David Larock in Mortgages and Finance, Home Buying

The latest Canadian and U.S. employment reports were released on Friday, and both came in higher than expected.

The latest Canadian and U.S. employment reports were released on Friday, and both came in higher than expected.

[Reminder: Employment reports are important to anyone keeping an eye on where mortgage rates are headed because they tell you whether labour is likely to become more expensive in future. Labour is a pervasive cost that spreads throughout the economy, and higher labour costs spur broad-based price inflation and, by association, higher mortgage rates.]

Overall, Canadian employment increased by 61,000 jobs versus the consensus forecast of 15,000, and unemployment dropped from 7.3% to 7.1% as a result. While the number was higher than expected, market reaction was tempered by the fact that almost all of the incremental growth came from teachers returning to work, and a rise in “self-employment”, which usually occurs when the economy is losing momentum. The report also showed wage growth decelerating and an outright decline in the number of overall hours worked, so the details left much to be desired.

The latest U.S. employment report showed 100,000 new jobs added, which was double the consensus forecast. Again though, a quick read of the underlying data tells a less encouraging story, because almost all of the upside surprise was attributed to the end of a workers’ strike at Verizon Communications, which put 58,000 workers back on the payroll in one fell swoop. Also, to put the 100,000 number in perspective, consider that the U.S. economy needs to create about 150,000 jobs each month just to keep up with its population growth.

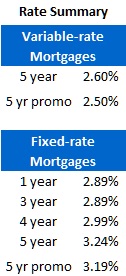

Five-year Government of Canada (GoC) bond yields rose nine basis points for the week, and to the surprise of many, some Big Five lenders raised their five-year fixed-mortgage rates by ten basis points (or .1%). The first Big Five lender raised its five-year market rate to 3.69% on Wednesday night when the five-year GoC bond yield closed at 1.40%, which implies a gross spread of 2.29% - well above the historical 1.25% to 1.50% range. The raise was really an attempt to ‘lead the market up’, but so far, only a few other lenders have followed suit. It will be interesting to see which group blinks first.

Several Big Five lenders also eliminated their variable-rate discounts altogether last week and are now offering five-year variable-rate mortgages at prime (or in one case, prime +.05%); hard to believe that prime minus .90% was available only six weeks ago. Borrowers who shop around can still find a variable rate as low as prime minus .50%, but this rate could be gone as early as this afternoon.

The bottom line: The U.S. economy hasn’t been generating enough new jobs to keep pace with its population growth for some time and last week, U.S. futures traders moved their consensus bet on when the U.S. Federal Reserve will next hike rates from July to November of 2013. Meanwhile, the latest Canadian job numbers suggest that our next GDP report (due out on October 31) will disappoint. None of this squares with last week’s fixed-rate hike by several of the Big Five banks, and it’s encouraging to see smaller lenders showing more restraint.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave