David Larock in Mortgages and Finance, Home Buying, Home Selling

If you want to sell your current home and use the proceeds as a down payment  on a different property, what do you do if the closing dates don’t fall on the same day? More to the point, what do you do if you have to buy your new home before you sell the old one? In these cases you need a short-term loan to bridge the gap between the two transaction dates and the solution, appropriately enough, is called bridge financing. Today’s post will explain how it works for borrowers who are considering this option.

on a different property, what do you do if the closing dates don’t fall on the same day? More to the point, what do you do if you have to buy your new home before you sell the old one? In these cases you need a short-term loan to bridge the gap between the two transaction dates and the solution, appropriately enough, is called bridge financing. Today’s post will explain how it works for borrowers who are considering this option.

Let’s start by addressing a few common concerns: If you need a bridge loan, it does not alter or limit your ability to qualify for a mortgage in any way. Also, you don’t actually need to qualify for bridge financing itself – the only requirement is that you have an unconditional offer to purchase for the property you are selling. It is almost always offered in combination with a traditional mortgage loan - your lender simply bridges your financing gap to help facilitate the overall transaction.

Here is an example of how a bridge loan would work:

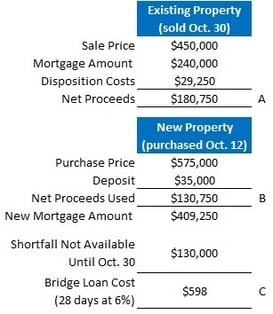

Assume you have just accepted an unconditional offer to purchase your current property on October 30. After paying off your mortgage and covering your disposition costs, you will be left with net proceeds of $180,750 (see item A).

Assume you have just accepted an unconditional offer to purchase your current property on October 30. After paying off your mortgage and covering your disposition costs, you will be left with net proceeds of $180,750 (see item A).

You then buy a new property, but the sellers want you to take possession on October 12, which is 18 days before you will complete the sale of your existing home.

After making a $35,000 deposit, you decide to use $130,750 (see item B) of the net proceeds from the sale (you hold back $50,000 for closing costs and minor renovations).

You need that $130,750 on October 12, but you won’t receive it from your buyer until October 30. As such, your mortgage planner helps you secure an 18-day bridge loan at prime +3% (6% in today’s terms) at a total cost of $385 (see item C). Problem solved.

Lenders typically expect a gap of no more than 30 days between your buy and sell dates, although bridges for longer periods may be offered by some lenders on an exception basis. Because bridge loans are usually unsecured and short term, lenders charge higher rates; as in the example above, you should expect to pay somewhere in the range of prime + 3% to prime + 4%, which works out to 6% to 7% in today’s terms (some lenders will also charge an application fee of approximately $250). Keep in mind that, on balance, bridge loan rates will have far less impact on your overall financing costs than mortgage rates because they only apply on the shortfall, and they are only in place for a brief period of time.

If you have borrowing room on any existing lines of credit, most lenders will ask you to draw down these lines first, before then bridging the remaining gap. On the day you complete the purchase of your new home, you will be required to sign a Letter of Direction and Irrevocable Assignment of Funds. This is a promise to use your net sale proceeds to pay off the lender’s bridge loan before taking any money for yourself. On larger bridge loans your lender may go a step further and require that a collateral charge be registered on the property you are selling (this is a slightly more expensive step that achieves the same basic end).

While not all lenders offer bridge financing, an experienced, independent mortgage planner will have access to several who do. So instead of worrying about lining up your closing dates on the same day and trying for perfection in an imperfect world, use bridge financing as an easy and cost-effective tool when coordinating buying and selling transactions.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog (integratedmortgageplanners.com/blog). Email Dave