David Larock in Mortgages and Finance, Home Buying

On Friday of last week Statistics Canada released its October Consumer Price Index (CPI) report on general price changes over the most recent twelve months. It showed that the overall rate of inflation fell from 3.2% to 2.9%, and core inflation (which excludes more volatile inputs like food and energy) fell from 2.2% to 2.1%. A drop in both measures was expected, and while we always keep our eye on the CPI data because inflation and mortgage rates normally go hand-in-hand, remember that the Bank of Canada and the federal government have both told us that changes in inflation won’t drive our interest-rate policy until the economic weather improves.

On Friday of last week Statistics Canada released its October Consumer Price Index (CPI) report on general price changes over the most recent twelve months. It showed that the overall rate of inflation fell from 3.2% to 2.9%, and core inflation (which excludes more volatile inputs like food and energy) fell from 2.2% to 2.1%. A drop in both measures was expected, and while we always keep our eye on the CPI data because inflation and mortgage rates normally go hand-in-hand, remember that the Bank of Canada and the federal government have both told us that changes in inflation won’t drive our interest-rate policy until the economic weather improves.

Speaking of the economic weather, the euro zone had another volatile week as Italian bond yields pushed past 7% again on Tuesday, before closing the week at a 6.64% thanks to aggressive support from the European Central Bank (ECB). The experts I read think that the only way to ensure the euro zone’s survival is for the ECB to announce that it will support the sovereign debts of its member countries at any cost. But like every other solution available, it’s not that simple.

While full scale ECB support would allay investors’ fears of more sovereign defaults, the Germans, who are essentially footing the bill for all of these bailouts, want fiscal control over countries who receive ECB support to ensure that they aren’t just writing blank checks with no post-bailout accountability. Angela Merkel needs the rescued countries to agree to fiscal oversight so that she can sell more bailouts to German voters, but for politicians in the beleaguered countries, surrendering fiscal sovereignty to the German Debt Management Office certainly doesn’t help anyone’s re-election plans.

Meanwhile in the U.S., it looks as though the bi-partisan super committee charged with recommending $1.2 trillion in budget cuts over the next ten years has reached an impasse and will announce today that it cannot reach agreement in time for this week’s deadline. If the deadline passes without a resolution, then by law a sequester will kick in that implements indiscriminate across-the-board cuts to achieve the necessary savings. While Congress may well come up with a temporary solution that kicks the can down the road a little further, uncertainty around the timing and impact of the coming cuts should fuel more short-term market volatility.

Five-year Government of Canada (GoC) bond yields were flat for the week and have traded in a surprisingly narrow range over the last five business days. Lenders continue to edge rates down (as yields suggest they should) and I am curious to see if any will launch rate promotions at the mortgage industry’s national conference this week. (I’ll be there on Monday and Tuesday to find out!)

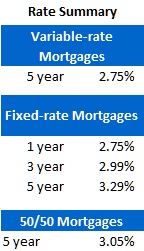

Five-year variable-rate mortgages are still priced in the prime minus .25% range (2.75% using today’s prime rate). While we have grown used to bigger discounts on variables, even at today’s reduced discounts they offer borrowers the cheapest interest cost and with rate hike expectations being pushed farther into the future, I think they still warrant a look.

The bottom line: Last week we learned that Canadian inflation is on the wane, we watched the euro-zone crisis continue to escalate, and we now see the U.S. federal government headed for another round of budget brinkmanship. All three developments should play a part in keeping GoC bond yields, and therefore mortgage rates, at ultra-low levels for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave