John Pasalis in Toronto Real Estate News

Two housing reports released this week have been making headlines across the country. The reports from Scotiabank and CMHC are forecasting a 'soft landing' for Toronto's real estate market and a low risk of a major correction.

A 'soft landing' means a few things for Toronto's real estate market:

- A record number of condominium apartments will start construction in the GTA in 2008. In 2009, condominium apartment starts will dip slightly to the second highest level on record. Low-rise home construction will trend lower.

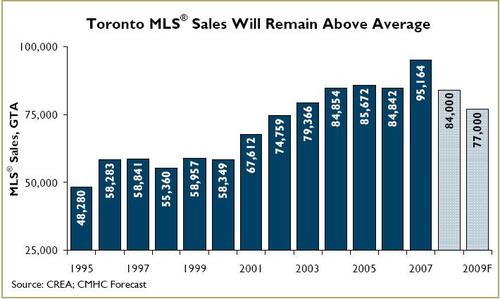

- Sales of existing homes will moderate over the next two years, but remain very high from a historic perspective.

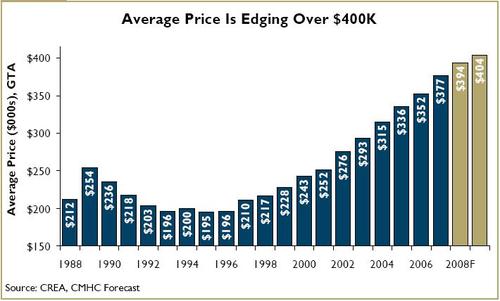

- The average selling price for existing homes will grow at a more moderate pace in 2008 and 2009.

- Job creation will remain positive in the GTA, but growth will be slow.

The following two charts are from CMHC's report and show their forecasts for resale home sales and average prices for the Toronto area.

But the most interesting story coming out of these reports has to do with the positive outlook for Toronto's condo market.

From the CMHC report:

As [condominium apartment] projects complete, some of these investors will choose to sell their apartments in order to take advantage of increases in market value which occurred during the construction period. These increased sales are not forecast to result in declining values for condominium apartments. Currently, the resale market is very tight. Sales accounted for half of active listings at the end of 2007. Moreover, the number of completed and unoccupied units is very low, ranging between 1,000 and 2,000 units. These tighter market conditions resulted in average condominium apartment prices growing at an annual rate of over 10 per cent in 2007. As more supply comes into the marketplace over the next year, however, the rate of price growth will moderate to approximately five percent in 2008 and 2.5 to three per cent in 2009.

From the Scotiabank report:

Canada’s real estate market is not overbuilt. While inventories of unsold homes are trending higher, the number of unabsorbed units, including condominiums, remains well below prior cyclical peaks in most major centres.

These forecasts are interesting because most industry watchers, including myself, have raised some concerns about the outlook for Toronto's condo market (see: What Does the Future Hold for Toronto's Condo Investors? Windfall or Bust?) . The key unknown is how many of Toronto's new construction condo units are owned by investors. CMHC suggests that it could be as high as 33% while other reports suggest the number is as high as 85%. The principle concern is that if many of these investors choose to sell their condos once their building is registered, we might see an oversupply of units on the market which will in turn have a negative effect on prices.

My principle concern with CHMC's conclusion is that they are forecasting that the condo market will have two separate negative factors working against it - increased supply due to investors selling their units and fewer first time buyers in the market - but will continue to appreciate, albeit at a more gradual pace. Had they concluded that the potential increase in supply due to investor sales would be mitigated by continued strong demand from first time buyers, I would have been a little more comfortable with the conclusion. But the fact that CMHC anticipates both an increase in supply of units and a decrease in demand from first time buyers raises some questions about their forecast for continued appreciation in the condo market.

Download the Scotiabank Report.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

Subscribe to the Move Smartly blog by email

Related Posts

What Does the Future Hold for Toronto's Condo Investors? Windfall or Bust?

May 16, 2008

Market |