David Larock in Mortgages and Finance, Home Buying

Last week’s big news was the U.S. Federal Reserve’s announcement on Wednesday that “economic conditions - including low rates of resource utilization and a subdued outlook for inflation over the medium run - are likely to warrant exceptionally low levels for the federal-funds rate at least through late 2014”.

Last week’s big news was the U.S. Federal Reserve’s announcement on Wednesday that “economic conditions - including low rates of resource utilization and a subdued outlook for inflation over the medium run - are likely to warrant exceptionally low levels for the federal-funds rate at least through late 2014”.

Point of Clarification: The U.S. federal-funds rate, also called the policy rate, is the U.S. equivalent to the overnight rate of the Bank of Canada’s (BoC). It is the floor rate on which all U.S. short-term interest rates are based.

This announcement extended the U.S. Fed’s previous target for the beginning of short-term rate hikes by another year and a half, and while it is still unusual for the U.S. Fed to make its views on the future direction of interest rates so transparent, the announcement didn’t come as a total shock to the market. After all, the U.S. Fed has now had a 0% policy rate for three years and has tripled the size of its balance sheet over that period. At the same time, the U.S. federal government has been pumping radical levels of stimulus into the economy, while running annual deficits that have averaged a colossal 10% of the nation’s GDP. Despite all of these measures, U.S. GDP growth has been anemic at best, and the country now looks mired in a classic liquidity trap (a phenomenon I first wrote about in the summer of 2010).

So what does this mean for Canadian mortgage rates? If the Fed stays on hold until late 2014, it is unlikely that the Bank of Canada will raise rates much beyond current levels between now and then. While BoC Governor Mark Carney has insisted that Canadian monetary policy is not entirely beholden to U.S. monetary policy, how could it not be substantially affected when higher Canadian interest rates will drive the loonie above par with the greenback and raise the cost of everything we sell to the U.S.? The higher the loonie soars, the greater the impact on our export-led businesses, which sell 80% of what they produce to U.S. buyers. This reduction in export-led growth would cause our economy to slow and exert downward pressure on rates.

Mr. Carney has said that Canadian rates can be theoretically sustained at levels as much as 2% higher than U.S. rates (we are about 1% higher today), but just because he wants the world to believe that is true doesn’t make it so. Think of the relationship between Canadian and U.S. interest rates as an elastic band - the harder the band is stretched by the difference in our rates, the harder other forces like our exchange rate pull it back in the other direction.

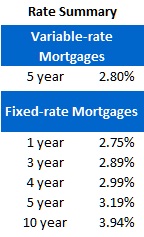

Five-year government of Canada bond yields were down 9 basis points this week, closing at 1.31% on Friday. As predicted in last week’s Update, the run up in yields that we saw the previous week was short lived. When you take the long view, the fundamentals for ultra-low Canadian bond yields are still well entrenched. A few lenders raised rates early last week, but most held firm, and rock-bottom promotional rates are still widely available.

Variable-rate mortgage holders with deeply discounted rates should again raise a glass to Chairman Bernanke and the U.S. Fed. If the rate of Canadian household-debt growth reverses its recent slowing trend and starts re-accelerating, continued low rates in the U.S. make it far more likely that it will be Mr. Flaherty making more changes to our mortgage rules, rather than Mr. Carney raising the BoC’s overnight rate.

The bottom line: The U.S. Fed’s announcement has confirmed what I have written in this space many times; both the global and U.S. recoveries are going to take much longer than many (but not all) experts have been predicting and our fixed and variable-mortgage rates will stay low until the world looks very different than it does today.

(For a more detailed explanation of what I mean when I say that, check out my Winter Quarterly Mortgage Market Update which, coincidentally, was posted on the same day that the Fed offered its new guidance.)

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

January 30, 2012

Mortgage |