John Pasalis in Toronto Real Estate News

In April of this year I indicated that my outlook for Toronto’s real estate market was neither bullish nor bearish. I said that Toronto was approaching a balanced market, a period where supply and demand are relatively equal resulting in very little change in house values.

Several recent economic reports appear to have a similar outlook for Toronto’s real estate market. The most recent coming from the University of British Columbia’s Sauder School of Business. Professor Tsur Sommerville and Kitson Swann recently released a report titled “Are Canadian Housing Markets Over-priced?” that analyzes the housing markets of nine major cities across Canada.

There are a number of different approaches economists can take to assess whether or not housing prices are balanced. In a previous post,I discussed how the International Monetary Fund (IMF) looked at several of the fundamental factors that drive real estate markets - housing affordability, growth in disposable income, short and long term interest rates, credit growth, changes in equity prices and working age population – to assess how balanced national real estate markets were. The IMF concluded that the appreciation in housing prices in Canada was largely explained by these fundamental factors leaving Canada’s market relatively balanced when compared to other countries.

In the UBC paper, Somerville and Swann decided to use a different approach, called the owner cost of capital, to assess housing price equilibriums. This approach compares the costs of owning a home – borrowing costs, property taxes, insurance and maintenance minus the expected appreciation in value - with the costs of renting. When the costs of owning are equal to the costs of renting, housing prices are balanced. When the cost of renting exceeds the costs of owning, housing prices are undervalued and when the cost of renting is less than the cost of owning, housing prices are overvalued.

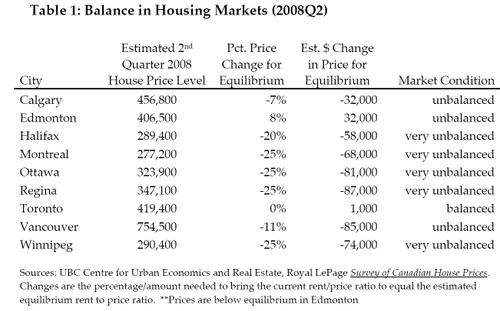

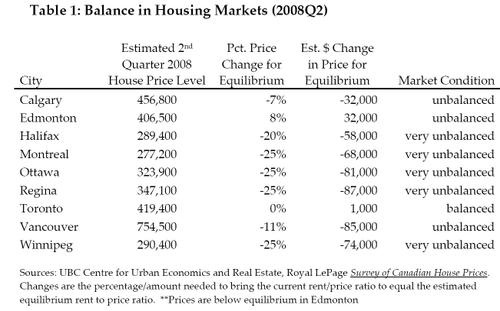

Out of the nine cities studied, Toronto was the only city with a balanced real estate market. Edmonton was the only city where houses are still below their equilibrium value. The report found that house prices in Montreal, Ottawa, Regina and Winnipeg are 25% above their true value.

The following table is a summary of their findings.

Somerville and Swann are not the only ones who think that Toronto’s real estate market is balanced. A recent report from Merrill Lynch also concluded that Toronto’s real estate market is at fair value. It's worth noting that the Merrill Lynch report used a different approach from Somerville and Swann to evaluate house prices and still ended up with a similar conclusion for Toronto. The Merrill Lynch report used an approach that is similar to the one used by the IMF.

The most bearish report I’ve recently read comes from CIBC’s Benjamin Tal who concluded that while Toronto is not nearly as vulnerable as many western cities, it may still experience a 5% decline in prices.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

September 11, 2008

Market |