David Larock in Mortgages and Finance, Home Buying

Mortgage debt can be intimidating; it is a massive personal liability that typically takes decades to pay off. During the early years of a loan, it can be downright depressing to see how much of a scheduled payment is used to cover the cost of int erest, and how little of each payment actually goes towards reducing principal. Not surprisingly, when their mountain of debt is at its highest point, borrowers don’t seem motivated to accelerate their rate of repayment, while conversely, borrowers who have only a few years left on their mortgage are willing to make a lot of extra sacrifices to shorten the time it will take to become mortgage free. While human nature has most of us picking up the pace only when the finish line is in sight, in today’s post I’ll run some basic numbers to show you why the best bang for your extra payment buck is in the early years of your mortgage. Then, once you see the benefit of chipping away early, I’ll offer some strategies on the best way to go about doing this and close with a special tip for variable-rate mortgage borrowers.

erest, and how little of each payment actually goes towards reducing principal. Not surprisingly, when their mountain of debt is at its highest point, borrowers don’t seem motivated to accelerate their rate of repayment, while conversely, borrowers who have only a few years left on their mortgage are willing to make a lot of extra sacrifices to shorten the time it will take to become mortgage free. While human nature has most of us picking up the pace only when the finish line is in sight, in today’s post I’ll run some basic numbers to show you why the best bang for your extra payment buck is in the early years of your mortgage. Then, once you see the benefit of chipping away early, I’ll offer some strategies on the best way to go about doing this and close with a special tip for variable-rate mortgage borrowers.

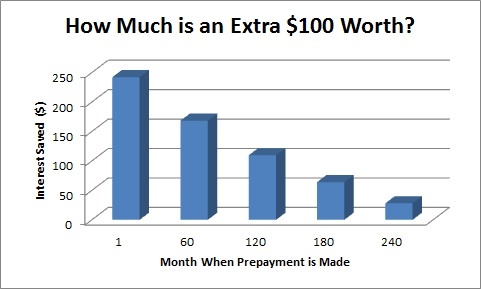

To keep the math simple, let’s assume that you have borrowed $250,000 at an interest rate of 5%, and that your mortgage is being amortized over 25 years. (Note: your amortization period tells you how long it would take to pay off your entire mortgage if your interest rate stays the same, and if you make only your regular, contractual payments.) We’ll then assume that you add one additional payment of $100 at different times over the life of your loan and calculate how much interest you will save depending on when you do this.

The chart above shows you what happens if you make that extra payment in the first month, the sixtieth month, the one-hundred and twentieth month etc., and the blue bars show how much interest that extra payment will save you over the life of your loan. As you can see, making that extra payment early saves you much more in the long run (interest savings by paying in the first month = $242.21, interest savings in month 240 = $27.98).

So if you’re a first-time home buyer who sees the wisdom in making extra payments on your mortgage, what is the best way to set this up? Many well-intentioned borrowers plan to make extra payments periodically, when they have surplus cash available, rather than scheduling to have an extra payment taken regularly by their lender. The only problem with this approach is that it almost never works. If you’re like most people, you will always find some excuse for spending the extra cash, so realistically, the only way to ensure that you follow through with the extra payments is to make them automatically. You have two options for doing this:

Option One – Set your payment above the minimum required by the lender on Day One. Once the overpayment is built into your mortgage contract, it’s difficult to undo so you’re essentially forcing yourself to meet this obligation.

Option Two – Schedule your lender to take a separate, extra payment from your account at the same time that they collect your regular payment. The advantage of this approach is that, if your circumstances change, you can adjust the additional payment more easily than in Option One, because it is not baked into the terms of your contract.

When you’re deciding how much extra you want to pay, try to stick with an amount that you know you can comfortably manage. (To see what the impact of making extra payments looks like, check out my mortgage payment calculator.) If you’re in a variable-rate mortgage, I would advise you to bank the interest-rate savings you enjoy today by setting your variable payment at the level you would have been paying if you had chosen the current fixed rate. Here’s how it works.

Bank the Savings: Tip for Variable Rate Mortgage Borrowers

Let’s use an example to illustrate:

Assume that you have a $250,000 mortgage to be amortized over 25 years. You choose a five-year variable-rate mortgage currently priced at 2.15%, which makes your monthly payment $1,077. Also assume that you could have had a five-year fixed-rate mortgage at 4% with a monthly payment of $1,315.

Instead of paying $1,077/month, you decide to set your payment at $1,315/month (which is the equivalent fixed-rate payment). This means you are making an extra payment of $238 each month ($1,315 - $1,077 = $238) for as long as your variable rate stays at 2.15%.

Here is what that does for you:

- An extra payment of $238/month for five years will have reduced your principal by an extra $15,000 at the end of the first five years when your mortgage comes up for renewal, and will save you about $8,400 in interest over the life of your loan.

- Your monthly mortgage payment will not increase until your current 2.15% rate rises above 4% (because your payment was set at 4% to begin with). This gives you more payment predictability than if you were only paying the minimum amount. In this way, you are benefiting from some of the protection you would have had if you had chosen the fixed rate. It’s a good compromise.

The best part is, every variable-rate mortgage holder can afford to do this. I know because the only way to get a variable rate today is to prove to your lender that you can afford to  pay a rate of between 4.55% and 5.69% (which is called the Mortgage Qualifying Rate). As such, setting your mortgage payment based on a rate of only 4% should be a snap!

pay a rate of between 4.55% and 5.69% (which is called the Mortgage Qualifying Rate). As such, setting your mortgage payment based on a rate of only 4% should be a snap!

If you’re a first-time home buyer, you may feel like it’ll take forever to pay off your mortgage. But like the power of water dripping on a stone, a little extra prepayment, especially if you start early in your mortgage’s life cycle, can dramatically shorten the amount of time it will take you to become mortgage free.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog (integratedmortgageplanners.com/blog). Email Dave