David Larock in Mortgages and Finance, Home Buying

Concerns over Greek default were set aside last week as Italy took centre stage in the escalating euro-zone crisis.

Concerns over Greek default were set aside last week as Italy took centre stage in the escalating euro-zone crisis.

Italy has $3 trillion of sovereign debt outstanding, which represents the third largest sovereign debt pool in the world and totals more than all Spanish, Irish, Portuguese and Greek debt combined. This large pool of debt must constantly be renewed and refinanced (like when your mortgage comes up for renewal but on a much larger scale!) and therein lies the latest and scariest twist yet in the euro-zone crisis.

Italy has to roll over $300 billion of its sovereign debt during the next year alone, and each time it tries to refinance another tranche, investors demand higher yields. These higher yields increase Italy’s borrowing costs, causing the gap between the country’s revenue and spending to grow wider still. The more Italy has to borrow, the more nervous investors get and the higher its bond yields go. It is a vicious cycle that is now dangerously close to spinning out of control.

Last week, ten-year Italian bond yields soared past 7%, which was the point at which Greece, Ireland and Portugal all had to seek a bailout to avoid sovereign default. As such, the threat of an Italian sovereign default is now very real, but unlike the other struggling countries, Italy is simply too big to bail out.

At this point the European Central Bank (ECB) is really all that stands between Italy and default. The ECB has been aggressively buying Italian bonds for some time, but when the country’s ten-year bond yields spiked last week, the ECB redoubled its efforts and drove the Italian ten-year bond yield back down to 6.45% by the close of business on Friday. While many would argue that any long-term average yield above 6% will be unmanageable for a stagnant Italian economy teetering on the brink of recession, the ECB’s unprecedented support has bought the world some time. For now.

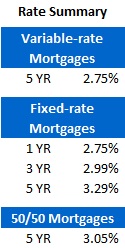

The five-year Government of Canada (GoC) bond yield finished two basis points lower for the week. That said, we’ve seen this bond yield drop more than 30 basis points since lenders last moved their fixed rates, so we really should have seen a corresponding drop in five-year fixed-rate mortgages by now. (Lenders argue that the recent drop in the GoC five-year bond yield has corresponded with a rising “risk premium” in their funding costs, but the TED spread hasn’t moved much at all in the last five weeks and default rates are miniscule, so I’m not sure I agree with that justification.)

Five-year variable-rate mortgage discounts are starting to increase again, with prime minus .20% now widely available. As always, borrowers who look a little harder can do better.

The bottom line: The threat of an Italian sovereign-debt default presents a massive systemic risk to the global banking sector, and even if Italy avoids default in the short-term, it will be with a band aid (more debt), instead of a cure (deleveraging). In the short-run, sovereign default fears will continue to spur demand for GoC bonds and that should keep yields, and Canadian mortgage rates, at rock bottom levels for a while yet.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

November 14, 2011

Mortgage |