David Larock in Mortgages and Finance, Home Buying

Last Friday Statistics Canada released its latest Consumer Price Index (CPI), which measures the change in general prices over the most recent twelve months. Each new look at our economy’s inflation gauge is of particular interest to anyone trying to read the tea leaves on where mortgage rates may be headed.

Last Friday Statistics Canada released its latest Consumer Price Index (CPI), which measures the change in general prices over the most recent twelve months. Each new look at our economy’s inflation gauge is of particular interest to anyone trying to read the tea leaves on where mortgage rates may be headed.

The headline CPI rate for September 2011 increased by 3.2%, and core inflation, which strips out more volatile inputs like food and energy, rose 2.2%. When core inflation exceeds the Bank of Canada’s (BoC) target of 2%, the markets take notice, and that’s why things got interesting after Friday’s announcement.

Investors would normally expect above-target inflation to prompt the BoC to start increasing its overnight rate sooner rather than later, and they would normally push bond yields higher in anticipation. But these are not normal times. With so many of the world’s economies teetering on the brink and Canada’s economy dangerously close to stall speed, higher interest rates might be one headwind too many for our fragile recovery.

Enter Federal Finance Minister Jim Flaherty. At a press conference in Ottawa shortly after last Friday’s CPI numbers were released, Mr. Flaherty was clearly trying to talk the bond markets back into a neutral position. He challenged the widely held assumption that 2% is the target rate for core inflation (you know, because it’s not like the BoC states that in writing).

Instead, he said, the BoC’s real mandate was to keep inflation within the 1% to 3% range, and that assertion dovetails nicely with the BoC’s recently introduced new term, “flexible inflation targeting”. The message from the federal government and the BoC is consistent and clear: inflation isn’t going to drive interest-rate policy until our economic weather improves.

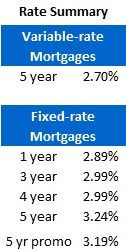

Five-year Government of Canada bond yields bounced around last week but when all was said and done, yields finished the week about where they started. Despite that, some smaller lenders inched their rates up on various fixed-rate terms. The market range for a five-year fixed-rate mortgage is 3.39% to 3.49%, but as always, those who shop around can do better.

Variable-rate discounts continued to shrink last week, and prime minus .30% on a five-year term is now at the low end of what’s on offer. (Big Five five-year variable-rate discounts are still at or very near prime.) While Friday’s developments made it clear that higher core inflation isn’t going to compel the BoC to raise its overnight rate in the short run, they also threw cold water on hopes for a rate cut coming any time soon.

The bottom line: The federal government and the BoC are aligned in their view that stimulating economic growth is a far more pressing concern than keeping core inflation at 2%. For the time being then, our rate of gross domestic product (GDP) growth will give us the best indication of where mortgage rates are headed, and we get our next GDP update on October 31. (Let’s hope for treats instead of tricks!)

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave