surge in the number of households defaulting on their mortgages because they are unable to keep up with payments due to job/income loss. Over the past couple of months I have become a bit less concerned about a significant surge in homeowners defaulting on their mortgage this fall for a couple of reasons.

Firstly, most industry insiders I speak with agree that the vast majority of households deferring their mortgages don't need to defer but decided to defer their mortgage payments as a precautionary measure given the uncertainty in the market back in March and April.

We are already starting to see significant declines In the number of households deferring their mortgage at a number of banks.

Secondly, I recently interviewed Mikael Khan from the Bank Of Canada who noted that the Bank of Canada is less concerned about this deferral cliff because most homeowners have a significant amount of equity In their homes (watch the full interview here). Home values in the Toronto area are up by 9% for condos and 16% for houses In the last year alone. When a homeowner has equity in their home and when the market is as competitive as it is in Toronto defaulting doesn't make sense for most homeowners.

A homeowner who is unable to keep up with their mortgage payments because of a job loss is more likely to simply list their home for sale vs defaulting on their mortgage.

This of course is not to say that that there will be no Increase in mortgage defaults. It is likely that we will see an increase among the most over leveraged homeowners, in particular those with high interest private mortgages, but I don't expect this to have a material impact on the market for the remainder of the year.

“When the demand shock from COVID unwinds and once owners have experienced life at the cottage during the winter, we will see If the prices reached as a result of this exogenous demand shock can be maintained”

-

For many people, the COVID pandemic has led to a big change in where they want to live. We are seeing many households decide to leave their urban lifestyles and small houses/condos for a more spacious home with outdoor space In the outer suburbs, exurbs and even cottage country. This is a trend we are seeing across North America.

From what we are seeing on the ground, this lifestyle shift is not necessarily a sudden change. Many of the households making these moves have been considering a change in lifestyle well before COVID and the shift to working from home has just accelerated their plans.

This shift out of the city is so significant that It has made municipalities like Innisfil, Uxbridge, Essa and Clarington among the most competitive areas in the GTA with many homes receiving multiple offers, something that is not typical for homes in these markets.

Anecdotally, we are hearing that the surge In demand for cottage properties is also partly driven by investors looking to capitalize on the strong demand for cottage rentals given the current travel restrictions.

While strong demand for housing Is an encouraging sign, a dramatic demand shock like the one we are seeing in the outer suburbs and cottage country comes with risks. The main risk Is that the surge in demand and intense competition will push prices far above where they should have been under normal conditions. Toronto buyers used to bidding wars and rapid price growth will assume that they can't lose with these purchases and that multiple offers and 15% price growth is typical for homes in these regions.

The reality is that these types of properties are typically more Illiquid when compared to urban and suburban homes and show more modest price growth. When the demand shock from COVID unwinds and once owners have experienced life at the cottage during the winter, we will see If the prices reached as a result of this exogenous demand shock can be maintained.

For anyone considering moving to a cottage or rural property permanently, the Globe and Mail's Rob Carrick has a great reality check on cottage living that is worth a read.

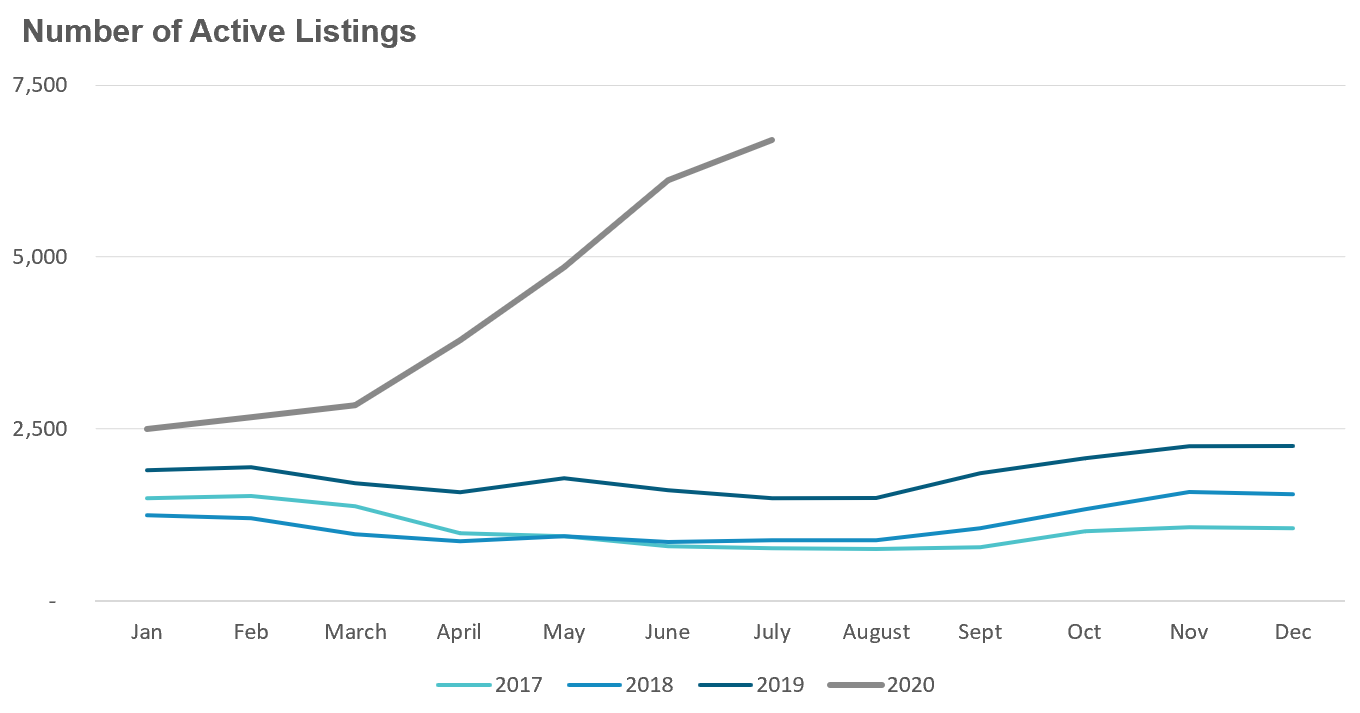

Condo rentals is one of the most important segments of the market to keep an eye on in the months ahead

One of the most Important segments of the market to keep an eye on right now is the condominium rental market, primarily in downtown Toronto. At the end of July there were 3X as many condominiums listed for lease vs for sale. The high concentration of Investor owned units means the behaviour of tenants and Investors can have spill over effects on the resale and pre-construction condo markets.

The big trend we are seeing in the condo rental market is declining rents. Average rents in Central Toronto (the old City of Toronto) peaked at $2,721 in September 2019 and have since declined 14% to $2,343 in July,2020.

What's Interesting about this trend is that it's not really driven by a decline in demand. Year to date the total number of condos leased is only down 5% compared to last year.

What's driving this decline in rents is a surge In condo rental listings. In July 2020 there were 6,697 condominiums available for lease compared to just 1,492 last year, a 350% increase.

What's driving this spike in listings? A combination of factors.

Firstly, according to condo research firm Urbanation, nearly 11,000 new condominiums were completed during the first half of 2020 many of which were purchased by investors and made their way Into the pool of condo rentals. We have also seen an Increase In listings from condominiums that were previously being rented as short term rentals on websites like Airbnb but have since been moved to the long term rental market.

Students who leased out condominiums for the upcoming school year but have decided to stay home are now trying to get out of their leases. In these situations the landlord is obligated to list those units for lease In order to mitigate the tenant's damages. Finally, we are also hearing that some condo tenants are leaving large crowded buildings In favour of renting in houses with more outdoor space or moving out of the city entirely, a reaction to the COVID pandemic.

In the months ahead we'll be monitoring whether condo rental listings continue to outpace demand for rentals which could put further downward pressure on rents and what impact if any this might have on the resale condo market.

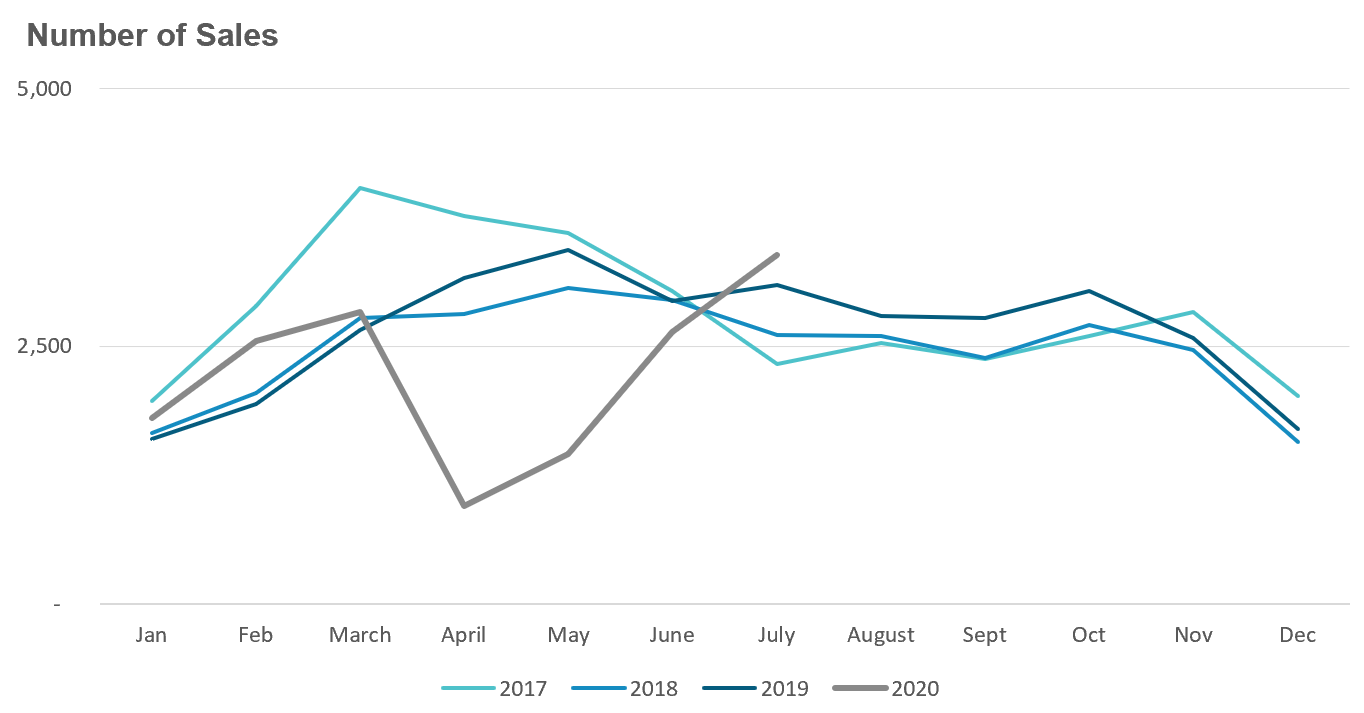

House sales in the Toronto area saw sales in July surge 39% above last year's volume

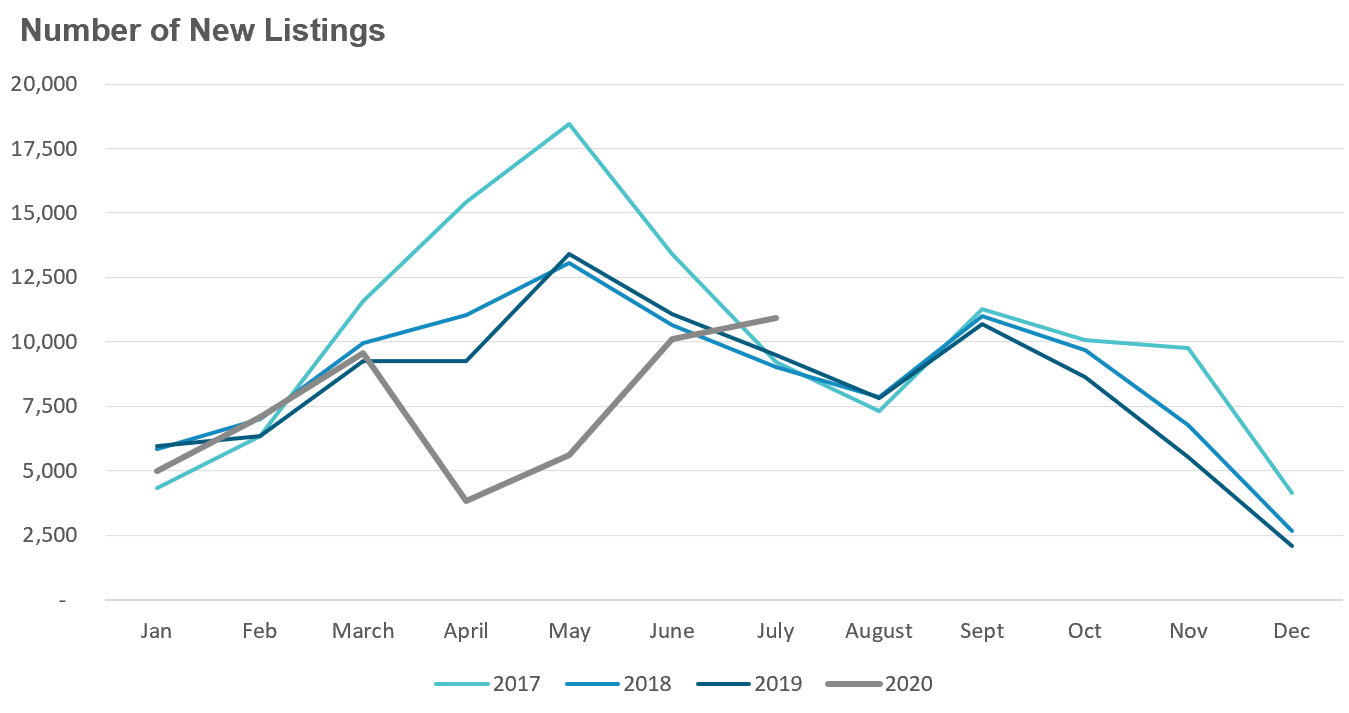

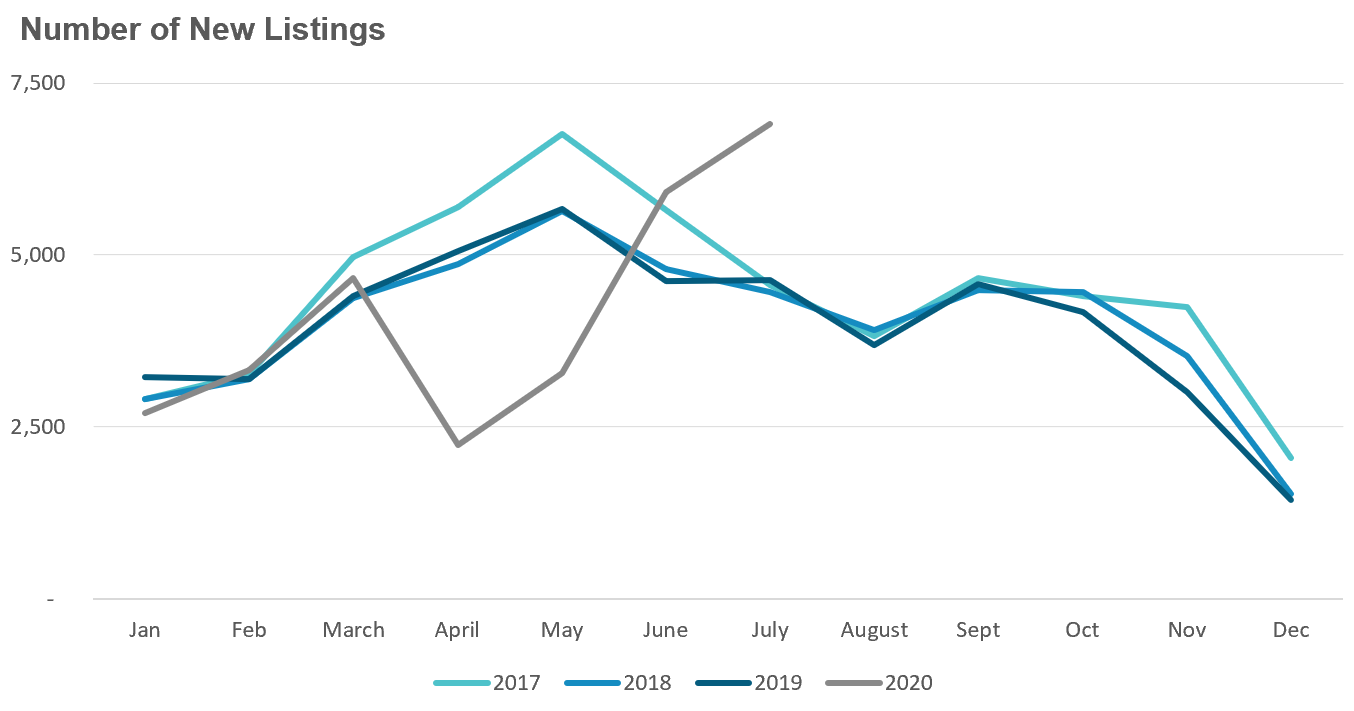

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area saw sales in July surge 39% above last year's volume. But year over year comparisons for the next two months will be slightly misleading because the busy spring market has effectively been pushed out two months because of the effective shutdown of the housing market In April and May due to COVID.

While year over year comparisons are slightly misleading, the rebound In sales Is still an encouraging sign that home buyers are confident and have returned to the market.

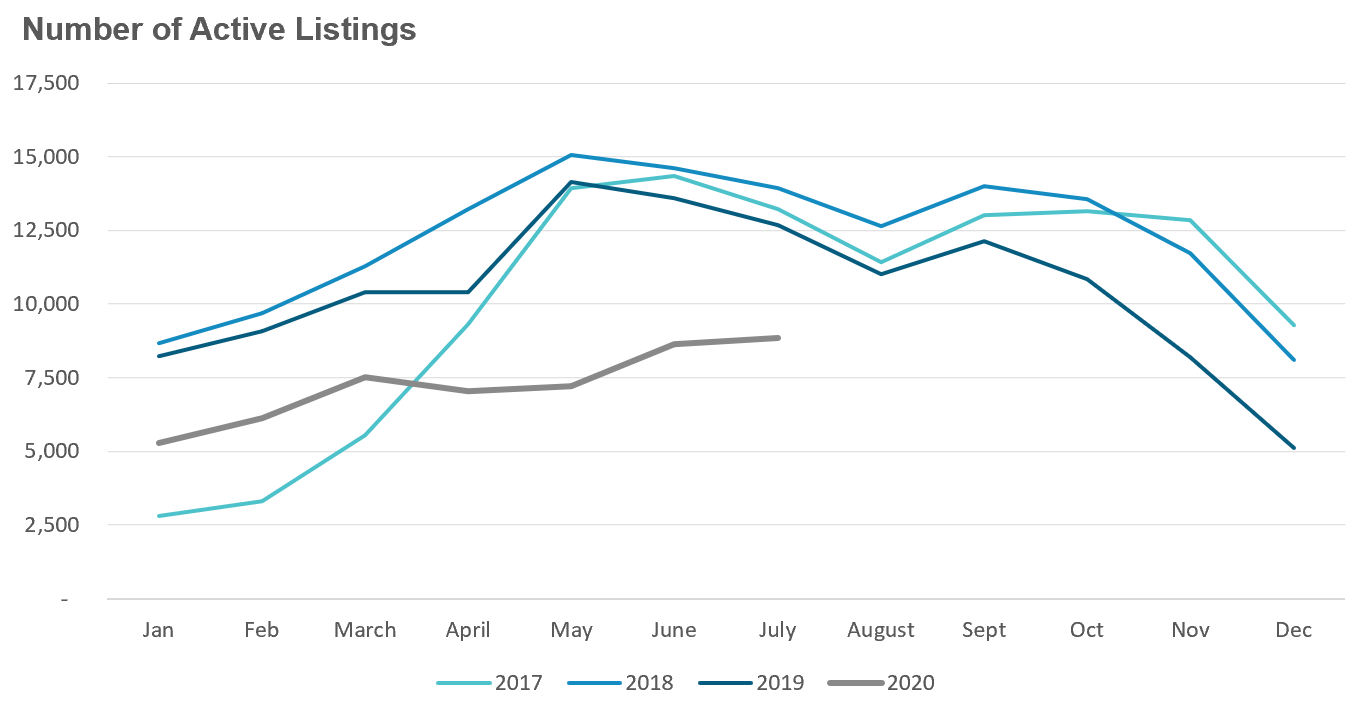

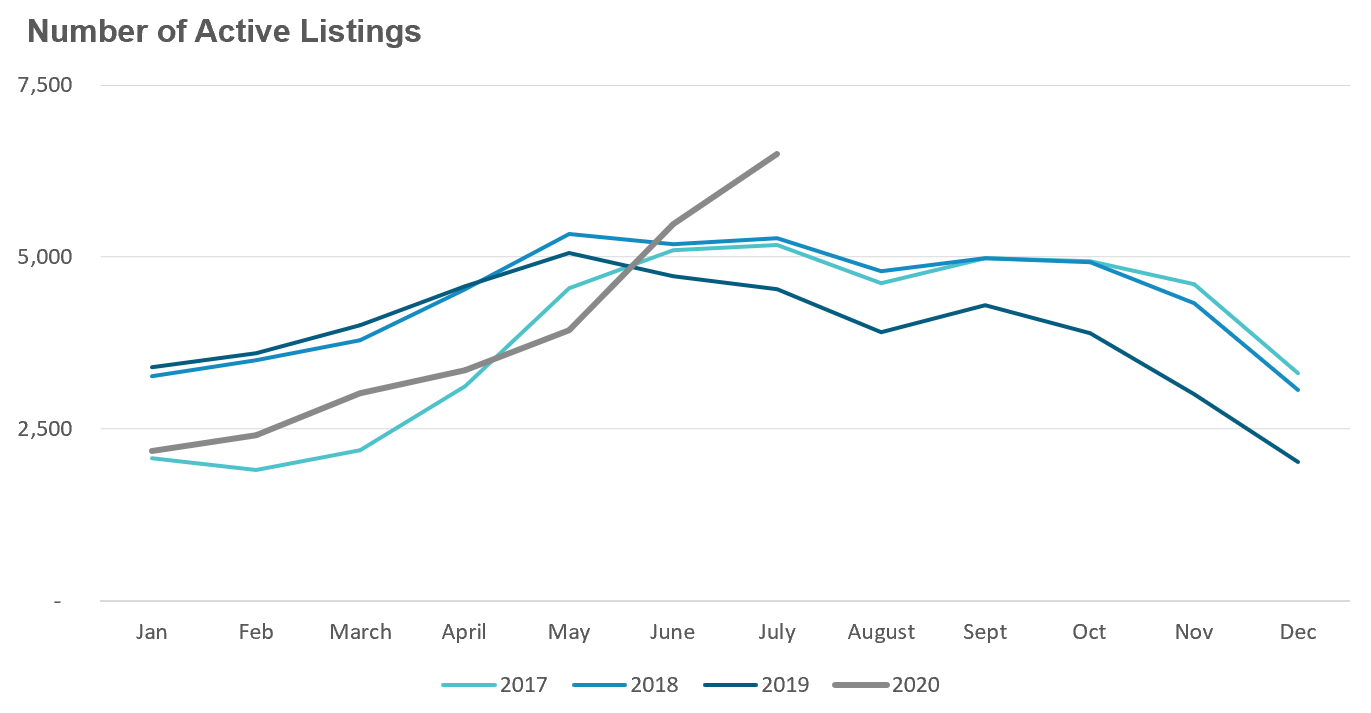

While we did see a 15% increase in the number of new low-rise listings in the Toronto area in July, there were still 30% fewer homes available for sale in July then there were the same month last year.

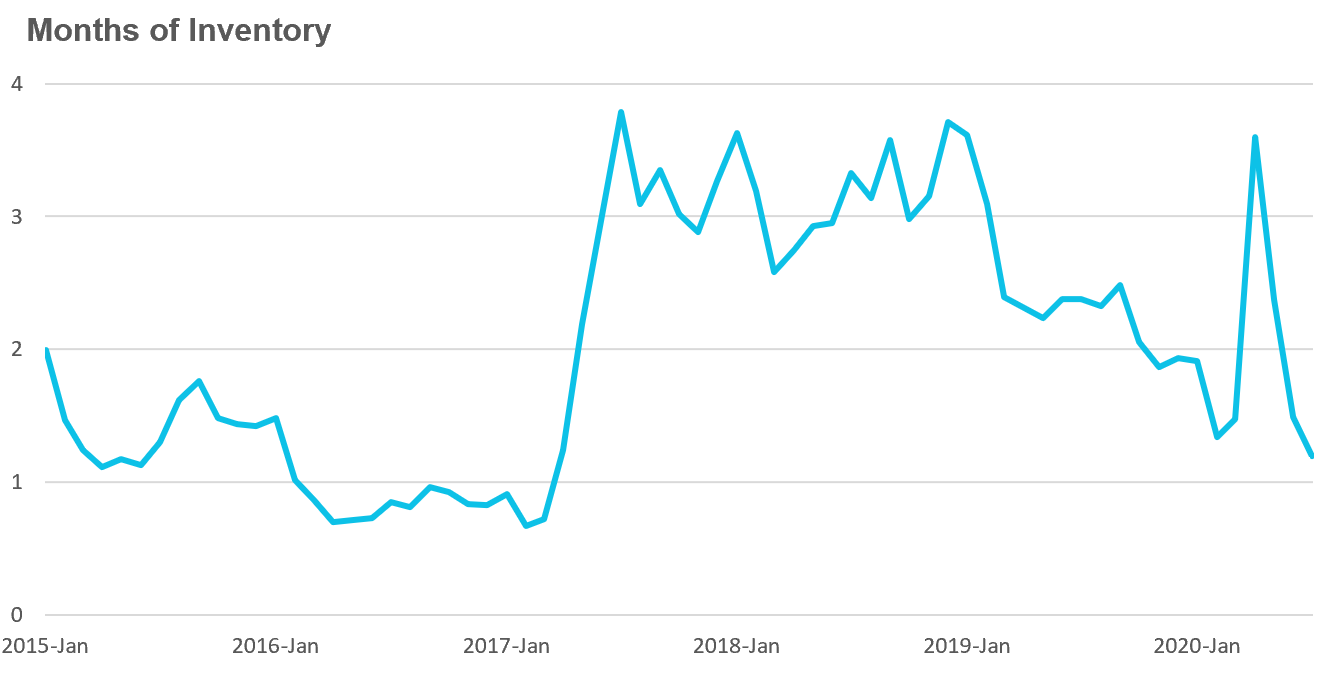

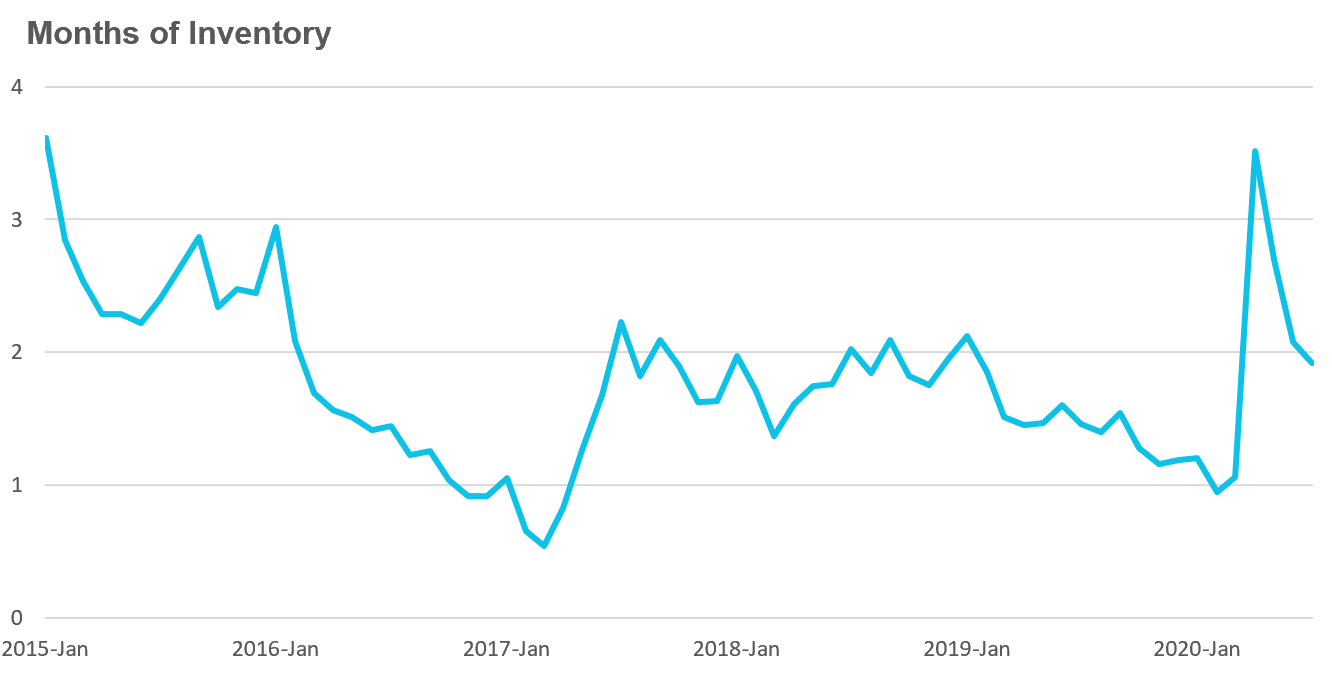

The Months of Inventory (MOI) looks at the number of homes available for sale In a given month divided by the number homes that sold In that month. It answers the question, If no more home homes came on the market for sale how long would It take for all the existing homes to sell given the current level of demand.

The higher the MOI the cooler the market Is. A balanced market (a market where prices are neither rising or falling) Is one were MOI is between 4-6 months. The lower the MOI the more rapidly we would expect prices to rise.

In April the MOI spiked to 3.6 months, not because the number of houses on the market surged but because demand plummeted. This resulted In a far cooler market than we saw during the first couple of months of the year. Since then, the surge In demand and the muted new listings volume has pushed the MOI to just over one month making the market for houses Incredibly competitive right now.

While the current level of the MOI gives us clues Into how competitive the market Is on the ground today, the direction It's moving In also gives us some clues Into where the market may be heading and right now the real estate market Is still heating up. We'll need to see the MOI Increase In the months ahead for house price appreciation to cool.

Strong demand coupled with very low Inventory levels helped push average house prices up 16% over last year.

Condo sales not as hot as low-rise sales in July

Condo sales (condo apartments, condo townhouses, etc.) were not as hot as low-rise sales in July but were still up 9% over last year recovering some of the lost ground from April and May.

New condo listings surged by 49% In July which pushed the active number of condos available for sale In July (inventory) up by 43%.

Despite the surge In Inventory, the condo market was more competitive In July than It was three months ago because sales Increased at a faster rate than Inventory. The MOI declined from 3.5 months In April to just under 2 months In July.

The tight Inventory In the condo market helped push average prices up 9% over last year

Real Estate Trends Across the Greater Toronto Area

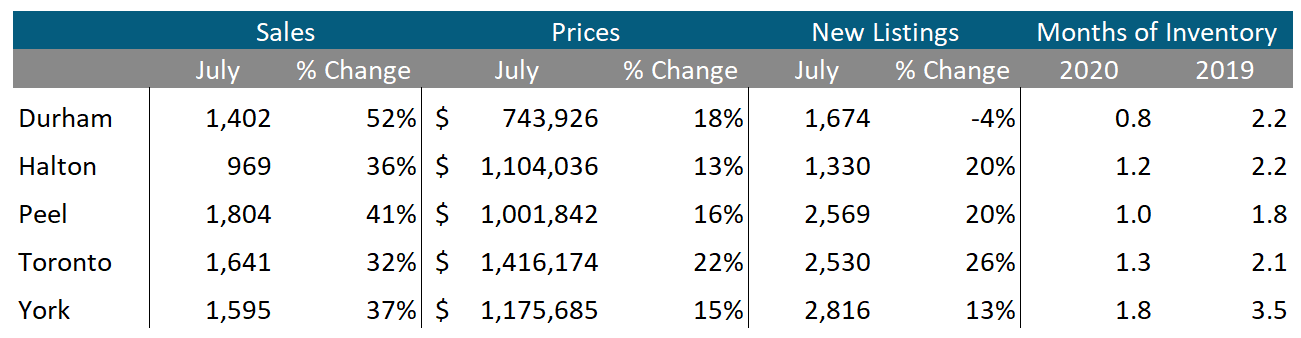

We can see that sales and prices are up across all five regions In the Toronto Area. New listings were up In all regions aside from Durham which saw listings fall 4% over last year.

The MOI Is down significantly In all five regions when compared to last year which tells us the market Is more competitive than It was a year ago.

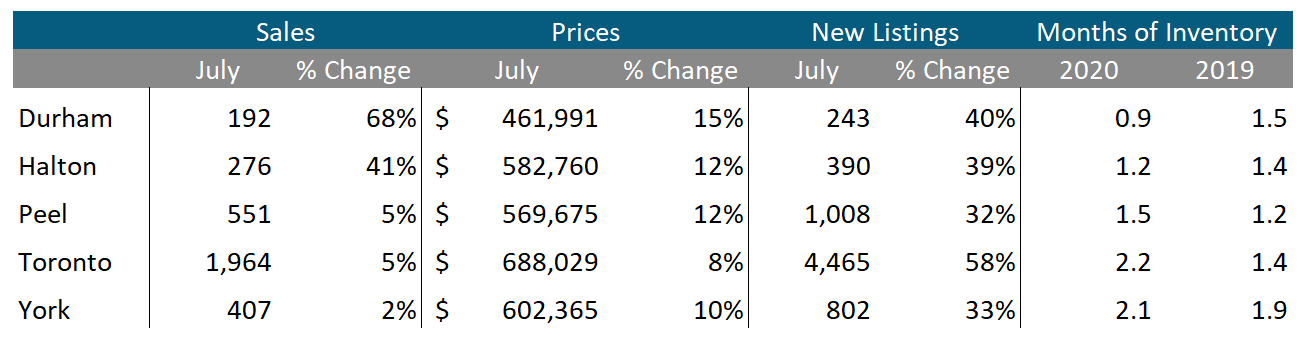

Condo sales saw big Increases In Durham and Halton but both are relatively small markets for condominiums. The MOI for Toronto's condo market Increased from 1.4 months last year to 2.2 months this year showing that the condo market was cooler last month than It was a year ago.

Greater Toronto Area Market Trends