John Pasalis in Toronto Real Estate News

Canada's Home Renovation Tax Credit (HRTC) was introduced as part of the 2009 federal budget and was just one of several measures introduced to help stimulate Canada's housing sector.

Canada's Home Renovation Tax Credit (HRTC) was introduced as part of the 2009 federal budget and was just one of several measures introduced to help stimulate Canada's housing sector.

How Will it Work?

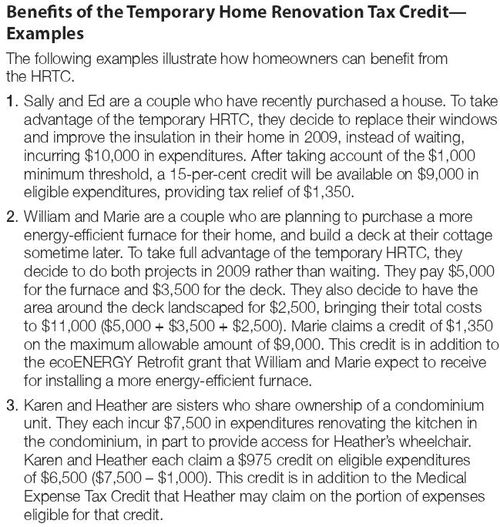

If the federal budget is passed, the temporary 15% tax credit would be claimed on up to $9,000 of eligible expenditures between January 27, 2009 and February 1, 2010. The credit would apply to the portion of eligible expenditures that exceeds $1,000 but does not exceed $10,000 up to a maximum credit of $1,350.

The credit can be claimed on more than one of an individual's eligible dwellings which generally includes any property used for personal use. The HRTC will be family-based and family members will be able to share the credit.

What's Eligible

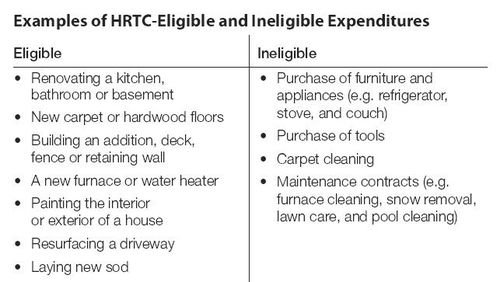

The HRTC can be claimed on renovations and alterations to a dwelling or the land on which it sits that are enduring in nature. Home owners will be able to claim expenditures for large renovations like additions or finishing a basement as well expenses as basic as paint and sod. The credit will also apply to all costs associated with such projects including permits, professional services and equipment rentals.

Here's a summary of several eligible and ineligible expenses:

Real Life Examples

The budget included the following real life examples:

For all the details on Canada's Home Renovation Tax Credit please visit the Department of Finance website.

John Pasalis is a sales associate at Prudential Properties Plus in Toronto and a founder of Realosophy. Email John

January 27, 2009

Market |