John Pasalis in Toronto Real Estate News

Updated (3:49pm 8/14/2008) :The Toronto Real Estate Board’s Market Watch reports for May and December of 2007 incorrectly swapped the values for Active listings and New listings. The fact that they reported new listing data were they should have published active listings explains the dip in May and December of 2007 I originally reported on. The following chart and post have been updated accordingly.

July’s real estate statistics for the Greater Toronto Area showed price appreciation relatively flat at 1%, a 28% increase in the number of homes for sale and an increase in the average days on market from 31 days to 33 days. This prompted one concerned reader to ask me the following question:

Aren't moderating prices, an increase in available properties, and increasing days on market all classic signs of a market that's about to 'correct'?

It depends on what you mean by 'correct.' While all of these are signs of a changing market, they don’t necessarily indicate that house values will decline significantly in the near future. A 28% increase in inventory is a sure sign that the market is cooling down, but in order to really understand what this number means, we need take a look at some historical data for Toronto’s real estate market.

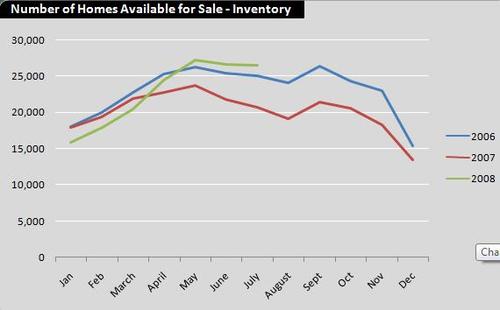

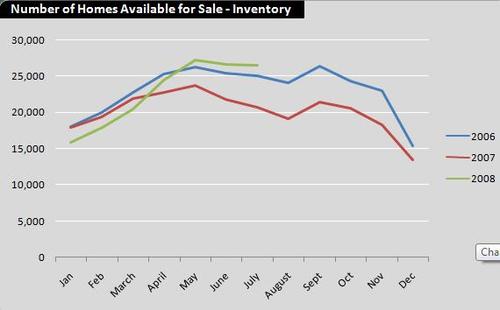

The following chart shows the number of homes available for sale in the Greater Toronto Area for each month since 2006. You’ll see that the inventory of homes available for sale in 2007 is significantly lower than the inventory in both 2006 and much of 2008.

Note that in July of 2008, there were 26,543 homes available for sale in the Greater Toronto Area, a 28% increase from the 20,694 homes available in July of 2007. A 28% increase in inventory makes for a great headline, but is it necessarily bad? Was the increase the result of extraordinarily high levels of inventory in July 2008 or was it because inventory levels in July 2007 were extraordinarily low? Or was it a bit of both? These figures suggest that inventory was relatively low in July 2007 which may magnify the increase in July 2008.

The 28% increase in inventory in July may sound pretty bad, but when we compare it to inventory levels in 2006, we see that we've been here before.

Having said this, consumers are understandably interested in and concerned about market conditions at present. I’ll continue my look at Toronto's real estate market next week.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

August 14, 2008

Market |