David Larock in Mortgages and Finance, Home Buying

With the markets no longer distracted by the U.S. debt ceiling talks, investors shifted their focus back to the cold, hard reality facing the global recovery, and they obviously didn’t like what they saw.

With the markets no longer distracted by the U.S. debt ceiling talks, investors shifted their focus back to the cold, hard reality facing the global recovery, and they obviously didn’t like what they saw.

First there was anaemic U.S. GDP growth of 1.3% in the second quarter to weigh, a number which at this stage of the recovery should really be more like 3.6%. Worse still, U.S. GDP growth estimates from previous quarters were also revised down: Q1, 2011 GDP was lowered from 1.9% to .4% (that is not a misprint) and Q4, 2010 GDP was lowered from 3.1% to 2.35% (details). It’s now clear that U.S. economic growth is slowing more quickly than expected, and at these levels another recession is increasingly likely. That’s troubling when you consider that their federal government and Federal Reserve have little ammunition left to fight off another downturn and that all of the U.S.’s current political momentum is tilted towards cuts and austerity measures.

Then, as the eurozone crisis deepened, there was an emergency meeting in Europe on Friday as investors continued to drive Italian and Spanish bond yields higher (in the bond market, this is what fear looks like). The European Central Bank (ECB) is demanding that Italy and Spain do more to get their fiscal house in order before it will provide support for Italian and Spanish bonds, and each bailout raises the level of dissent in other eurozone member countries. Of course, the ECB can only do so much for economies as large as Italy’s and Spain’s anyway, and band-aid loans don’t address the underlying problems that brought both countries to this point.

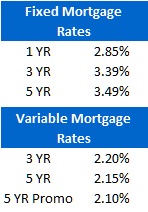

Five-year Government of Canada bond yields plummeted again this week, dropping another 25 basis points as uncertainty and fear in the markets continued to fuel demand for low-risk investments. Lenders have started to inch rates down, but slowly, and not to the degree that the drop in bond yields suggests they should. While this is frustrating for borrowers, rest assured that with healthy competition in our market, rates will continue to go lower. Somebody always blinks.

All of this bad news continues to be good news for variable-rate mortgage borrowers. While most Big Five Bank economists are still forecasting a significant increase in short-term rates in the next 12 to 18 months, implicitly guiding borrowers towards the banker’s favourite five-year fixed rate, the bond market is now betting that the next move in variable rates will be down, not up, and that’s a significant development.

The bottom line: When credit bubbles burst, economic recoveries take much longer than normal and recessions happen more frequently. If, as now, many developed countries experience credit-induced downturns at the same time, these effects are magnified. At times like this, low mortgage rates are among the few bright spots on most personal balance sheets - for those who take full advantage.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave