David Larock in Mortgages and Finance, Home Buying

Variable-rate mortgage holders should put Ben Bernanke on their Christmas card list this year. Last week when the U.S. Federal Reserve chairman said he wouldn’t raise short-term rates until mid-2013, it may as well have been Mark Carney uttering those same words. It’s hard to imagine Canadian variable-mortgage rates increasing much, if at all, when our short-term rates are already 1% higher than comparable U.S. rates and the Loonie is hovering around par with the Greenback (see my Summer Mortgage Market Update for a more detailed explanation).

Variable-rate mortgage holders should put Ben Bernanke on their Christmas card list this year. Last week when the U.S. Federal Reserve chairman said he wouldn’t raise short-term rates until mid-2013, it may as well have been Mark Carney uttering those same words. It’s hard to imagine Canadian variable-mortgage rates increasing much, if at all, when our short-term rates are already 1% higher than comparable U.S. rates and the Loonie is hovering around par with the Greenback (see my Summer Mortgage Market Update for a more detailed explanation).

The U.S. Federal Reserve is holding its short-term rates at 0% to promote borrowing, spending and investment. Simply put, if money is cheap, businesses and consumers should buy more. But the power of ultra-low rates can be diminished if there is uncertainty about how long they will remain at emergency levels, and this announcement removes any uncertainty until the middle of 2013.

Despite his best intentions, it’s not clear that Mr. Bernanke’s guarantee will have much impact on the beleaguered U.S. economy because U.S. short-term rates have already been at 0% for nearly three years, and to little effect, even when combined with the most aggressive stimulus programs in modern U.S. history. Many of these temporary programs are now being wound down and with little voter appetite for more deficit spending, the (cash) cavalry isn’t coming to rescue this time. Let’s call this announcement the best of the very limited options Mr. Bernanke has left.

Five-year Government of Canada (GOC) bond yields took us on quite a roller coaster ride again this week. We had a drop of 17 basis points (bps) on Wednesday followed by a 15 basis point surge on Thursday, before finishing the week down 27 bps overall. Lenders are using the recent volatility as an excuse to hold rates at artificially high levels, but the cynical among us would note that this ‘cautious’ approach is also producing much higher profits margins. (Lenders are usually happy with a gross spread of about 150 bps between five-year GOC bond yields and deeply discounted five-year fixed mortgage rates, and as of last Friday, that spread was more like 200 bps.)

It looks like variable-rate mortgage holders now have at least a two-year window to capitalize on rock-bottom rates by using the money they save in interest to pay off their mortgage principal more quickly. It’s time to make hay while the sun shines! (Read The Power of Prepayment to see why doing this is a no brainer.)

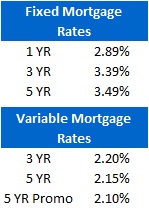

The bottom line: Today, a fixed-rate mortgage will cost you about 1.4% more than an equivalent variable-rate mortgage, and will protect you against a rising rate environment, which normally occurs when our economy is healthy and growing. By comparison, variable-rate mortgages cost significantly less, and will protect you during economic downturns by providing much needed savings when money is tight and incomes are flat or falling. While a variable-rate mortgage is not normally thought of as a way to offset risk, consider which form of protection will help you sleep better at night in the current environment.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave