David Larock in Mortgages and Finance, Home Buying

The U.S. debt ceiling talks dominated our headlines last week as expected, but in the grand scheme this game of political brinkmanship was a blip on the radar compared to the unfolding sovereign debt crisis in Europe.

The U.S. debt ceiling talks dominated our headlines last week as expected, but in the grand scheme this game of political brinkmanship was a blip on the radar compared to the unfolding sovereign debt crisis in Europe.

The risk of sovereign default in the eurozone is no longer limited to the smaller, peripheral economies of Greece, Ireland and Portugal. Both Italy and Spain have stagnant and over-indebted economies, meaning that their growth rates have not kept pace with their rising debts. When this happens, the only way to make up the shortfall is to borrow more…and more…and more again.

While the U.S. is struggling with the same problem of debt outpacing growth, its economy has historically been more responsive and dynamic, making its long-term return to healthy growth more probable. As such, fixed-income investors have been willing to ride out the U.S.’s economic turbulence without demanding substantially higher yields (so far).

Italy and Spain are not so lucky. Investors have smelled blood in their waters and are pushing yields higher. More expensive debt only compounds the underlying problem – kind of like hitting the accelerator in a car that is speeding toward a brick wall.

This past week provided the most recent example when Italy tried to raise 3 billion euros in ten-year bonds but fell $300 million short, even when offering investors a yield of 5.77%, which was .81% higher than the yield it offered only a month ago in the June placement (Spanish ten-year bond yields are already north of 6%). By comparison, U.S. ten-year treasury yields hit a new 2011 low of 2.79% to close out the week. So while the U.S’s economic car is also headed for a brick wall, it’s not picking up as much speed at the moment.

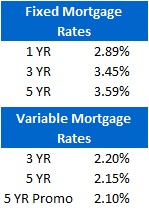

Meanwhile, five-year Government of Canada bond yields were down almost 16 basis points for the week. This was primarily due to U.S. debt ceiling concerns and weaker than expected May GDP numbers for both the U.S. and Canada. We could be due for another drop in fixed-mortgage rates now that five-year yields are down to 2.04%.

Qualifying for a high-ratio variable-rate mortgage got a little easier this week when the Bank of Canada dropped its mortgage qualifying rate (MQR) back down to 5.39%. The May GDP numbers weren’t great for the overall economy but they were good news for variable-rate borrowers, because slower growth will ease pressure on the Bank of Canada to raise shot-term rates.

The bottom line: The risk of sovereign default in the eurozone isn’t going away any time soon, and the ebb and flow of this risk will continue to weigh on bond markets, and therefore mortgage rates, for the foreseeable future.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave