David Larock in Mortgages and Finance, Home Buying

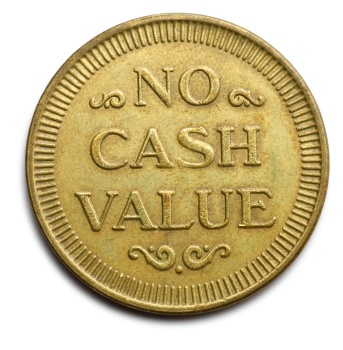

Mortgage pre-approvals are full of conditions and qualifiers, and when you think about it, why wouldn’t they be? When you submit an application for pre-approval you haven’t provided any documentation to verify that your information is accurate and you haven’t even chosen the property you want to borrow against. With so many unknowns, it’s not surprising that pre-approvals aren’t worth the paper they’re written on. So why bother getting one? Well, for starters, the lender does evaluate the information you provide and, if that information is accurate, its conditional approval will give you a rough indication of whether y our borrowing plans are realistic. Also, pre-apps come with a rate hold that lasts for 120 days, so you’re also getting free interest-rate protection. Today’s post will explain the basics of how pre-approvals work, dispel some of the myths, and offer some tips on the best way to go about getting one.

our borrowing plans are realistic. Also, pre-apps come with a rate hold that lasts for 120 days, so you’re also getting free interest-rate protection. Today’s post will explain the basics of how pre-approvals work, dispel some of the myths, and offer some tips on the best way to go about getting one.

Pre-approvals should more accurately be called “rate-holds” because their biggest benefit is letting you lock in a rate for 120 days. To use an example, assume that you are pre-approved for a five-year fixed-rate mortgage at 3.6%. If you buy a house two months later and the same five-year rate has increased to 4%, you can still borrow at your original 3.6% pre-approved rate (assuming that you meet the required conditions). Conversely, if you apply for a variable-rate mortgage pre-approval and prime increases, your rate will go up by the same amount because there is no way to lock in a floating rate loan. The only protection a variable-rate pre-approval offers is in holding your prescribed discount to prime, so, if you are pre-approved for a variable rate of prime minus seventy, and the lender then reduces its discount to prime minus sixty, you would still be able to borrow at prime minus seventy (for the remainder of your pre-approved period). While the prime rate changes frequently, a lender’s prescribed discount to prime is rarely changed, and for that reason, most borrowers are better to apply for a fixed-rate pre-approval even if they plan on switching to a variable rate before closing.

While a pre-approval comes with an array of conditions that you must satisfy before your lender will give you a firm mortgage commitment, it does give you a dry-run look at whether your borrowing expectations are realistic. Understan ding your buying budget will save you a lot of time when house hunting with your realtor, and it will give you confidence to know what you can truly afford if you end up in a competitive bidding situation. While many lenders will let you increase your borrowing amount without losing your rate hold when you are ready to convert your pre-approval to a live deal, it is best to get pre-approved for your maximum mortgage amount upfront to eliminate this risk altogether. Also, if evaluating any part of your application will involve some subjectivity on the part of the lender, such as determining how much of your commissioned or self-employed income will be used for qualifying purposes, a good mortgage planner will work with the lender to clarify these issues upfront. After all, getting pre-approved should be about eliminating as much uncertainty as possible.

ding your buying budget will save you a lot of time when house hunting with your realtor, and it will give you confidence to know what you can truly afford if you end up in a competitive bidding situation. While many lenders will let you increase your borrowing amount without losing your rate hold when you are ready to convert your pre-approval to a live deal, it is best to get pre-approved for your maximum mortgage amount upfront to eliminate this risk altogether. Also, if evaluating any part of your application will involve some subjectivity on the part of the lender, such as determining how much of your commissioned or self-employed income will be used for qualifying purposes, a good mortgage planner will work with the lender to clarify these issues upfront. After all, getting pre-approved should be about eliminating as much uncertainty as possible.

The biggest difference between a pre-approval and an approval is that a pre-app doesn’t provide details about the subject property (which, when you apply for a mortgage, is the asset you are borrowing against). Without your lender knowing anything about the collateral you are using to secure your loan, it treats your pre-approval as a purely theoretical exercise. Also, some pre-approvals are limited to very basic information and seem designed mainly to build a marketing database, so if you haven’t provided much in the way of personal information, you should put even less stock in your pre-approval as a predictor of your suitability for mortgage financing. A top-notch mortgage planner should coach you through this process  and give you a candid assessment of how indicative your pre-approval really is. It is important to have this conversation before you even think about waiving your financing condition.

and give you a candid assessment of how indicative your pre-approval really is. It is important to have this conversation before you even think about waiving your financing condition.

While getting pre-approved may seem like a cursory exercise, if rates increase after the fact you may find yourself married to the lender who pre-approved you, regardless of its terms and conditions. What seems like a meaningless exercise, because it costs nothing and doesn’t involve a firm commitment on your part, can turn into a long-term financial relationship before you know it. As such, choosing where you apply for pre-approval is an important decision that should include a review of the lender’s contract terms and conditions, covering important details like conversion rates, prepayment privileges and penalties, registrations on title, etc. (For more information on this topic, see my post called “What’s In the Fine Print?”)

Lastly, to make your pre-approval worth more than the paper it’s written on, partner with an experienced independent mortgage planner who works with a multitude of Canadian lenders for the best odds at finding the ideal fit.

Further Reading: Realosophy Home Buyer Guide

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog (integratedmortgageplanners.com/blog). Email Dave