John Pasalis in Toronto Real Estate News

Using a simple average to measure the change in real estate values can present a number of problems. I have covered these issues in several recent blog posts. The National Bank of Canada along with Teranet recently developed a House Price Index which aims to give us a more accurate look at how prices are changing in six Canadian cities.

Using a simple average to measure the change in real estate values can present a number of problems. I have covered these issues in several recent blog posts. The National Bank of Canada along with Teranet recently developed a House Price Index which aims to give us a more accurate look at how prices are changing in six Canadian cities.

The House Price Index uses something called the repeat sales methodology to calculate changes in house values. This approach requires a property to have been sold at least twice in order for it to be used in their calculations. They take the current sale price of a particular house and compare it to the previous sale price to measure the increase or decrease in value over that period. This approach offers a more realistic look into changes in real estate values. You can read more about their methodology here.

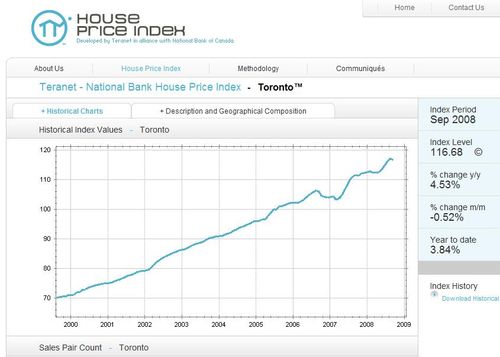

Instead of reporting on prices for a particular city, National Bank and Teranet have converted house prices into a standard index. To do this they first assign a base period, in this case June 2005, for which the index for all regions is set to 100. The index then captures just the appreciation or depreciation in house values for a particular market.

If we look at the chart for Toronto, an Index Level of 116.68 means that houses in the city of Toronto are roughly worth 16.68% more than they were in June 2005. The chart also shows that as of September 2008 house prices are up 4.53% year over year.

Their well designed website offers data and charts for six Canadian cities; Toronto, Vancouver, Calgary, Montreal, Ottawa and Halifax.

The introduction of the Teranet-National Bank House Price Index is definitely great news for anyone who likes to keep an eye on Canada’s real estate market.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

December 30, 2008

Market |