David Larock in Mortgages and Finance

In today’s interest-rate environment, using a rental property’s Free Cash Flow to determine its value will significantly understate its potential return as an investment. For those who don’t know, Free Cash Flow is basically the money you are left with once mortgage payments, property taxes and maintenance/upkeep expenses are paid. Some rental investors take the amount they are left with (the Free Cash Flow) each year and divide it by the amount of their investment to calculate their return. For example, if you make a down payment of $150,000 on a rental property and at the end of the first year you have $1,500 of rental income left over after paying all expenses including your mortgage payments, your investment return using Free Cash Flow would be 1% ($1,500/$150,000). It should come as no surprise then that investors who value income properties this way are not lining up to buy right now. But there is a big piece of the investment return missing, and it is a by-product of our current low interest rate environment.

maintenance/upkeep expenses are paid. Some rental investors take the amount they are left with (the Free Cash Flow) each year and divide it by the amount of their investment to calculate their return. For example, if you make a down payment of $150,000 on a rental property and at the end of the first year you have $1,500 of rental income left over after paying all expenses including your mortgage payments, your investment return using Free Cash Flow would be 1% ($1,500/$150,000). It should come as no surprise then that investors who value income properties this way are not lining up to buy right now. But there is a big piece of the investment return missing, and it is a by-product of our current low interest rate environment.

One of the golden rules of successful real-estate investing is that the rent cheques must go straight to the bank to pay off the mortgage. Every time this happens, the mortgage shrinks and equity increases. The hidden value in today’s low interest-rate environment is found in the percentage of each mortgage payment that goes to principal. To illustrate, let’s compare two scenarios. In scenario #1 we’ll use an i nterest rate of 8.5%, which is Canada’s average five-year mortgage rate over the last 25 years. If you borrowed $500,000 amortized over 25 years, your total payments made in the first year would be $47,722. Of that amount, $41,533 would be eaten up by interest and only $6,189 would be used to reduce mortgage principal (13% of the total). In scenario #2, if we change the five-year interest rate to the currently available 3.7% and you borrow $500,000 under the same terms, your total payments in year one would be $30,592. Of that amount, $18,151 would be allocated to interest and a whopping $12,442 would be used to reduce mortgage principal (41% of the total paid).

nterest rate of 8.5%, which is Canada’s average five-year mortgage rate over the last 25 years. If you borrowed $500,000 amortized over 25 years, your total payments made in the first year would be $47,722. Of that amount, $41,533 would be eaten up by interest and only $6,189 would be used to reduce mortgage principal (13% of the total). In scenario #2, if we change the five-year interest rate to the currently available 3.7% and you borrow $500,000 under the same terms, your total payments in year one would be $30,592. Of that amount, $18,151 would be allocated to interest and a whopping $12,442 would be used to reduce mortgage principal (41% of the total paid).

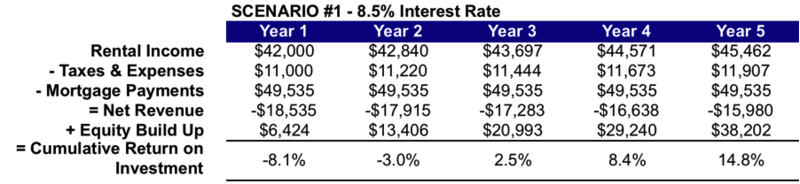

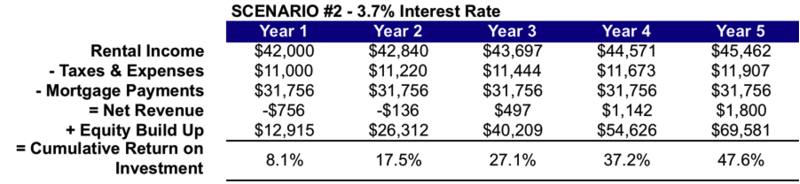

So in today’s interest-rate environment, not only are the payments lower, but even more importantly, the proportion of each payment that goes toward principal is more than three times greater. In scenario #2 you’re not just paying less interest, you’re paying off your mortgage twice as fast. This hidden benefit is well understood by seasoned investors but is often overlooked by less experienced buyers who focus solely on Free Cash Flow when evaluating investment opportunities. Here is a summary of what the two scenarios would look like over a five-year period, using the details from a rental property currently listed for sale by one of my realtor partners at $669,000. (I have assumed a 2% annual increase in rents and expenses because this is the lower end of the central bank’s inflationary target band.)

Note that in the examples above, we are assuming no appreciation in property value. The returns shown are based solely on the Free Cash Flow generated, combined with the amount of equity built up as the mortgage principal is reduced. If we assume annual house-price appreciation of 3%, the cumulative five-year return on investment at a 3.7% interest rate jumps from 47.6% to 119%.

There are other hidden advantages when owning a rental property. Most people know that you can write off the cost of your mortgage interest ag ainst your rental income, but you can also depreciate all of the major appliances as well. This gives you additional non-cash write-offs to further reduce your tax hit. Of course, the flip side is that there is no capital gains exemption when selling an income property, but I don’t think that's a bad trade-off if you can write off your mortgage interest instead. On balance, mortgage interest is a certainty while a capital gain is not, and what’s more, since you only incur a capital gain as a result of having just made a profit, it’s not the worst time to have to make a tax payment.

ainst your rental income, but you can also depreciate all of the major appliances as well. This gives you additional non-cash write-offs to further reduce your tax hit. Of course, the flip side is that there is no capital gains exemption when selling an income property, but I don’t think that's a bad trade-off if you can write off your mortgage interest instead. On balance, mortgage interest is a certainty while a capital gain is not, and what’s more, since you only incur a capital gain as a result of having just made a profit, it’s not the worst time to have to make a tax payment.

If you’ve been evaluating rental property investments using the Free Cash Flow method, take a second look including mortgage principal payments in the calculation of your returns. You’ll be surprised at the difference it makes.

David Larock is an independent mortgage planner and industry

insider specializing in helping clients purchase, refinance or renew

their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog (integratedmortgageplanners.com/blog). Email Dave

September 14, 2010

Mortgage |