John Pasalis in Toronto Real Estate News

Toronto’s real estate bubble in the late 1980’s left a grave mark on the city. Those who didn’t lose money in the bubble probably knew someone who did.

We saw the lingering effects of the last bubble in 2002 when after just five years of modest price appreciation in Toronto’s real estate market (2.61% to 6.64% annually) fears of another real estate bubble loomed in the minds of many Toronto home owners and buyers. Six years later the fear of a repeat of the early 1990's real estate crash continues to be on the minds of many Torontonians.

In a previous post (see: Toronto Real Estate Market is balanced: UBC Study) I discussed how several prominent economists are in agreement that Toronto real estate prices are balanced. But many of our readers remain skeptical. They remain convinced that we are in the middle of a real estate bubble similar to the late 1980’s that is just waiting to pop.

Today I’ll highlight some of the key differences between Toronto’s current real estate market and the market in the late 1980’s.

What’s a bubble?

It is characterized by rapid increases in valuations of real property such as housing until they reach unsustainable levels relative to incomes and other economic elements.

Wikipedia

Real estate markets appreciate and depreciate naturally as the economy expands and contracts. As the economy grows, wages rise and unemployment falls we expect to see an increase in the demand for real estate and a corresponding increase in prices. As our economy contracts, wages fall and unemployment rises we expect to see a decrease in demand for real estate along with a decline in prices.

Unlike the gradual appreciation in property values we expect to see during strong economic times, bubbles are characterized by rapid and significant increases in property values.

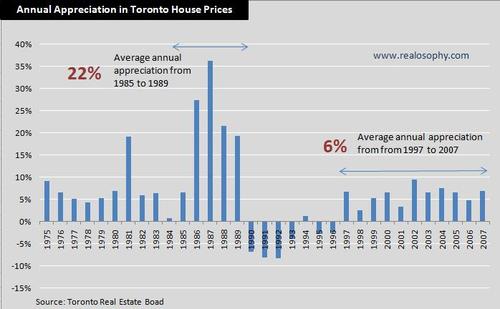

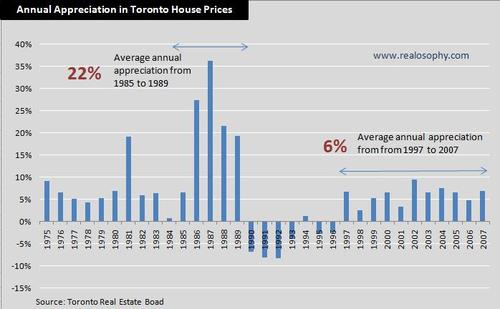

The following chart shows the annual appreciation in house values in Toronto from 1975 to 2007.

The late 1980’s real estate boom occurred over the span of five years with an average annual appreciation in value of 22%. During this period, houses appreciated from $102,318 in 1984 to $273,698 in 1989, a 167% increase in just five years.

Following this unprecedented growth, prices came crashing down in 1990 and continued to decline for six out of the seven following years.

Looking at the current appreciation in Toronto’s real estate market we can see that that the rise in prices is not nearly as rapid or as sizeable as the late 1980’s. Real estate prices have been on the rise for the past eleven years in Toronto - twelve if we include 2008 - increasing an average of 6% a year. During this period, houses appreciated from $198,150 in 1996 to $376,236 in 2007, a 90% increase in eleven years.

Real Estate Prices and GDP

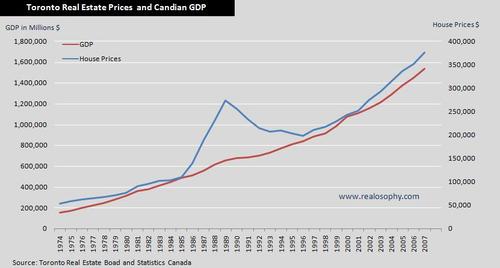

Canada’s Gross Domestic Product (GDP) is a measure of our country’s national income and output and is one of the key measures used to gauge the strength of our economy. GDP is an important measure when looking at the real estate market because we expect to see a high correlation between GDP and real estate prices. The idea here is that as our country’s economy and income grows, so should real estate prices. The following chart shows Canada’s GDP and Toronto real estate prices from 1974.

You’ll see that real estate prices in Toronto have followed GDP relatively closely, with the exception of the period leading up to and just following the 1980’s real estate bubble. Here real estate prices began to deviate from GDP in 1986 and peaked in 1989. Even though prices fell significantly from 1990 to 1994, they still appeared to be overvalued relative to GDP. By 1996 our economy had finally caught up to real estate prices.

Economic Factors

The crash in Toronto’s real estate market in the early 1990’s was made worse by a struggling Canadian economy.

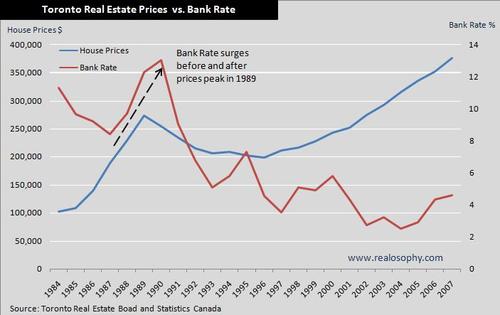

High inflation in the late 1980’s led the Bank of Canada to raise interest rates as a way to reduce inflationary pressure. Interest rates rose as high as 14% in 1990 before the Bank of Canada started to ease their stand on high interest rates.

High interest rates had a couple of different effects on Toronto’s real estate market. First, the higher costs of bowering made real estate less affordable. By the time the Bank of Canada decided to lower interest rates the downward spiral in our economy and in the real estate market had already started.

High interest rates also made it more expensive for Canadian businesses to operate. In January 1989 the Canada-US free trade agreement was put in place. With interest rates in Canada running higher than in the US, the higher costs of borrowing made it difficult for many Canadian companies to compete with their US competitors. The problem was made worse by a high Canadian dollar which drove up the cost of Canadian exports. The result was a rise in personal and corporate bankruptcies and a rise in Canada’s unemployment rate starting in 1990, just as the real estate bubble burst.

All of these negative economic factors contributed to the slowdown in Toronto’s real estate market in the early 1990’s.

How are things different today?

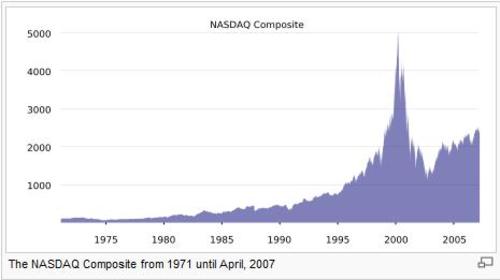

Unlike the late 1980’s, Toronto’s current real estate market cannot be characterized as a bubble. Bubbles in any industry have rapid increases in value much like the Toronto real estate bubble in the late 1980’s and the tech bubble of the late 1990’s, see below.

The appreciation in Toronto’s real estate prices has not been rapid. Prices have risen gradually over the span of twelve years.

Furthermore, economists are in agreement that the appreciation in value in Toronto’s real estate market is justified given current economic conditions. The same cannot be said for many west coast Canadian cities.

Will Toronto Real Estate Prices Fall?

Even though Toronto is not experiencing a real estate bubble, that doesn’t mean we’re in the clear.

CIBC Senior Economist Benjamin Tal recently noted that any slowdown in Ontario’s real estate market would not reflect an overvaluation in the market but rather a slowing economy in Ontario that is probably already in a recession. Tal forecasted a 5% drop in real estate prices in Ontario.

Another factor that may impact Toronto’s economy and real estate market is the recent and rapid decline in US Financial Markets. The combined size of the financial institutions that have failed is unprecedented, as is the US Government’s proposed $700B bail out. Nobody really knows what impact, if any, this fall out is going to have on our economy. CIBC Chief Economist Jeff Rubin suggests that Canada’s economy would benefit from the proposed $700B bailout package.

Is Now a Good Time to Buy Real Estate in Toronto?

Potential home buyers should focus on the real issues that may impact Toronto’s real estate market, namely our economy. Is your job or your partner’s job at risk given the slowdown in Ontario’s economy and the collapse in financial markets in the US? If you answered yes you may want to think twice before buying in this market.

If you decide that you want to purchase a house, make sure to buy a house that you can live in for at least five years. You want to give yourself time to build some equity and to recover from a potential short term decline in prices due to our slowing economy.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

September 25, 2008

Market |