David Larock in Mortgages and Finance, Home Buying

Last week’s headlines were dominated by the threat that Greece would put its acceptance of the euro zone’s bailout plan to a public vote, and everyone breathed a big sigh of relief on Thursday when Greek Prime Minister Papandreou thought better of his latest attempt at brinkmanship and took that option off the table.

Last week’s headlines were dominated by the threat that Greece would put its acceptance of the euro zone’s bailout plan to a public vote, and everyone breathed a big sigh of relief on Thursday when Greek Prime Minister Papandreou thought better of his latest attempt at brinkmanship and took that option off the table.

Of course, relief doesn’t last long in the euro zone these days. Not with so many unanswered questions such as: When the German Debt Management Office drops the hammer on Greek spending, will the coming austerity programs destroy the country’s prospects for growth and essentially bankrupt it anyway? When will Portugal, Ireland, Belgium and Spain ask for the same debt-forgiveness package Greece is now getting? How long will it be before Italy’s soaring ten-year government bond yields spawn a euro-zone economic meltdown that will exceed the current Greek threat by an order of magnitude? I could go on, but you get the picture.

Having watched the euro-zone crisis develop over the last two years, I am certain of only one thing: the euro-zone leadership can shake hands at press conferences until their hands fall off, but this crisis won’t be over until the bond market says it is.

In other news, the European Central Bank (ECB) cut its key interest rate by .25% last week, which was noteworthy because the ECB has demonstrated a single-minded obsession with keeping inflation low, even at the expense of growth. But the ECB could not ignore the euro zone’s slowing economic momentum any longer, and said as much when it downgraded its growth and inflation forecasts for the region.

Meanwhile, across the pond the latest U.S. jobs report showed a headline increase of 80,000 new jobs, which is well below the 150,000 new jobs the country needs just to keep pace with its population growth. Of even greater concern is the fact that average incomes are not keeping pace with inflation, continuing a worrying trend of U.S. consumers getting less and less bang for their incremental buck.

According to the latest employment report from Statistics Canada, we now face the same two challenges. The October data, released last Thursday, showed that our economy lost 54,000 jobs overall, and worse still, lost 72,000 full-time jobs with only part-time jobs making up the difference. The report also showed a decline in hours worked, and average income levels that were flat for the month and up only 1.1% over the past twelve months. So while our inflation is quite low by historical standards, prices are still rising faster than our average incomes.

On a more positive note, our real gross domestic product (GDP) for August came in at .3%, which was a little higher than the Bank of Canada’s (BoC) estimate of .2%, and Stats Canada also added .1% to its original estimate for GDP growth in July, bringing it up to .4%. Three cheers for the energy sector, which accounted for most of the upside surprise.

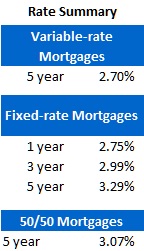

The five-year Government of Canada bond yield fell 24 basis points (bps) last week and has fallen 30 bps since its most recent peek last Thursday. If Friday’s yield levels hold, a rate drop on five-year fixed-rate mortgages should be imminent.

Variable-rate mortgages no longer come with the deep discounts we saw in the summer, but they still offer borrowers the lowest interest cost; and with rate-hike expectations getting pushed farther into the future all the time, they’re still worth a careful look for the right profile of borrower.

The bottom line: In the last two weeks we have had the U.S. Federal Reserve, the ECB and the BoC (not to mention several other central banks) lower both their domestic and international growth forecasts while highlighting “downside risks” as their primary concern. While that’s not the news we want to hear, the current economic malaise should keep mortgage rates low for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

November 7, 2011

Mortgage |