John in Toronto Real Estate News

For the average home buyer, making sense of Toronto’s real estate market is not easy. We often read conflicting media reports about the market because economists rarely agree on where things are heading. One week we’ll read about a report forecasting a significant downturn in Canada’s real estate market, the next week we’ll read a more balanced outlook forecasting modest price appreciation.

This leaves most buyers confused when trying to answer two equally important questions:

1. Is Toronto in the middle of a real estate bubble?

2. Is this the right time to buy a house?

Today I’ll do my best to tackle the first question by giving our readers some tips on how to make sense of Toronto’s real estate market.

Think Local

Most media reports talk about Canada’s real estate market as a whole. The problem with a national forecast of the the real estate market is that it tells us very little about what's going on in Toronto. House prices can appreciate and depreciate at very different rates across different cities.

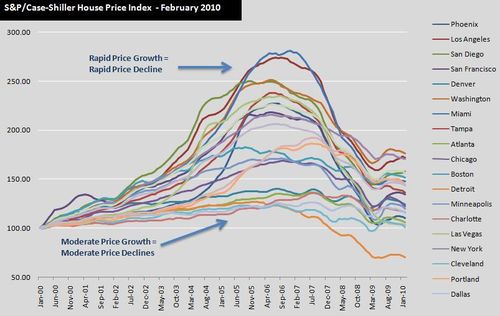

We can see this in action by looking at a chart of house prices over the past ten years for 20 different US cities.

The cities with the most rapid appreciation in prices experienced the biggest drop in prices while cities with a moderate appreciation generally experienced a more modest decline in prices.

Do your best to find reports that are focused on Toronto's real estate market and put less emphasis on national forecasts.

Understanding Appreciation

We need to be a little cautious when reading monthly real estate statistics for Toronto’s market. I’ll give you one example of how appreciation statistics as reported in the press and even here on this blog only tell part of the story.

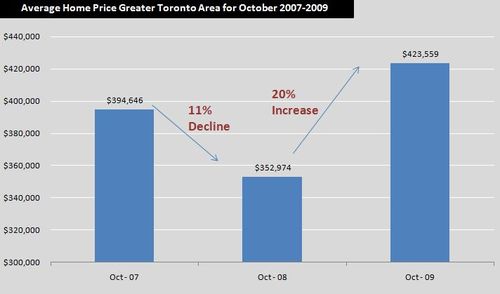

The average price for a home in Toronto in October 2007 was $394,646. As the financial crisis started to unravel in the fall of 2008, prices in October of that year declined by 11% to $352,974.

A year later, Toronto’s real estate market not only rebounded but was in the middle of a hot seller’s market. The average price for a home in October 2009 jumped by 20% to $423,559.

Reading about a 20% appreciation in house prices definitely causes most people to worry that Toronto is in the middle of a real estate bubble. But if we look at the numbers a little more closely we’ll see that the 20% appreciation we are reading about may be a little misleading.

If we compare the average sale price in October 2007 to October 2009 we see that prices appreciated by just 7% over that two year period, or roughly 3.5% per year. So was the 20% appreciation in 2009 the first sign of a bubble or was the market just re-balancing after the decline we experienced a year earlier?

If we use the Toronto Real Estate Board’s average price figures, Toronto experienced a relatively modest 4% appreciation in house prices in 2009.

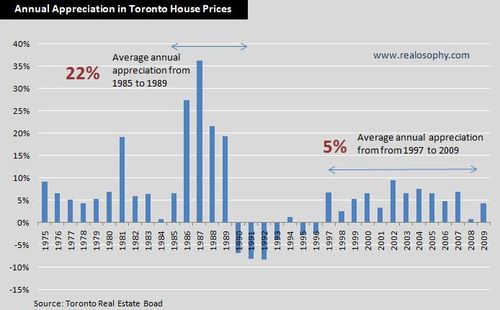

The following chart shows the annual appreciation in house prices in Toronto over the past 35 years. It’s easy to see the difference between the rapid price appreciation we saw in the late 1980’s versus the moderate appreciation we have been seeing since 1997 in Toronto’s real estate market.

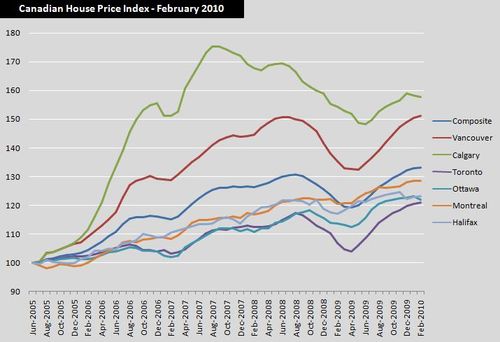

We can also turn to the Teranet National Bank House Price Index for another look at how prices have appreciated in Toronto. According to the this measure, Toronto house values have appreciated by 21% since June 2005 or roughly 4% per year.

We can also see from the chart above that Toronto house values have actually appreciated the least out of the six cities tracked by the Index.

So remember to think local and not to put too much emphasis on the short term numbers. Look beyond the month over month statistics to get a better picture of where the market is really heading.

John Pasalis is the Broker owner of Realosophy Realty Inc in Toronto. Realosophy focuses on researching Toronto neighbourhoods to help their clients make smarter real estate decisions. Email John

May 27, 2010

Market |