David Larock in Mortgages and Finance, Home Buying

The markets were feeling a little less risk averse last week as money shifted out of low-risk assets, like government bonds, and into higher risk areas like stocks. This drove bond yields up, which gave our lenders higher funding costs, and if the current trend continues, another increase in the five-year fixed rate may not be far off.

The markets were feeling a little less risk averse last week as money shifted out of low-risk assets, like government bonds, and into higher risk areas like stocks. This drove bond yields up, which gave our lenders higher funding costs, and if the current trend continues, another increase in the five-year fixed rate may not be far off.

That said, when you look at the news that is making investors more optimistic, beauty is still very much in the eye of the beholder. For example, the latest U.S. retail sales number came in higher than expected, which is good, but that was primarily because their savings rate fell, which in an economy that needs to shrink its debt, is a trend in the wrong direction. It would be much better to see higher U.S. retail sales caused by rising U.S. incomes.

The markets also rose on optimism that this weekend’s meeting of finance ministers from the G20 would go well, and investors probably liked hearing Federal Finance Minister Jim Flaherty saying post-meeting that his worst fears were allayed after hearing from France and Germany. If so, this will push bond yields higher still in the coming days. But good meetings have caused lots of market bounces over the last several months, and they have always been short lived. Forgive my skepticism, but the euro-zone leadership has repeatedly done much less than was required to address the fundamental issues underlying their current crisis, and the competing pressures they face, such as acting in the best interest of the wider euro zone but being accountable to domestic voters, haven’t gone away.

While the short-term momentum arrow for fixed rates is clearly pointing up, this feels like a short-lived rally to me (keeping in mind that my crystal ball is as murky as ever).

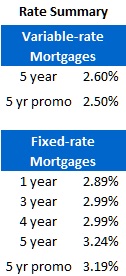

Five-year Government of Canada bond yields surged another 13 basis points last week and most, but not all lenders raised their five-year fixed-mortgage rates. Lenders have had to absorb some additional costs lately (IFRS changes to capital requirements and wider TED spreads, for example), but my sense is that there is still more padding in their gross spreads than normal. In a situation like this, free market competition acts as the great equalizer for consumers because there are smaller lenders who are happy to price more aggressively, especially when they can do so while maintaining normal gross spread levels.

More lenders shrank their variable-rate discounts last week, with market five-year variable rates now offered in the prime minus .20% range (2.8% using today’s prime rate of 3%), but best rates are still available at prime minus .50% (2.5%). The mortgage-qualifying rate , which lenders use to qualify variable-rate borrowers who are making down payments of less than 20%, was raised to 5.29% this morning.

The bottom line: When you combine the current volatility in the markets with so many disparate opinions about where our economy is headed, it’s no real surprise that there is a wider than normal disparity in mortgage rates. At times like this, shopping around will help you save even more than normal.

Editor's appeal: In today's world, you’re nobody till facebook likes you. So if you enjoy reading the Move Smartly blog, please scroll to the right column of this blog and click on the facebook "like" button just under the the subscribers box. And thanks for the love!

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave