David Larock in Mortgages and Finance, Home Buying

It’s been three months since we ran our first Mortgage Rate Simulation where we compared the cost of a current five-year fixed-rate mortgage to the potential cost of a five-year variable-rate mortgage under different scenarios. Since then, market rates for five-year fixed-rate mortgages have dropped from 3.69% to 3.49%, while standard variable-mortgage rates have risen from 2.1% to about 2.3% (if you don’t look too hard). If you’re trying to weigh the narrower spread between fixed and variable rates against the growing belief that the sluggish global economic recovery will keep interest rates low for the foreseeable future, today’s post will give you some more grist for your mill.

It’s been three months since we ran our first Mortgage Rate Simulation where we compared the cost of a current five-year fixed-rate mortgage to the potential cost of a five-year variable-rate mortgage under different scenarios. Since then, market rates for five-year fixed-rate mortgages have dropped from 3.69% to 3.49%, while standard variable-mortgage rates have risen from 2.1% to about 2.3% (if you don’t look too hard). If you’re trying to weigh the narrower spread between fixed and variable rates against the growing belief that the sluggish global economic recovery will keep interest rates low for the foreseeable future, today’s post will give you some more grist for your mill.

Let’s start by reviewing some basic guidelines:

- The fixed vs. variable question depends as much on a borrower’s individual circumstances as it does on any guess about where interest rates are headed in the future. Here is a good summary of what I mean when I say that.

- Trying to get too specific when forecasting interest rates can make you look foolish (bank economists nodding in agreement), so we’ll keep our simulations simple: variable rates will only go up, the timing of the increases will be spread out fairly evenly, and each increase will be 25 basis points (or .25%).

- We’ll use three different scenarios to show you when variable rates will save you money, when you’ll just about break even, and when choosing a fixed-rate mortgage will leave you better off. You can decide for yourself which scenario seems most likely.

Just as we did last time, we’ll take a mortgage of $250,000, amortized over 25 years, and compare the cost of a five-year fixed rate at 3.49% to a five-year variable rate that starts at 2.30%. Each simulation will include a fixed-rate borrower, a variable-rate borrower who makes the minimum payment, and a variable-rate borrower who sets his initial payment at the fixed rate (we’ll call him Mr. Smarty Pants).

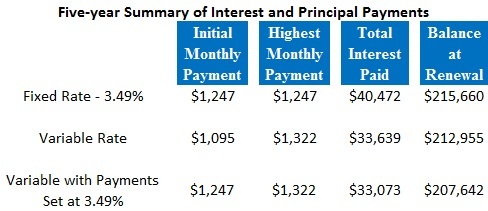

Variable Rate Simulation #1

In the first simulation we assume that today’s standard variable rate of 2.3% doesn’t start to rise until June of 2013 (which is about when the U.S. Federal Reserve’s guarantee not to raise its short-term rates will expire). We see another increase in September of 2013, and then every June and September until the end of the term, at which point the variable rate will have risen to 4.05%.

In this scenario variable-rate borrowers come out well ahead, and Mr. Smarty Pants extends his advantage by using the money he has saved in interest to pay off his mortgage much more quickly (that’s $8,000 he’ll never have to pay interest on again).

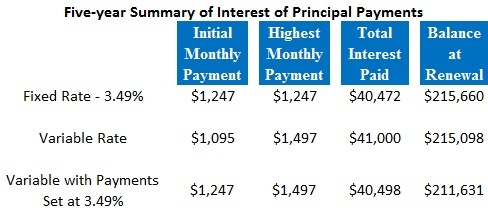

Variable Rate Simulation #2

In our second simulation we get our first variable-rate increase of .25% in September of 2012, followed by another in December of that same year. Then from 2013 on we get increases every June, September and December until the end of the term, with variable rates topping out at 5.55%.

The second scenario is basically a wash if you make the minimum required payment on either a fixed or variable-rate mortgage. The only way to come out ahead (again) is by borrowing at the variable rate but setting your payment at the fixed rate (like Mr. Smarty Pants). You end up paying about the same amount in interest but because you banked the savings available on your variable rate early on in your term, you still end up with $4,000 less principal at renewal.

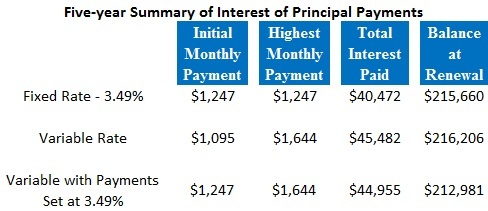

Variable Rate Simulation #3

In our third simulation Mr. Carney starts raising rates in September of 2012 and keeps raising them every three months thereafter until we hit 6.55% by our renewal date on September 1, 2016.

In this scenario, fixed was the way to go. That said, even though Mr. Smarty Pants was on the wrong side this time, the early advantage he staked out with his strategy still cushioned the blow of higher than anticipated variable rates. While he spent an extra $4,500 in interest, he also paid off more than $2,500 in extra principal, and when you net the two out he is only $1,800 worse off over five years.

These are just three possible scenarios from a pool of endless possibilities - a more detailed analysis would certainly include a comparison of shorter and longer-term fixed rates as well (email me if you want to explore other iterations). While today’s post did not offer too much insight on where rates may be headed, if you’re interested in my take on that question, check out my Summer Mortgage Market Update (this is a quarterly letter I send to my clients).

We’ll do another round of simulations in another three months and in the meantime, I hope you enjoy the grist!

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave