David Larock in Mortgages and Finance, Home Buying

Would it surprise you to learn that the advertised interest rate on a variable-rate mortgage does not represent its real rate of interest?

Variable-mortgage rates are quoted in simple-interest terms, but because this rate is then

compounded either monthly or semi-annually, it does not reflect your t rue cost of borrowing. (An interest rate that factors in compounding is called an ‘effective’ or ‘real’ interest rate, but lenders rarely advertise their mortgage offers this way.) Today’s post will compare the costs of variable-rate mortgages with different compounding periods and give you some guidance on what to look for. This post is long overdue because, although interest-rate compounding can make a noticeable difference to your cost, it is a complicated topic and therefore easily the least understood part of mortgage lending.

rue cost of borrowing. (An interest rate that factors in compounding is called an ‘effective’ or ‘real’ interest rate, but lenders rarely advertise their mortgage offers this way.) Today’s post will compare the costs of variable-rate mortgages with different compounding periods and give you some guidance on what to look for. This post is long overdue because, although interest-rate compounding can make a noticeable difference to your cost, it is a complicated topic and therefore easily the least understood part of mortgage lending.

If you take out a mortgage for $250,000 and are quoted an interest rate of 5%, your actual cost of borrowing will be affected by two additional factors: the frequency of your payments and the number of compounding periods in your interest rate.

While many people think that making more frequent mortgage payments will significantly reduce the interest they pay over the life of their loan, the effect is really very small. Paying more than the minimum required is what really saves you money over time; the impact of simply paying the same amount in smaller, more frequent instalments is negligible (for a full explanation, check out my post called Puff the Magic Payment Frequency).

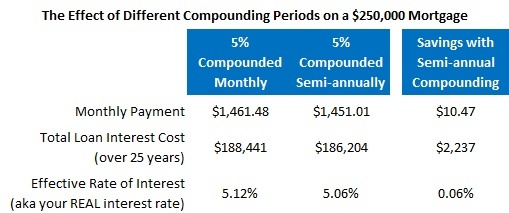

On the other hand, the number of compounding periods that your lender uses when applying your annual rate of interest can have a material impact on your borrowing cost over the long run. Here is a table that shows the difference in the cost of a $250,000 mortgage with an interest rate of 5% when it is compounded monthly vs. semi-annually:

Even though both mortgages have the exact same quoted rate of 5%, as you can see, the one with monthly compounding will cost you an extra 6 basis points in interest each year.

Section 6 of our federal Interest Act tries to make it easier for borrowers to compare the fine print costs associated with different mortgage offers. It requires lenders to convert whatever terms they are offering you into an Annual Percentage Rate (APR), which is calculated using a prescribed formula and boils everything down to a simple annual rate. This information is provided to borrowers in a document called the Cost of Borrowing Disclosure, which must be read and signed by every borrower before their mortgage transaction can be completed.

While section 6 is well intentioned, in practice most borrowers don’t receive their disclosure until late in the mortgage application process, and that can limit its potential impact on their decision making process. (Of course, if you want to request your Cost of Borrowing document in advance to see the APR information upfront, it should be readily provided).

By the way, if you’re wondering why we’re not talking about fixed-rate mortgages, it’s because Section 6 of the Interest Act also requires that all fixed-rate offers be quoted using only semi-annual or annual compounding periods. (Lenders prefer semi-annual compounding, so that’s what is typically used.)

Variable-rate mortgage borrowers on the other hand will encounter differences in the way their mortgage-interest rates are compounded, and the higher their interest rate, the greater the difference between monthly and semi-annual compounding becomes. While the amount of money we’re talking about under the current circumstances can be small, wouldn’t you rather keep it in your pocket if all else is equal?

If you answered yes, forewarned is forearmed.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog (integratedmortgageplanners.com/blog). Email Dave

May 11, 2011

Mortgage |