David Larock in Mortgages and Finance, Home Buying

On Friday, all twenty-seven leaders from the countries that make up the European Union (EU) will assemble in Brussels to take their latest shot at resolving the region’s financial crisis, which is based largely in the seventeen EU countries that use the euro as their currency (called the euro zone).

On Friday, all twenty-seven leaders from the countries that make up the European Union (EU) will assemble in Brussels to take their latest shot at resolving the region’s financial crisis, which is based largely in the seventeen EU countries that use the euro as their currency (called the euro zone).

If past is prologue, the meeting will end with a press conference where EU leaders announce new measures and declare an end to the current crisis once and for all. The markets will rally around the headline, but as scant details emerge in the coming days, doubt will creep back in, and we’ll be one more whippy rally away from being right back where we started. (Sorry to spoil the ending for you.)

The euro-zone crisis won’t end until its member countries agree to cede their fiscal sovereignty to a central body that will enforce strict budgetary discipline, and politicians can’t sell that kind of concession to their voters until the majority of them are convinced that the only alternative is financial collapse. That means that the current crisis has to continue to get worse before it can get better – but this is a dangerous game the euro-zone leaders are playing as they cling to the market’s tiger tail for dear life, hoping for that fleeting moment when political expediency meets economic necessity.

Here are some other highlights from last week:

Central banks from several of the world’s largest economies (including the Bank of Canada) joined together to lower the cost of their short-term loans to the European Central Bank. True to form, bond markets rallied on the news, but the momentum was short-lived because making liquidity cheaper and more easily available does nothing to address the fundamental cause of the euro-zone crisis, which is solvency. Instead of a cure, this was more like giving a terminally ill patient another shot of morphine to ease the pain.

The U.S. Department of Labor released its latest employment report , showing a net gain of 120,000 new jobs in November and, to everyone’s surprise, a dramatic decline in the overall unemployment rate from 9% to 8.6%. A closer look at this unexpected drop reveals that it was primarily caused by 315,000 fewer Americans actively looking for work (this is referred to as a drop in the “participation rate”). If we adjust the current employment numbers using the U.S.’s historical-average participation rate, U.S. unemployment is actually in the 11 to 12% range, and to put that in perspective, the U.S. would have to average 400,000 new jobs each month between now and 2020 to return to its long-term average employment level.

Meanwhile, in the Great White North, we lost another 19,000 jobs in November on top of our 59,000 net loss in October. While our third-quarter gross domestic product (GDP) increase came in at a robust 3.5%, most of that growth was export driven, and with global growth slowly markedly, this momentum is not expected to continue. In short, there was nothing in the latest data to change my prevailing view that mortgage rates will be on hold for the foreseeable future.

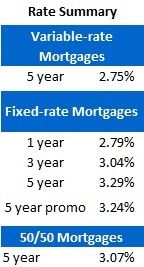

Five-year Government of Canada bond yields had one of the stranger weeks I can remember. We started with a few days of big rallies but by the end of each day they had fizzled to nothing. The market seemed ready to rally on any hint of good news but there just wasn’t enough confidence to keep the surges going. In the end, all that volatility left the five-year yield at 1.36% on Friday, down 3 basis points overall for the week. One of the major banks dropped its five-year fixed-mortgage rate by 10 basis points on Friday, so expect other lenders to respond in kind over the next few days.

Variable-rate mortgages have fallen out of favour with the Big Five, and this was confirmed in the comments accompanying their latest quarterly results. If you’re thinking about a variable rate mortgage, non-bank lenders are your best bet these days.

The bottom line: The markets are so desperate for any good news that we will probably see a run-up in bond yields this week in anticipation of the EU’s Friday meeting. If you’re in the market for a pre-approval, best to lock in today so you don’t get wrong-sided by market overreaction to the post-meeting press conference where EU leaders will declare the crisis over…again.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave