David Larock in Mortgages and Finance, Home Buying

If you like action, last week had it all.

If you like action, last week had it all.

Topping the headlines was Thursday’s announcement that the euro-zone countries had reached a solution on a managed Greek debt default, and had also agreed to beef up the European Financial Stability Fund (EFSF). As usual during this drawn-out crisis however, the details were murky.

While the markets reacted with relief-inspired enthusiasm on Thursday, by Friday the bloom was already off the rose. The main goal of a resolution on the debt crisis was to allay investor fears of default and the resulting contagion from spreading to other countries, most notably Italy and Spain, whose economies are too big to bail out. On Friday, Italy put the market’s new-found optimism to the test by issuing new ten-year debt, and investors responded by pushing Italian ten-year bond yields past 6%, a critical threshold beyond which the interest costs for these low-growth countries are considered to become unsustainable. Spanish ten-year bond yields also spiked on Friday, finishing the week at 5.51%, which was about where they were before Thursday’s announcement. These subsequent developments make it clear that the euro-zone crisis is far from over.

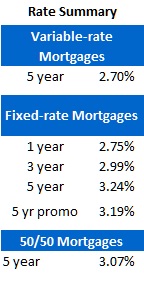

On the home front, the Bank of Canada (BoC) announced on Tuesday that it would, as expected, keep its overnight rate on hold. (That means there was no change to bank prime rates, and by association, to variable-mortgage rates, which are priced off prime).

The BoC then issued its latest Monetary Policy Report for October on Wednesday, which slashes our projected growth from 2.8% to 2.1% in 2011, and from 2.6% to 1.9% in 2012. It also calls for a brief recession in the euro zone (umm…brief?), and in keeping with previous reports, cites consumer deleveraging, government spending cuts, and declining levels of business and consumer confidence as the biggest drags on our prospects for future growth. The report predicts that the Canadian economy will not return to full capacity until the end of 2013, and that lower oil prices will cause our core inflation rate to drop in 2012, before it returns to its 2% target by the end of 2013 (and yes, that’s the same 2% core-inflation target that federal Finance Minister Flaherty recently said was no longer the target).

Five-year Government of Canada bond yields swung like a piñata last week with double-digit moves on three of five days, but finished the week only 3 basis points higher. In response to all of the volatility, many lenders raised their fixed-mortgage rates, on some terms by as much as .40%. Thankfully for borrowers, other lenders held firm and given that, five-year fixed rates as low as 3.19% can still be had.

All of this bad news continues to be good news for anyone with a variable-rate mortgage. Until we see broad-based signs of recovery, variable rates aren’t going anywhere (except maybe down).

The bottom line: Thursday’s euro-zone announcement may have been progress in the right direction, but it clearly did not do enough to dispel widespread investor fears of contagion. If the euro-zone leadership doesn’t figure out how to resolve the crisis once and for all, the market will solve the problem for them, and if history is any indication, it will do so by using a chainsaw instead of a scalpel. (For a more detailed take on how the latest euro-zone developments are affecting Canadian mortgage rates, check out my latest Quarterly Mortgage Market Update, which was launched last week).

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

October 31, 2011

Mortgage |